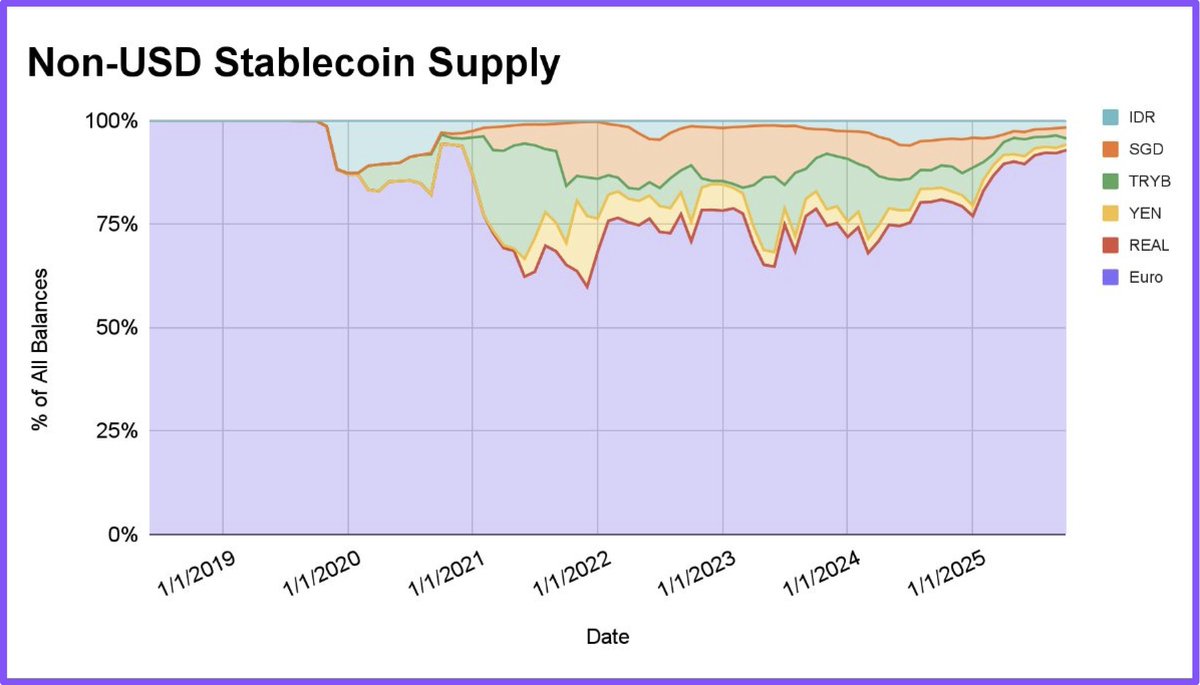

Euro-denominated stablecoins have quietly become the strongest segment of the non-USD market, standing out at a time when most other currency-backed stablecoins continue to lose ground.

New data shared by Artemis shows a decisive shift in supply composition, with euro-based tokens dominating the chart as other currencies shrink in relative presence.

EURC Drives the Trend with a Sharp Rise to €287 Million

The standout performer is EURC, which has climbed to €287 million, making it the only non-USD asset class showing clear upward momentum.

The chart illustrates this transition clearly: while supply tied to currencies such as the Indonesian rupiah, Singapore dollar, Turkish lira, yen, and Brazilian real has thinned over the years, the euro segment has expanded to occupy nearly the entire non-USD stablecoin share.

The visual trend underscores how the euro has quietly become the preferred alternative for on-chain liquidity outside the dollar, benefiting from consistent demand and a growing role in cross-border settlement and digital payments.

A Lone Bright Spot in a Contracting Non-USD Stablecoin Landscape

With other non-USD stablecoins drifting downward, EURC’s growth signals a shift in market preference toward stability, regulatory clarity, and regional adoption within Europe. While the broader non-USD stablecoin sector remains muted, euro-backed supply continues to strengthen, positioning EURC as the clear leader and the only bright spot in this category.