Key Takeaways

- •Ethereum has rebounded by 3.7% to $3,520 following significant liquidations.

- •Approximately $56 million in Ethereum positions were liquidated, with a majority being short positions.

- •Technical indicators such as the MACD and RSI suggest an improvement in market momentum.

- •On-chain data indicates that major resistance for Ethereum is situated at the $3,700 level.

- •A rise in open interest points to increasing trader participation in the market.

- •Analyst Tom Lee has projected that Ethereum could reach $15,000 by the end of the year.

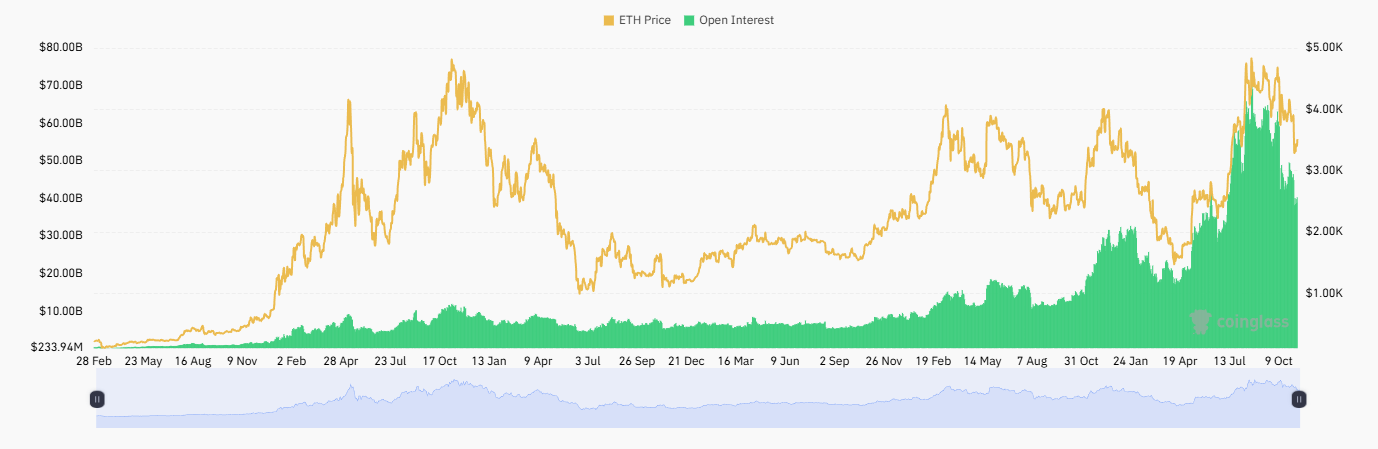

The world's second-largest cryptocurrency experienced a rise of over 3% in the past 24 hours, trading around $3,520 with a market capitalization of $424 billion. Despite weekly losses nearing 9%, Ethereum's recent rebound suggests a potential stabilization of investor sentiment as traders prepare for the next significant market movement. This surge also coincides with an increase in open interest, indicating a renewed growth in market participation after a period of cautious trading.

Liquidations Shake Out Bears

Data from CoinGlass reveals that Ethereum saw over $56 million in liquidations within the last 24 hours. Short positions constituted approximately $43 million of this total, while long positions accounted for around $13 million. This indicates that a substantial number of traders betting against Ethereum were compelled to close their positions as prices began to trend upward. The liquidation of short sellers often signifies a shift in market momentum, particularly when accompanied by rising open interest, as it suggests traders are re-establishing positions and potentially anticipating a continuation of the rally if key resistance levels are overcome.

However, analysts caution that excessive leverage in the market could amplify risks if prices encounter rejection near resistance zones.

Open Interest Points to Rising Market Confidence

Ethereum's open interest has shown a consistent upward trend since mid-October, reaching levels comparable to previous peaks. This increase suggests that derivative traders are positioning themselves for upcoming volatility, with the recent uptick indicating a bullish bias. Historically, an increase in open interest combined with price gains has often preceded strong rallies in ETH's spot price, especially when coupled with liquidations of short positions. This growing participation in the derivatives market signals renewed confidence among traders.

Technical Indicators Show Early Recovery Signs

From a technical perspective, Ethereum's daily chart is exhibiting encouraging signs of recovery. The MACD indicator, which has been in bearish territory for several weeks, is now showing signs of flattening. A potential bullish signal would occur if the blue MACD line crosses above the signal line, indicating the commencement of a new upward trend.

Concurrently, the Relative Strength Index (RSI) has recovered to 41, an improvement from oversold levels near 30, which suggests an increase in buying momentum. Price action on the daily chart also indicates that ETH found strong support near the $3,300 mark, a level that previously served as a breakout zone during the summer rally.

Resistance Builds at $3,700

On-chain data supports the assessment that $3,700 is currently a critical price ceiling for Ethereum. Analyst Ali Martinez has noted that approximately 869,000 ETH were accumulated around the $3,700 level, forming a significant resistance wall. A successful breach of this level could potentially pave the way for a move towards $4,000, where sellers might again take profits.

Over 869,000 Ethereum $ETH were accumulated around $3,700, forming a major resistance wall. pic.twitter.com/CYZhGSfrJL

— Ali (@ali_charts) November 9, 2025

Until this resistance is decisively broken, ETH is likely to trade within a range between $3,300 and $3,700 as traders monitor macroeconomic conditions and data related to ETF inflows.

Tom Lee’s $15,000 Target Fuels Debate

A notable forecast from Fundstrat's Tom Lee has generated renewed excitement within the Ethereum community. Lee's projection, shared by Crypto Rover on X (formerly Twitter), suggests that ETH could reach $15,000 by December, representing an increase of nearly fivefold from current levels.

🇺🇸 Tom Lee predicts Ethereum will hit $15,000 by December. pic.twitter.com/RaO7QOhUlb

— Crypto Rover (@cryptorover) November 9, 2025

While this target is considered highly optimistic by many analysts, Lee's reputation for long-term market insights keeps investors attentive. His prediction arrives at a time when Ethereum's underlying fundamentals continue to strengthen, driven by increasing institutional adoption and the expansion of decentralized finance (DeFi) across Layer 2 ecosystems.

Futures Data Suggests Renewed Accumulation

The derivatives market indicates a growing conviction that the recent price correction may have been a short-term market shakeout. The combination of rising open interest and liquidations of short positions suggests that traders are actively accumulating ETH exposure once again. If funding rates remain balanced, this could signal a healthier rally ahead, free from excessive speculative risk.

Broader Market Context

Ethereum's recovery is occurring in parallel with a broader uptrend observed across major cryptocurrencies, as Bitcoin stabilizes near $101,000. This market recovery follows several weeks of volatility that were influenced by evolving expectations regarding potential U.S. interest rate cuts and the performance of risk assets, including AI and technology stocks.

The ability of Ethereum to maintain its position above $3,500 will be a key factor to watch in the coming days. A sustained upward movement could attract new capital from both retail and institutional investors looking to capitalize on a potential major breakout.