The Ethereum price has experienced a 15% decline over the past week and a 1.1% drop in the last 24 hours, trading at $3,024 as of 2:33 a.m. EST. This movement occurred amidst a 16% increase in trading volume, reaching $38 billion.

This price action coincides with a significant development: fund management titan BlackRock has registered in Delaware for a staked ETH ETF (exchange-traded fund). This registration represents one of the initial steps required for a fund issuer before submitting a formal regulatory application for a new ETF.

BlackRock is planning to file for a Staked Ethereum ETF, as per the Delaware name registration. '33 Act. Filing coming soon. pic.twitter.com/NmAsQhcq5D

— Eric Balchunas (@EricBalchunas) November 19, 2025

The move by BlackRock signals a strong level of institutional confidence in Ethereum, even with its recent price slide. It also presents a new avenue for investors looking to gain exposure to crypto assets that offer staking returns.

The sharp decline in the ETH price has been influenced by growing uncertainty surrounding monetary policy. Minutes from the Federal Reserve's October 28-29 meeting revealed that a slim majority of Fed officials were against a December rate cut.

Yesterday, the Minutes of the Federal Open Market Committee were released. At the meeting, many participants favored lowering the target range for the federal funds rate, although some indicated they could have supported leaving rates unchanged, while several opposed a cut. When… pic.twitter.com/XEaC2whw8z

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) November 20, 2025

Ethereum Price Indicators Signal Continued Bearish Stance

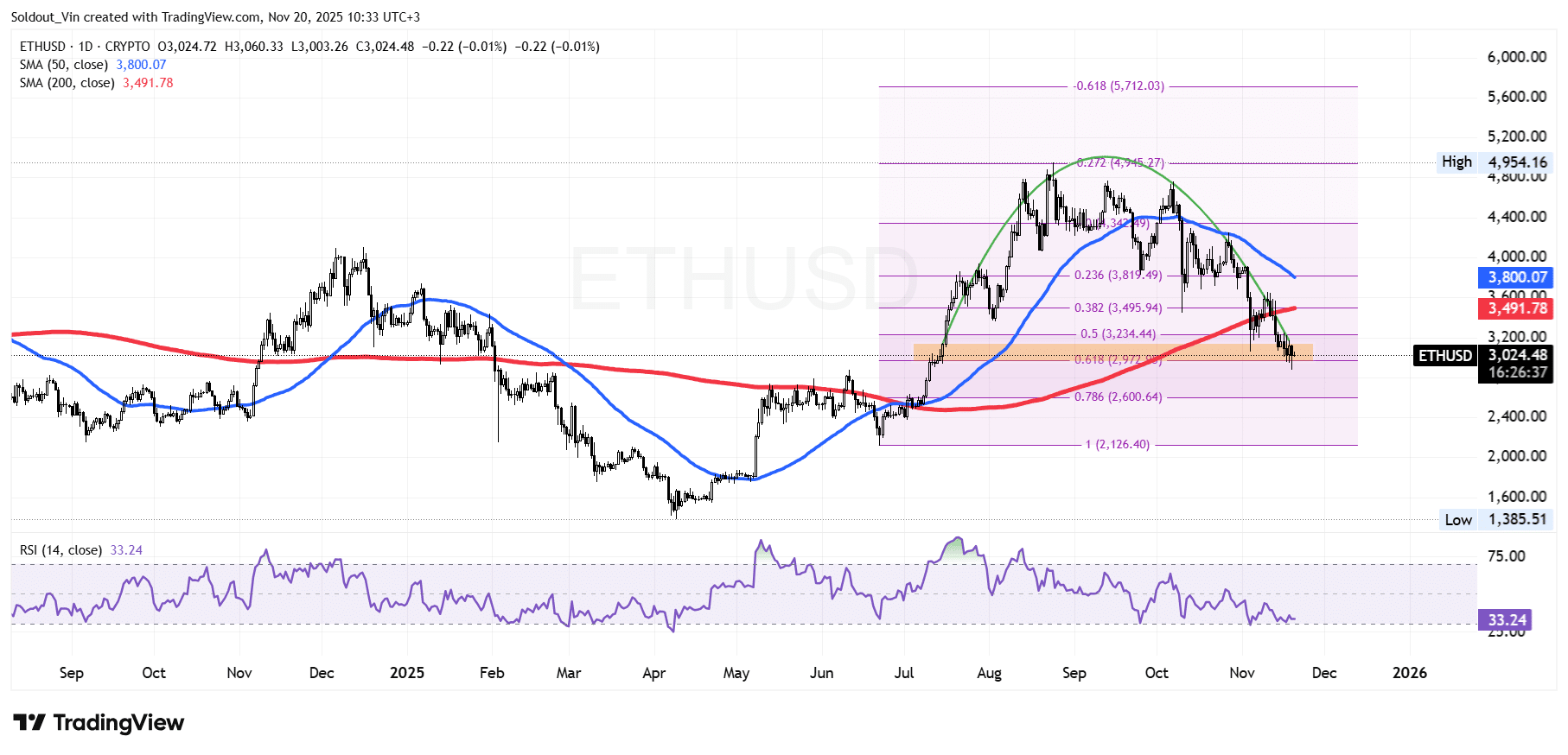

Following a correction at the beginning of the year, Ethereum price bulls leveraged the support around $1,560 to drive the asset to a new all-time high in August of $4,954.

However, the bulls were unable to sustain this resistance level, and the Ethereum price retested the $4,736 resistance multiple times. Consequently, bears gained control, forming a rounded top pattern.

Concurrently, the price of Ethereum continued to decline, retesting the neckline at the $2,972 support, which aligns with the 0.618 Fibonacci retracement level.

As a result of the ongoing downtrend, ETH has fallen below both the 50-day and 200-day Simple Moving Averages (SMAs), which are now acting as resistance levels at $3,800 and $3,491, respectively.

Furthermore, selling pressure remains intense, with the Relative Strength Index (RSI) still positioned within the 30-oversold zone, currently at 33.24.

ETH Price Prediction

Based on the current ETH/USD chart analysis, the ETH price is testing a critical confluence zone near the 0.618 Fibonacci retracement level, approximately between $2,970 and $3,050.

This area has historically served as a strong reaction level, and the price of ETH's ability to hold above it, or its failure to do so, will likely dictate the next directional movement.

A sustained close back above the 200-day SMA could pave the way for a recovery towards the $3,230 (0.5 Fib) and $3,495 (0.382 Fib) regions, which might act as resistance during any potential relief bounce.

However, with weakening momentum and the RSI hovering near oversold territory, downward pressure continues to be a significant factor. If the price of Ethereum loses the current support, the next major Fibonacci level is near $2,600, with the possibility of a deeper retracement towards $2,126 if selling pressure intensifies.

Despite the turbulence in the Ethereum price, network fundamentals remain resilient. ETH staking reached a record high in November 2025, with over 33 million tokens now locked, according to Milk Road.

ETH staking just hit a new all time high… again.

Price has been messy, and sentiment has been worse.

But the one thing that hasn’t moved is the amount of $ETH people are willing to lock away for years.

Just a steady climb toward 33M+ ETH locked.

That’s long term alignment… pic.twitter.com/HycnZ4gtk1

— Milk Road (@MilkRoad) November 19, 2025

Milk Road noted that although sentiment has been weak, the high level of staked ETH indicates strong long-term confidence in the network.