Ethereum’s ecosystem is entering another transition phase as fresh data from Crypto.com Research highlights notable shifts in Layer-2 transaction costs following the network’s successful Fusaka upgrade.

Alongside this change, new partnerships and infrastructure launches are reshaping the DeFi landscape, signaling broader maturation across the sector.

Crypto.com Expands Its Product Footprint

The update outlines several initiatives now advancing within the Crypto.com ecosystem. A new partnership with 21Shares introduces investment products tracking CRO, designed to give market participants more accessible exposure to the exchange’s native token.

At the same time, Cronos Labs is rolling out Cronos One, an onboarding hub built to streamline Web3 interaction for both users and developers.

Ethereum’s Fusaka upgrade also features prominently in the update, marking another milestone in the network’s ongoing roadmap to improve performance and user experience.

What the Transaction Cost Chart Reveals

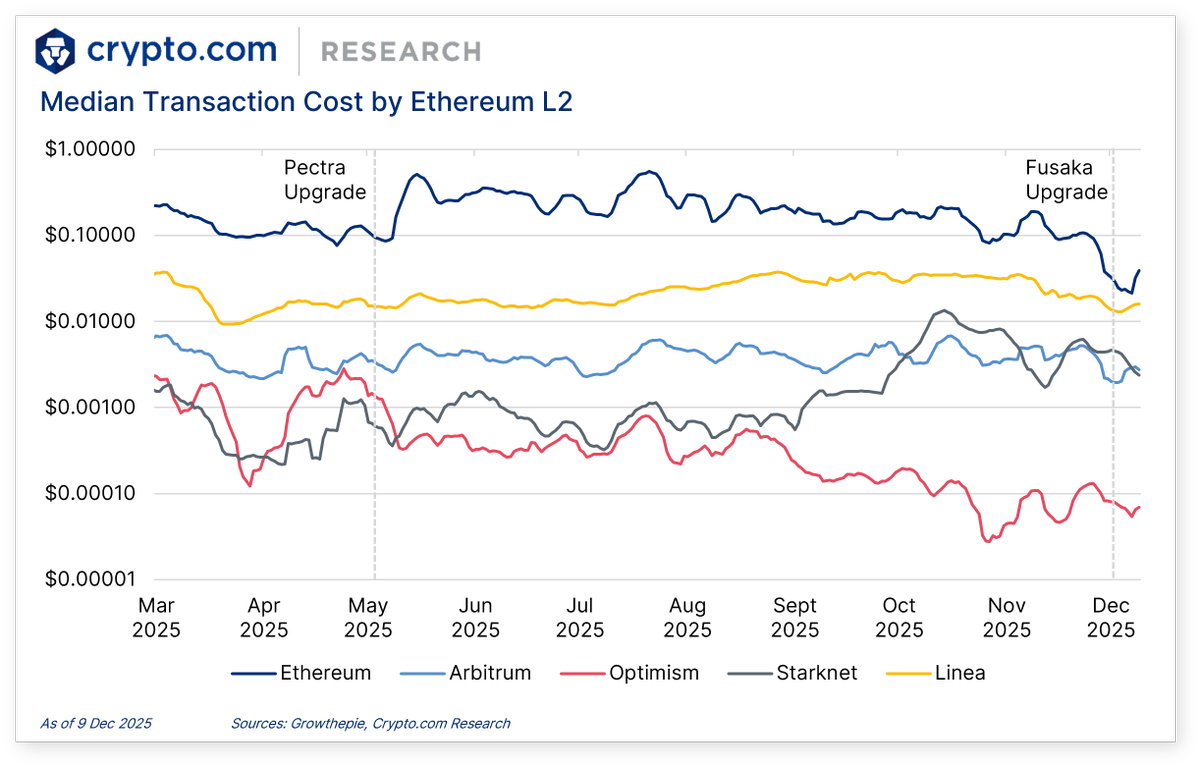

The chart shows how median transaction costs evolved across Ethereum and its major L2 networks – Arbitrum, Optimism, Starknet, and Linea, between March and December 2025. Ethereum’s own fees remain the highest across the period, with visible spikes surrounding the Pectra and Fusaka upgrades.

Arbitrum and Starknet maintain similar mid-range patterns, generally oscillating around the $0.001–$0.01 range, while Optimism consistently trends lower, drifting toward sub-$0.0001 levels in several intervals.

Linea tracks slightly above Arbitrum during most months, holding a steady median cost near $0.01. The comparison highlights how L2 ecosystems continue to deliver meaningful fee reductions relative to Ethereum mainnet, even as upgrades influence network-wide pricing dynamics.

Fusaka’s Impact Across the Ecosystem

The successful activation of the Fusaka upgrade marks another refinement to Ethereum’s scaling architecture. While the chart’s data suggests temporary volatility around upgrade windows, overall L2 costs continue to reflect the network’s efforts to maintain competitive settlement pricing.

For developers and users, these signals reinforce Ethereum’s strategic direction as it aims for lower fees, greater throughput, and smoother onboarding pathways.

A Broader Step Toward Integrated DeFi Growth

Taken together, Crypto.com’s partnership with 21Shares, Cronos Labs’ new onboarding framework, and Ethereum’s latest upgrade illustrate a synchronized push toward usability and institutional accessibility.

With median L2 costs maintaining a clear advantage over mainnet fees, the sector is better aligned with real-world adoption needs. As these developments converge, the next phase of DeFi growth appears increasingly focused on lowering barriers and widening the pipeline for both new users and traditional investors.