BitMine chairman Tom Lee has made a bold Ethereum price prediction, forecasting a potential rise to $63,000. This prediction is rooted in the concept of the Ethereum network capturing a fraction of the immense $300 trillion global financial market through tokenization.

In the meantime, the price of Ethereum (ETH) has remained stable above a critical support level near $3,300, following a significant 12% correction over the past seven days.

Tom Lee’s $63,000 Ethereum Price Prediction

Tom Lee has issued a striking Ethereum price prediction, suggesting the cryptocurrency could soon reach $63,000.

According to Lee, this forecast is based on the premise that the Ethereum network only needs to secure a small percentage of the global financial markets, a significant portion of which major players like Blackrock are planning to tokenize on the blockchain.

The trend of tokenization is rapidly gaining traction, with prominent firms such as BlackRock actively exploring methods to bring real-world assets onto the blockchain.

Ethereum, already boasting a valuation of approximately $440 billion, is considered one of the leading platforms poised to facilitate this transformative shift.

🚨 TOM LEE JUST BROKE IT DOWN! 🤯

— BMNR Bullz (@BMNRBullz) November 8, 2025

•Ethereum is worth $440B today

•Global markets = $300 TRILLION

•BlackRock’s Larry Fink wants to tokenize assets on blockchain

•If even a small % moves to Ethereum…

Lee says $ETH could hit $63,000+ 🔥

The upside? MASSIVE, Trillions in… pic.twitter.com/HGr5a4Hka0

If even a modest portion of the global market is integrated into the Ethereum network, the platform's long-term value could experience substantial expansion. Under such a scenario, projections suggest a potential price far exceeding current levels, possibly reaching as high as $63,000 per coin.

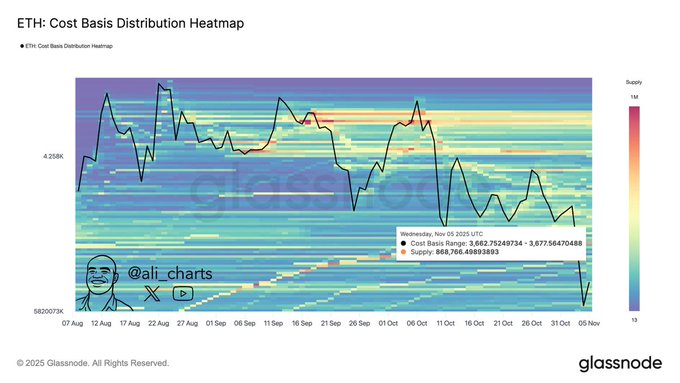

Buyers Accumulated 869,000 Ethereum (ETH) Around $3,700

Ethereum's recent price action is encountering a significant supply barrier, according to data shared by Ali_charts.

Over 869,000 ETH were accumulated in the vicinity of the $3,700 mark, creating a substantial resistance zone that could impede further upward movement.

The cost basis heatmap provided by Glassnode clearly illustrates a concentration of holdings around this price point, where a considerable number of investors previously entered the market.

Should Ethereum ascend back into this cluster, it could transform into a critical battleground between buyers and sellers, with some aiming to secure profits and others seeking to mitigate losses.

Meanwhile, support in the range of $3,200 to $3,300 is currently holding firm, as every dip to this zone has been met by buyers.

At the time of writing, ETH price is trading below resistance, with buyers maintaining its stability as all eyes are on this key level.

Furthermore, the altcoin has the potential to re-enter bullish territory with a successful reclaim of $3,600, which could pave the way for a push towards $5,000. On-chain data also indicates significant accumulation by large holders, with Tom Lee’s Bitmine Immersion Technologies adding over 744,600 ETH to its treasury since October 5.

ETH Supply on Exchanges is Dropping at High Rate

According to a post by CryptoRover on X, the supply of Ethereum across exchanges has seen a sharp decline, signaling a high rate of accumulation relative to selling.

This trend is viewed as a positive indicator, suggesting the market is well-positioned to absorb any potential sell-side pressure that could otherwise drive the price downwards.

Based on this Ethereum price prediction, the immediate path forward will encounter resistance levels near $3,783, $4,231, and $4,549, as indicated by Fibonacci extension levels.

Concurrently, a cluster of exponential moving averages situated between $3,833 and $4,011 could present another significant price resistance. A sustained push above this zone might unlock the potential for a more robust bullish movement.