Ethereum’s latest on-chain data shows a clear shift beneath the surface of the market. While price spent most of November drifting lower, wallets holding between 1,000 and 10,000 ETH, often described as Ethereum’s “millionaire tier,” quietly switched from heavy distribution to active accumulation.

This trend, combined with a sharp rise in network growth, signals improving confidence among influential market participants even before price fully recovers.

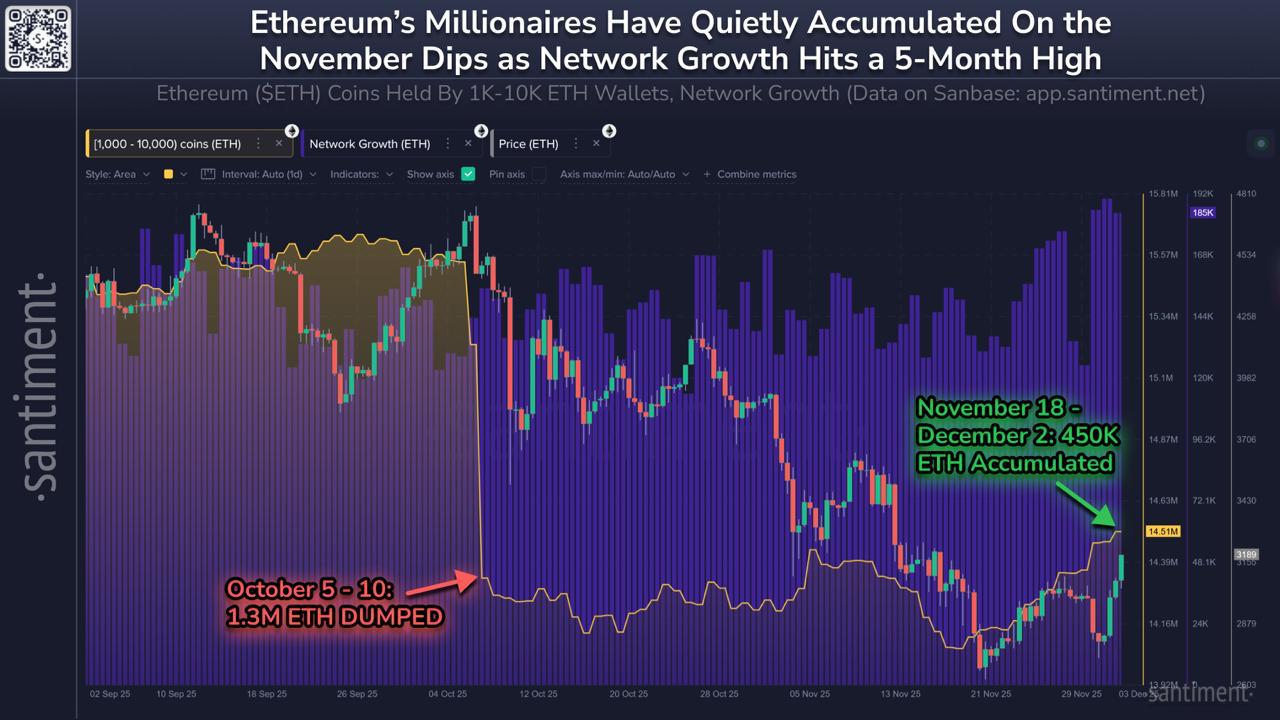

Whales Dumped in October, Then Re-Entered in Late November

The attached Santiment chart highlights how sharply sentiment flipped over the past two months. From October 5–10, these mid-tier wallets off-loaded roughly 1.3 million ETH, a move that aligned closely with Ethereum’s breakdown and the broader market correction in mid-October. But the narrative reversed in the back half of November. Between November 18 and December 2, the same group accumulated around 450,000 ETH, steadily rebuilding positions as price hovered near multi-week lows.

This pattern, heavy selling during fear followed by accumulation during exhaustion, has historically marked important turning points for Ethereum. It suggests whales saw the November weakness as value rather than the start of a deeper macro breakdown.

Network Growth Hits a 5-Month High

Ethereum’s network expansion adds another critical layer to the trend. Network growth, measured through the number of new ETH addresses interacting on-chain, has climbed to its highest level in five months, signaling a fresh wave of users returning to the ecosystem. Rising network activity during consolidation is often viewed as a leading indicator for future price strength, especially when paired with quiet whale accumulation.

The combination of address growth, re-accumulation, and stabilizing price structure suggests the recent downtrend may represent a cooling phase rather than a structural shift in market momentum.

What This Means for Ethereum Going Forward

The November accumulation phase reinforces the idea that influential holders are positioning early, not exiting the market. Historically, when this wallet band accumulates into dips while network growth accelerates, Ethereum has entered strong mid-term recovery phases. The current structure doesn’t guarantee an immediate rally, but it does show improving health across core on-chain metrics.

With whales rebuilding exposure and new addresses increasing, Ethereum appears to be forming a foundation that could support a more sustained upside once market volatility settles.