Market Dynamics: Whales Buy, Holders Sell

Ethereum price is currently trading near the $3,337 mark, showing little movement despite significant accumulation by large wallets. Over the past two days, whales have reportedly added nearly $582 million worth of ETH. However, this buying pressure is being offset by selling from both long-term and short-term holders, preventing any substantial price rally.

The On-Balance Volume (OBV) and holder data suggest that Ethereum requires stronger buying momentum before a significant upward movement can begin. Until the primary buying signal turns positive, the ETH price is likely to remain range-bound.

Long-Term Holders' Selling Pressure

Data from Lookonchain indicates that the recent whale accumulation is largely driven by institutional investors. Despite this influx, long-term holders, who typically hold ETH for extended periods, are selling more coins than they are acquiring. The holder net position change, which tracks the activity of these older wallets, remains negative, indicating a net outflow of ETH from these holdings.

This trend of long-term holders selling, often to secure profits after price increases, is a key factor suppressing the ETH price. When these long-term investors sell into whale buying, the demand generated by whales is effectively neutralized. For a sustained rally to occur, a shift in sentiment among these long-term holders, leading to renewed accumulation, is necessary.

Short-Term Traders Also Reducing Holdings

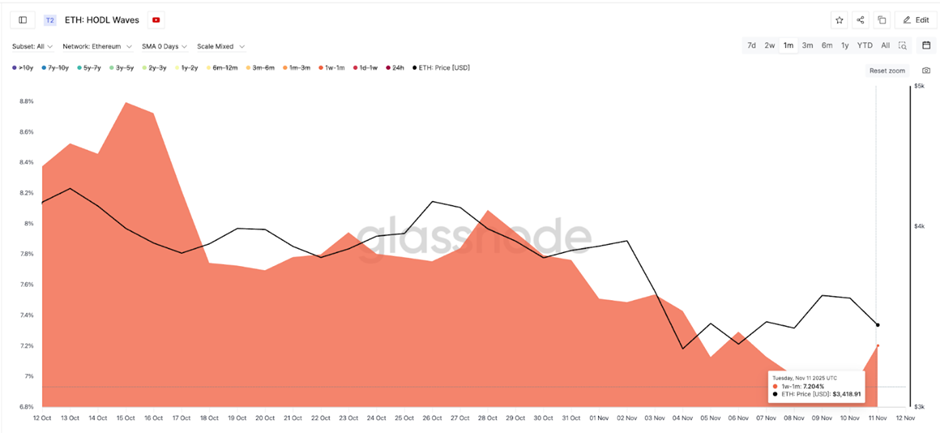

Compounding the selling pressure, short-term holders, who typically keep ETH for a few weeks, are also decreasing their exposure. Approximately a month ago, these wallets held around 8.79% of the total Ethereum supply, a figure that has now fallen to 7.2%.

Analysis of the HODL waves metric, particularly focusing on the 1-month to 3-month cohort, highlights an aggressive dumping trend among these shorter-term traders. This reduction in short-term holdings suggests a decreased willingness among these traders to weather minor price dips. Consequently, even with whale buying, the combined selling pressure from both long-term and short-term investors is contributing to the flat price action of Ethereum.

For Ethereum to experience a significant upward price movement, broader support from holders is required. When short-term wallets begin to build positions, buying pressure tends to disseminate across the market, rather than being concentrated in a few large wallets. This broader participation has not yet materialized.

Price Levels and Technical Indicators

Currently, the ETH price is holding precariously around its $3,337 support level. A break below this level could lead to a decline towards the $3,049 zone. Conversely, for Ethereum to demonstrate renewed strength and target the $3,910 zone, it must first break above the $3,514 resistance.

The On-Balance Volume (OBV), a technical indicator that measures buying and selling pressure, has been in a downward trend since September 25. This decline in OBV indicates a decrease in trading volume flowing into ETH. A sustained increase in OBV would signal the return of fresh buying pressure.

However, a breakdown of the descending trendline on the OBV could signal a potential price structure breakdown, exposing ETH to lower levels, including the $3,000 mark and below. Until these technical indicators show a clear positive turn, Ethereum is expected to continue trading within its current range, with fluctuations in daily performance.

In summary, while whale accumulation is present, the Ethereum price requires more widespread support from regular holders. The selling pressure from long-term holders and the lack of increasing trading volume suggest that ETH may remain subdued near $3,300. A significant rally is unlikely until key market signals, such as the OBV and holder net position, turn green.