The Ethereum price has experienced a significant downturn, dropping 5% in the last 24 hours to trade at $3,315. This decline is occurring amidst a notable increase in trading volume, which rose by 46% to $71 billion.

This price action follows a recommendation from 10x Research to short Ether, suggesting it as a potential hedge against Bitcoin. The firm cited structural risks within the Ethereum network and a decline in institutional demand as key factors influencing this strategic advice.

The research firm further highlighted that while Bitcoin continues to attract substantial treasury capital, Ethereum-focused companies are reportedly facing capital constraints, potentially impacting their investment capacity in the asset.

According to 10x Research, these conditions present ETH as a viable shorting opportunity for investors seeking to mitigate their exposure within the digital asset sector.

LATEST: ⚡ 10x Research has identified Ethereum as a potential shorting opportunity, highlighting structural weaknesses as Bitcoin continues to capture the majority of institutional treasury capital. pic.twitter.com/s79Jgc0fy8

— CoinMarketCap (@CoinMarketCap) November 5, 2025

Analysts from 10x Research observed that the "digital asset treasury" narratives surrounding Ethereum had previously encouraged institutions to accumulate ETH, which was then distributed to retail investors. However, this pattern is reportedly breaking down due to a lack of transparency in private investment in public equity (PIPE) disclosures and uncertainties in capital flows.

The firm also referenced BitMine, noting that its strategy enabled institutional investors to acquire ETH at par value and subsequently sell it to retail buyers at a premium. This cycle had previously contributed to driving prices higher.

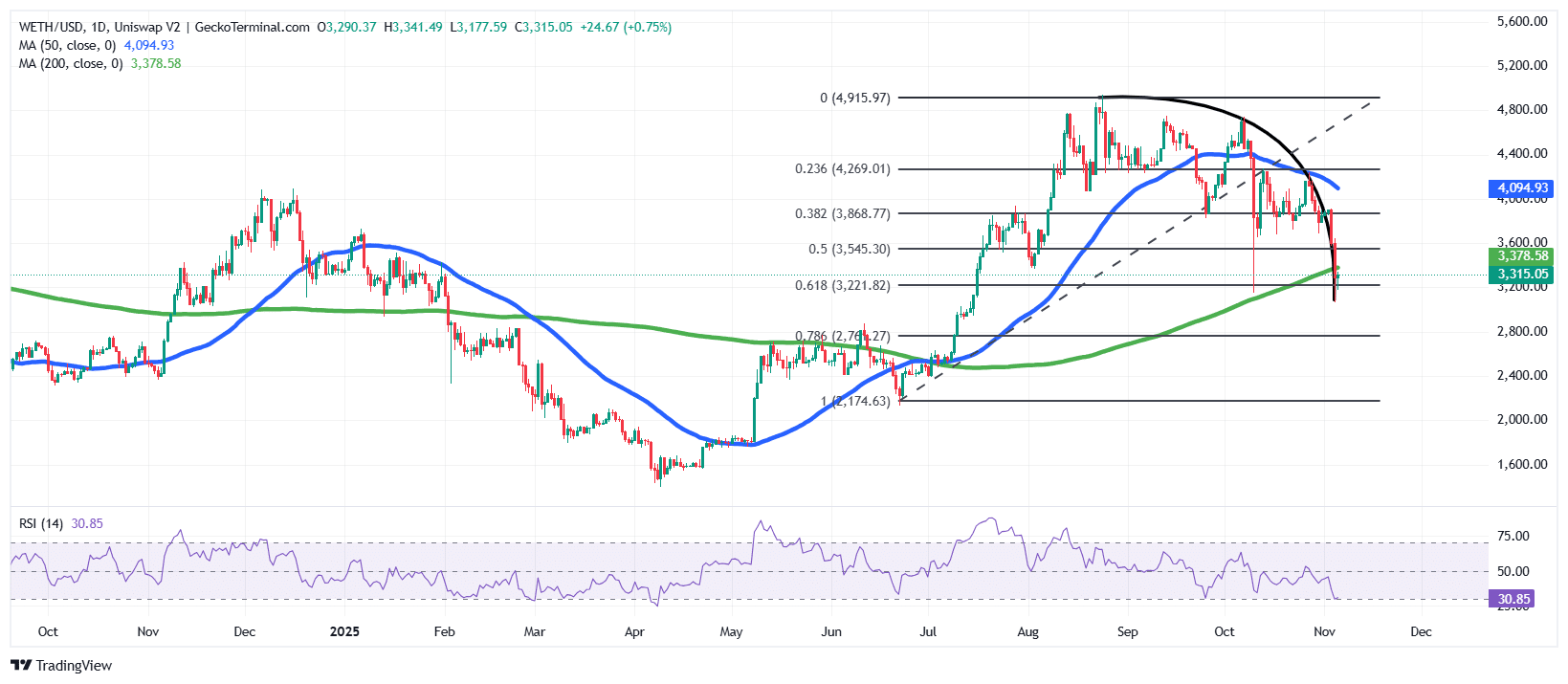

Ethereum Price Tests Key Support After Rounded Top Breakdown

The ETH price has entered a bearish phase after experiencing a strong rally earlier in 2025. Following a local high near $4,915, the Ethereum price formed a rounded top pattern, which typically signals a shift in market momentum from bullish to bearish.

Since then, the price of ETH has declined sharply, breaking below the $4,400 and $3,800 levels. It is now testing the support zone between $3,200 and $3,300.

This support zone aligns with the 0.618 Fibonacci retracement level of the previous rally, which stands at $3,221. This level is often considered a critical point where buyers may attempt to regain control of the market.

The 1-day chart analysis indicates that ETH has fallen below its 50-day Simple Moving Average (SMA) at $4,094. It is currently positioned near the 200-day SMA at $3,378, a significant indicator of the long-term trend. If buyers successfully defend this support level and push prices back above $3,500, it could confirm a potential rebound and avert a deeper correction.

The Relative Strength Index (RSI) is currently around 30.86, nearing the oversold region, which suggests that bears are exerting considerable control over the price.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator continues to support the bearish momentum, with the blue MACD line trading well below the orange signal line.

ETH Price Outlook: Bears In Control, But Bounce Possible

From a technical standpoint, the trend remains bearish as long as the ETH price trades below both the 50-day and 200-day SMAs. Immediate resistance is observed around $3,545, corresponding to the 0.5 Fibonacci level, followed by $3,868.

A daily close above these resistance levels could signal the commencement of a short-term recovery, potentially pushing prices toward the $4,000–$4,200 range.

Conversely, if the $3,200 support level fails to hold, the next potential downside target is projected to be near the $2,780–$2,800 zone.

Overall, Ethereum's chart structure indicates that the market is at a critical juncture, with bears currently in control. However, technical indicators suggest the possibility of an upcoming oversold relief bounce.

Related News

- •Analyst Doubts Strategy Will Need To Sell Some Of Its BTC Holdings To Pay Off Its Debts

- •Banking Group “Strongly Opposes” Coinbase’s Trust Bank Charter Application

- •Wintermute CEO Denies Rumors Of Plan To Sue Binance Over October Flash Crash Losses