The introduction of Europe’s Markets in Crypto-Assets (MiCA) framework on 30 June 2024 has reshaped the euro-pegged stablecoin sector.

One year later, a clearer pattern has emerged: regulated assets are expanding rapidly according to a report by Decta, consumer interest is rising across the EU, and MiCA-authorized issuers are capturing market share from legacy or non-compliant tokens.

Below is a data-driven breakdown of the most important findings from the first year of post-MiCA stablecoin activity.

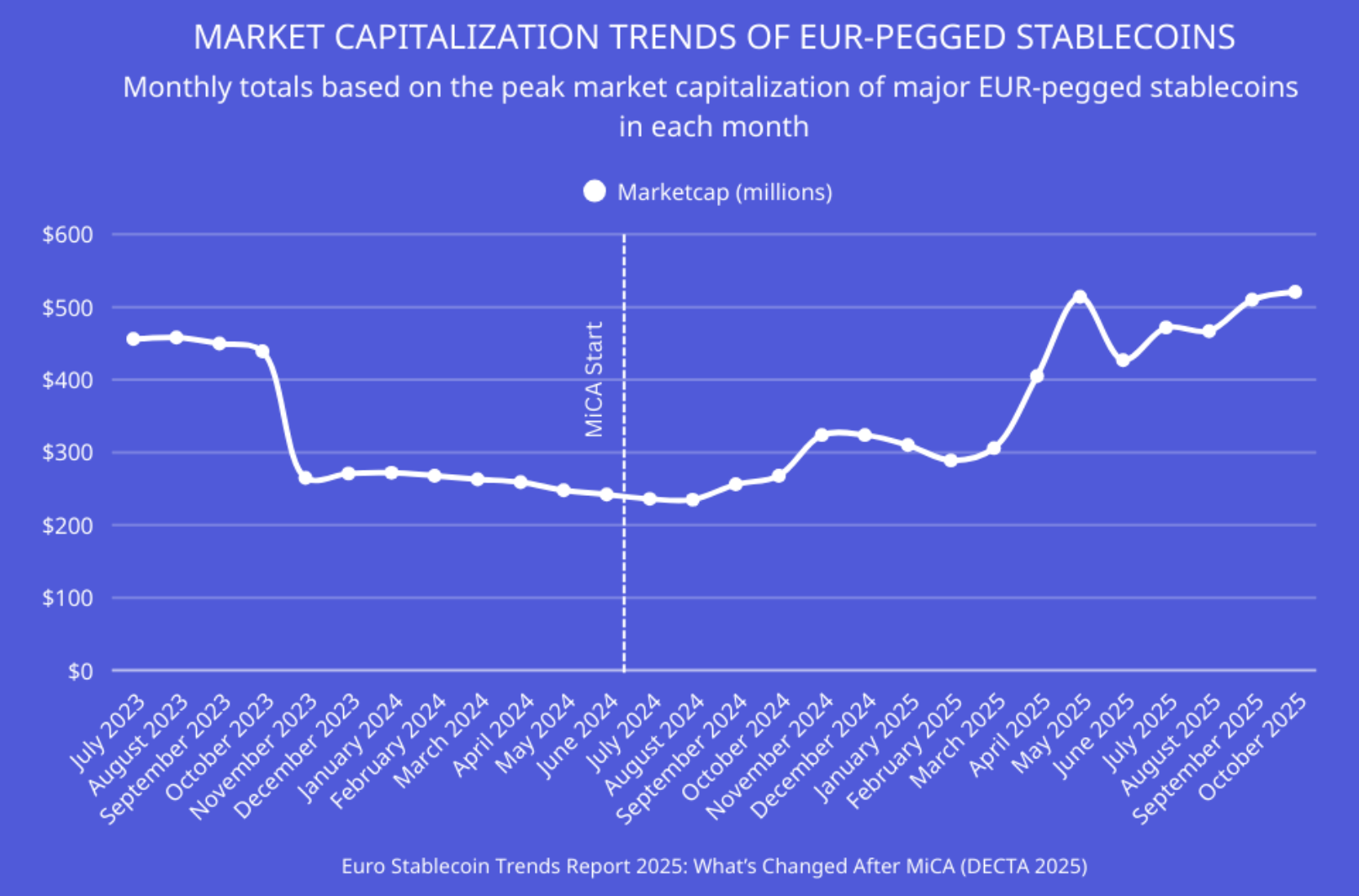

Market Capitalization After MiCA: +102% Growth

Euro-stablecoin capitalization entered a new phase following MiCA:

- •Total euro-stablecoin market cap hit $500M in May 2025.

- •EURS surged 643.86%, rising from $38.2M to $283.9M by October 2025.

- •In the 12 months before MiCA, market cap dropped 48%.

- •In the 12 months after MiCA, market cap grew 102%, fully reversing earlier declines.

This shift reflects investor confidence returning once clear regulatory rules for redemption rights, reserves and issuer licensing were enforced.

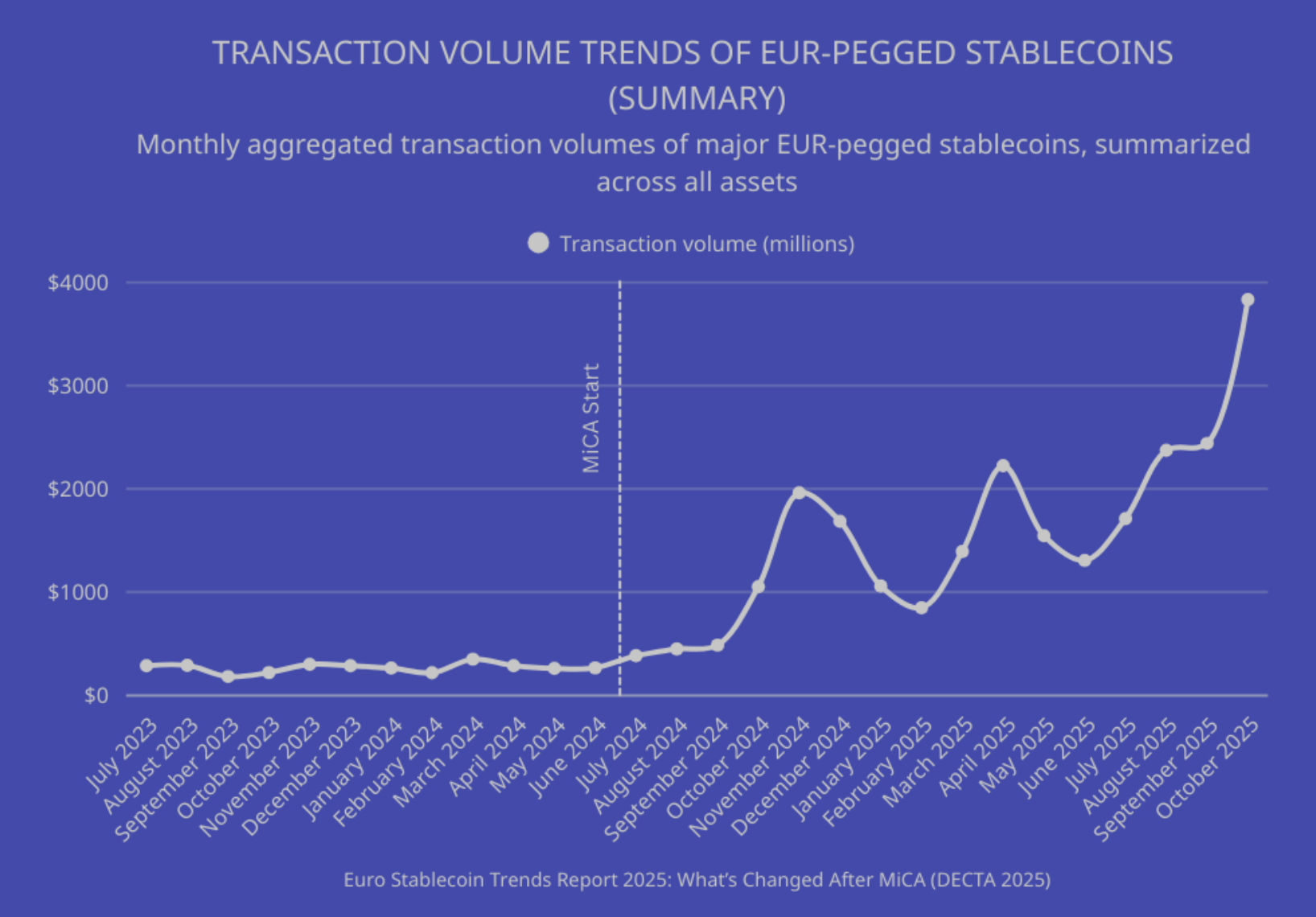

Transaction Volume Skyrockets: +899% EU-Wide

MiCA’s impact on transaction activity was even more dramatic:

- •Monthly transaction volumes jumped from $383M to $3.832B – an 899.3% increase.

- •EURC transaction volumes rose 1139.42%, leading all assets.

- •EURCV followed with a 343.26% volume increase.

By late 2025, monthly usage reached the highest levels ever recorded for euro-denominated stablecoins.

Winners and Losers: Which Stablecoins Are Growing?

Fastest-Growing MiCA-Aligned Tokens

- •EURØP, EURR, and EUROe gained traction as fully compliant products.

- •EURC expanded across multiple blockchains and saw the strongest usage surge.

- •EURCV, issued by Société Générale, grew in institutional and tokenization markets.

Stablecoins Facing Decline or Limits

- •EURT (Tether) remains widely used but not MiCA-authorized, limiting EU access.

- •Algorithmic or synthetic assets such as sEUR, PAR, and EURA saw reduced visibility due to stricter rules.

Regulation is now clearly shaping winners: MiCA-approved, fiat-backed products.

Consumer Survey: Bitcoin Still Dominates Payments

A survey of 1,160 EU respondents who used crypto for online payments revealed:

- •55.17% used Bitcoin for their latest transaction – the top choice.

- •21.21% used USD stablecoins.

- •Only 3.62% used euro stablecoins.

- •56.7% said they are very likely to use crypto for payments again within 12 months.

- •78.3% used crypto for services, while 21.7% used it for products.

Despite MiCA’s impact, euro-stablecoin payment adoption remains in its early stages.

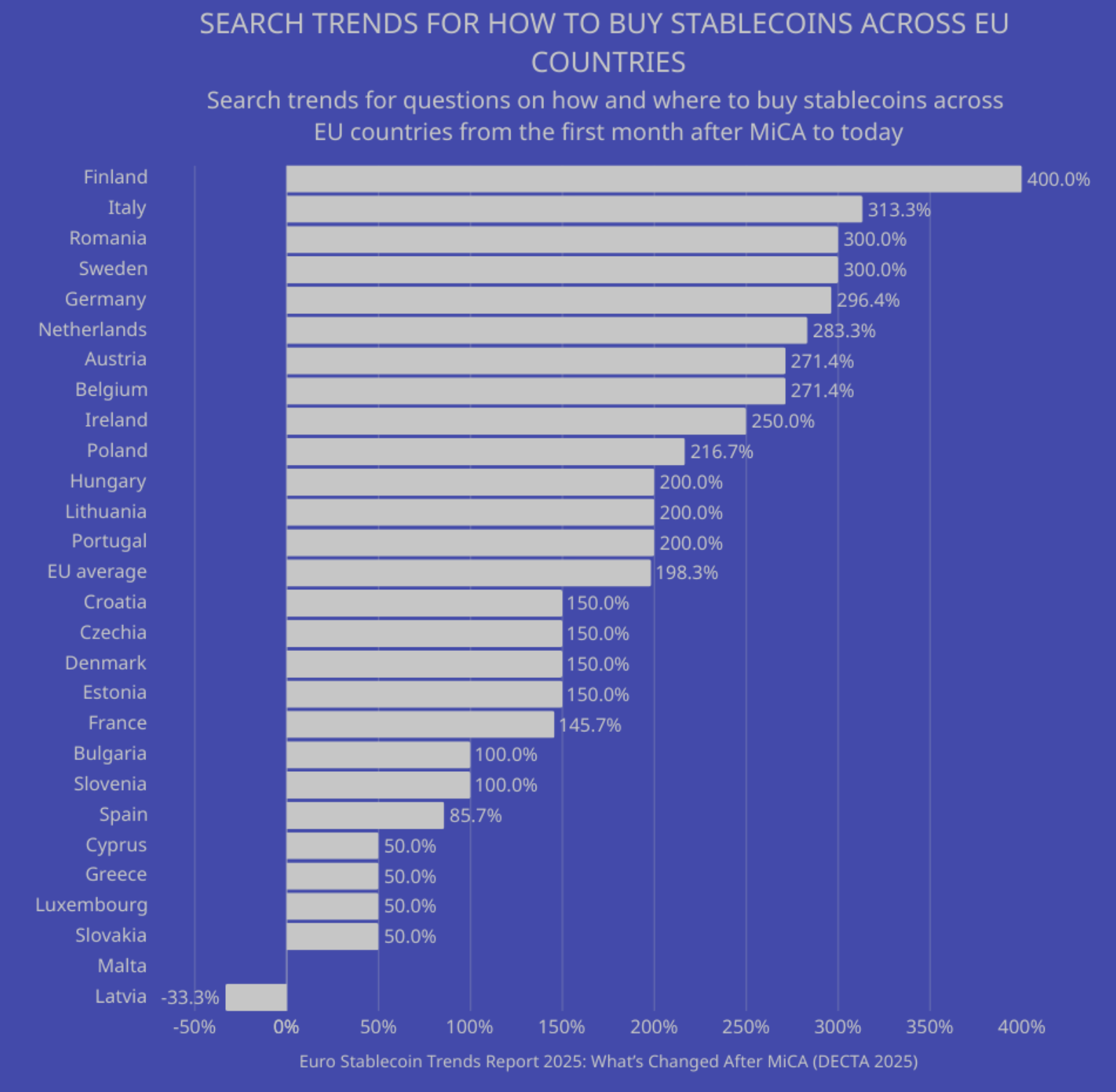

Where Europeans Are Buying Stablecoins: Search Interest +198% on Average

Consumer search behaviour shows growing curiosity toward euro-pegged stablecoins:

Largest Post-MiCA Increases

- •Finland: +400%

- •Italy: +313.3%

- •Romania: +300%

- •Sweden, Germany, Netherlands: +280% to +300%

Lowest Growth or Declines

- •Spain: +85.7%

- •Bulgaria, Slovenia: +100%

- •Latvia: –33.3% (only EU country with a drop)

Average EU-wide growth reached +198.3%.

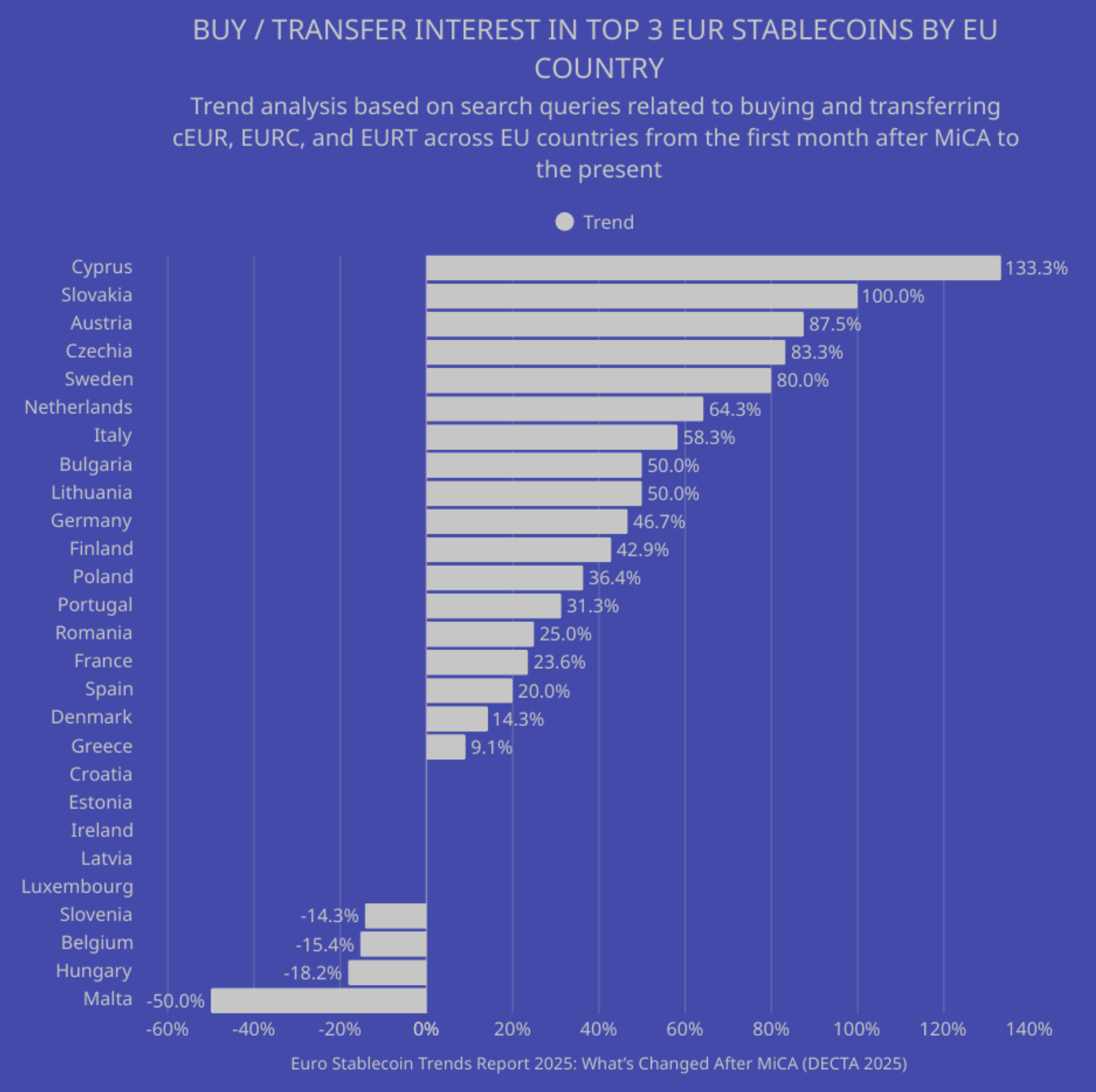

Search Demand for Specific Euro Stablecoins (EURC, cEUR, EURT)

Interest in buying or transferring the three top euro stablecoins rose in most markets:

- •Cyprus: +133.3%

- •Slovakia: +100%

- •Austria, Czechia, Sweden: +80% to +87.5%

- •Netherlands: +64.3%

- •Italy: +58.3%

Declining markets included:

- •Slovenia, Belgium, Hungary: –14% to –18%

- •Malta: –50% (largest drop)

Gaps between markets indicate uneven consumer readiness across the EU.

What Comes Next in 2026

Euro-stablecoin adoption is expected to accelerate throughout 2026. Several drivers stand out:

- Issuer Expansion

Growth will depend on how rapidly MiCA-licensed issuers scale banking rails, distribution and cross-border access. - Institutional Adoption

As tokenized bonds, securities and settlement networks rise, demand for compliant euro tokens will increase. - Consumer Payment Growth

EU consumers show rising awareness, but adoption varies widely by country. - Shift Away From Non-Compliant Tokens

Exchanges and payment providers are gradually phasing out unregulated euro assets.

By late 2026, the market is expected to be more consolidated, regulated and utility-driven – with euro stablecoins becoming a core component of Europe’s digital financial infrastructure.