Analysts are re-tuning Ethereum price prediction models, observing on-chain metrics that indicate increased demand from both retail and institutional investors. With ETH staking growing at its fastest rate since 2023, certain market strategists view this as a foundation for a potential price rise. This phenomenon is driving renewed interest in utility-focused projects, such as an increasingly popular payments-focused cryptocurrency that has been likened to the next generation of settlement networks.

Ethereum Gains on Growing Staking Demand

Ethereum's recent performance suggests strong investor confidence in its proof-of-stake consensus mechanism. The coin has experienced a notable decline of 3.58% in the past day, and is currently trading at $3,889.84.

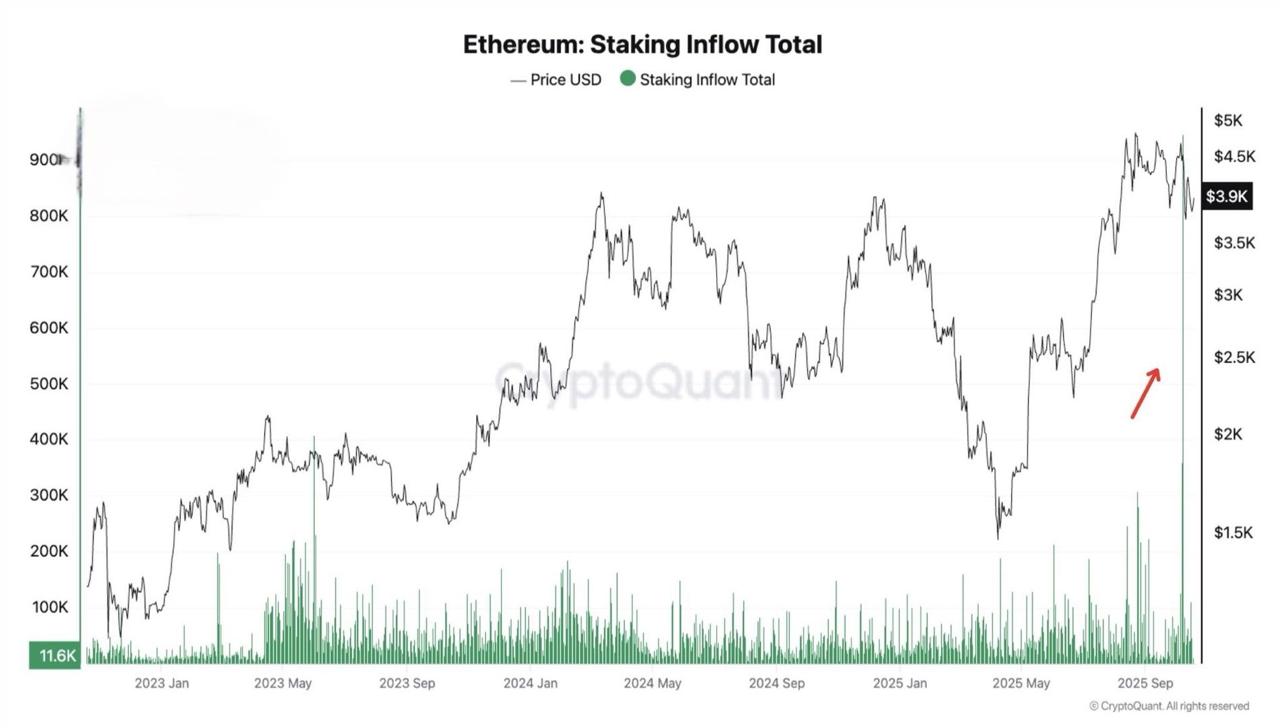

A significant shift of capital towards yield-generating assets within the Ethereum ecosystem is evident in the recent surge in staking inflows, which some observers have described as "parabolic." Technical analysts highlight Ethereum's capacity to maintain staking momentum as a structural support for price stability. With sustained inflows at the current pace, numerous forecasts suggest the potential for a retest of the $4,200 level in the near term.

Despite these positive indicators, near-term volatility remains a possibility, influenced by macroeconomic fundamentals and Bitcoin's performance, which often sets the overall market sentiment.

ETH's performance is gaining traction across social channels, fueling optimism regarding its medium-term price outlook.

New Rising Crypto Gains Global Traction

While Ethereum solidifies its position through network fundamentals, other new projects are making waves with innovations extending beyond traditional DeFi. One such project is Remittix, a utility token focused on optimizing cross-border payments.

Remittix has successfully raised over $27.5 million from strategic private investors through the sale of more than 679 million tokens at $0.1166 each. This substantial financial infusion underscores investors' strong belief in its expanding ecosystem.

The project has recently achieved CertiK verification, securing the #1 ranking among all pre-launch tokens. This milestone further validates its credibility and readiness in terms of security. Additionally, RTX is slated for listing on BitMart and LBank, which is expected to increase liquidity and investor accessibility upon going live.

Remittix is also making technical advancements, with its wallet beta testing now open to users. The platform offers a 15% USDT referral program providing daily rewards through its dashboard. Analysts anticipate that these developments could significantly boost market exposure, especially as the platform's adoption grows.