Key Insights

- •Ethereum price has experienced a notable increase, surpassing the $3,000 mark.

- •Inflows into US Ethereum ETFs have shown strength, outperforming Bitcoin ETF inflows and bolstering market confidence.

- •Analysts are predicting a potential upward movement for ETH, with some forecasting a rise to $3,600.

Ethereum Price Dynamics and Market Influences

Ethereum price has seen a significant uplift, with gains exceeding 2% and holding firmly above the $3,000 level. This surge is occurring amidst increasing corporate investment and positive sentiment in the broader financial markets. The recent performance of the US Spot Ethereum ETF has also contributed to the upward momentum of ETH price.

The overall market sentiment has been positively influenced by developments in traditional finance, including Bitcoin's recent climb past $90,000, which has been partly attributed to growing expectations of a Federal Reserve rate cut in December. This positive outlook has extended to the cryptocurrency sector.

Corporate confidence in Ethereum is further underscored by ongoing strategic investments. For instance, BitMine (BMNR) has continued to demonstrate its conviction in the asset through substantial accumulation. This sustained corporate interest is seen as a supportive factor for Ethereum's price trajectory.

Market analysts are closely watching key price levels for Ethereum. A break above certain thresholds is considered crucial for shifting the current bearish trend, according to expert commentary.

Ethereum Price Movement and Investment Trends

Ethereum's price has climbed by over 2%, trading at approximately $3,063 after reaching a daily high of $3,069. While the cryptocurrency experienced a low of $2,987 in the past 24 hours, its trading volume has seen a slight decrease of 16%. Despite a weekly gain of over 11%, Ethereum has seen a 23% decrease over the last month.

This recent price increase is largely attributed to a broader recovery in the cryptocurrency market, fueled by Bitcoin's ascent to over $90,000. The stock market's positive performance, influenced by increased probabilities of a Federal Reserve rate cut in December, has also played a role. Consequently, cryptocurrency-related stocks have also rallied, with BitMine (BMNR) stock showing a significant increase of nearly 9%, reaching $34.41.

BitMine has continued its aggressive investment strategy in Ethereum, which appears to be supporting its price gains. Data from Lookonchain indicates that BitMine recently acquired an additional 14,618 Ethereum, valued at approximately $44.3 million.

Future Outlook for ETH Price Amidst Ethereum ETF Inflows

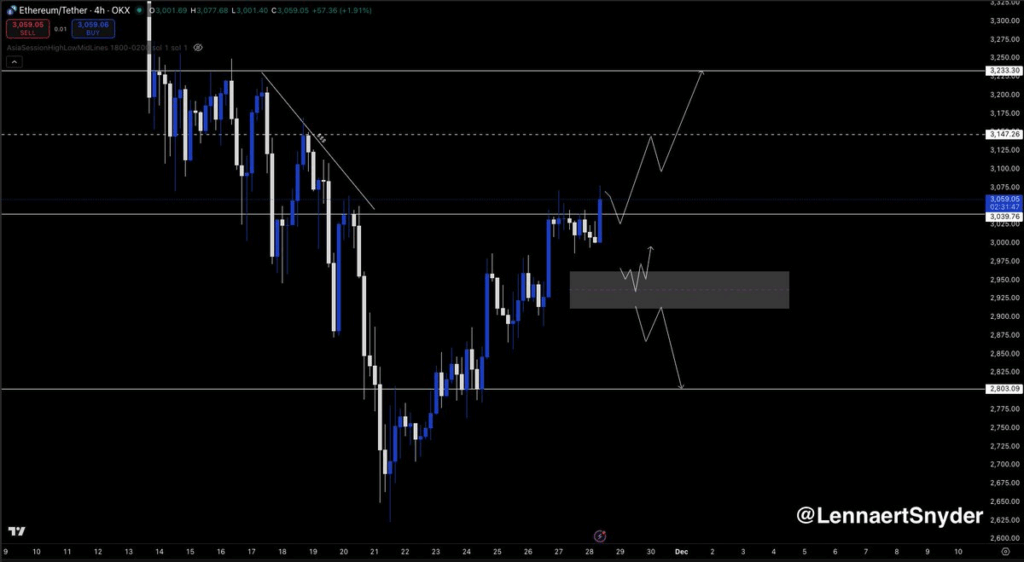

Amidst the prevailing positive market sentiment, analyst Lennaert Snyder has identified $3,040 as a critical level for Ethereum price. A sustained drop below $3,000 could potentially lead to further pullbacks and increased selling pressure in the market.

Conversely, Snyder suggests that a breakthrough above the $3,230 level could signify a reversal of the bearish trend. Similarly, analyst That Martini Guy has indicated that if Ethereum can maintain support at $3,040, the next significant price target could be $3,631.

These optimistic projections are further supported by consistent inflows into the US Spot Ethereum ETF. Data from Farside Investors shows that the US Spot Ether ETF recorded an inflow of $60.8 million on November 26, marking its fourth consecutive day of inflows. In comparison, the US Spot Bitcoin ETF saw an inflow of only $21.1 million on the same day, with a streak of two consecutive days of inflows.

This trend suggests a growing institutional confidence in the long-term potential of Ethereum price.