Ethereum’s validator exit queue has fallen to almost zero, marking a sharp reversal from conditions seen late last year and signaling a meaningful shift in staking behavior.

The change suggests a steep drop in near-term selling pressure and growing confidence in Ethereum’s yield mechanics as more participants choose to stay locked in rather than exit.

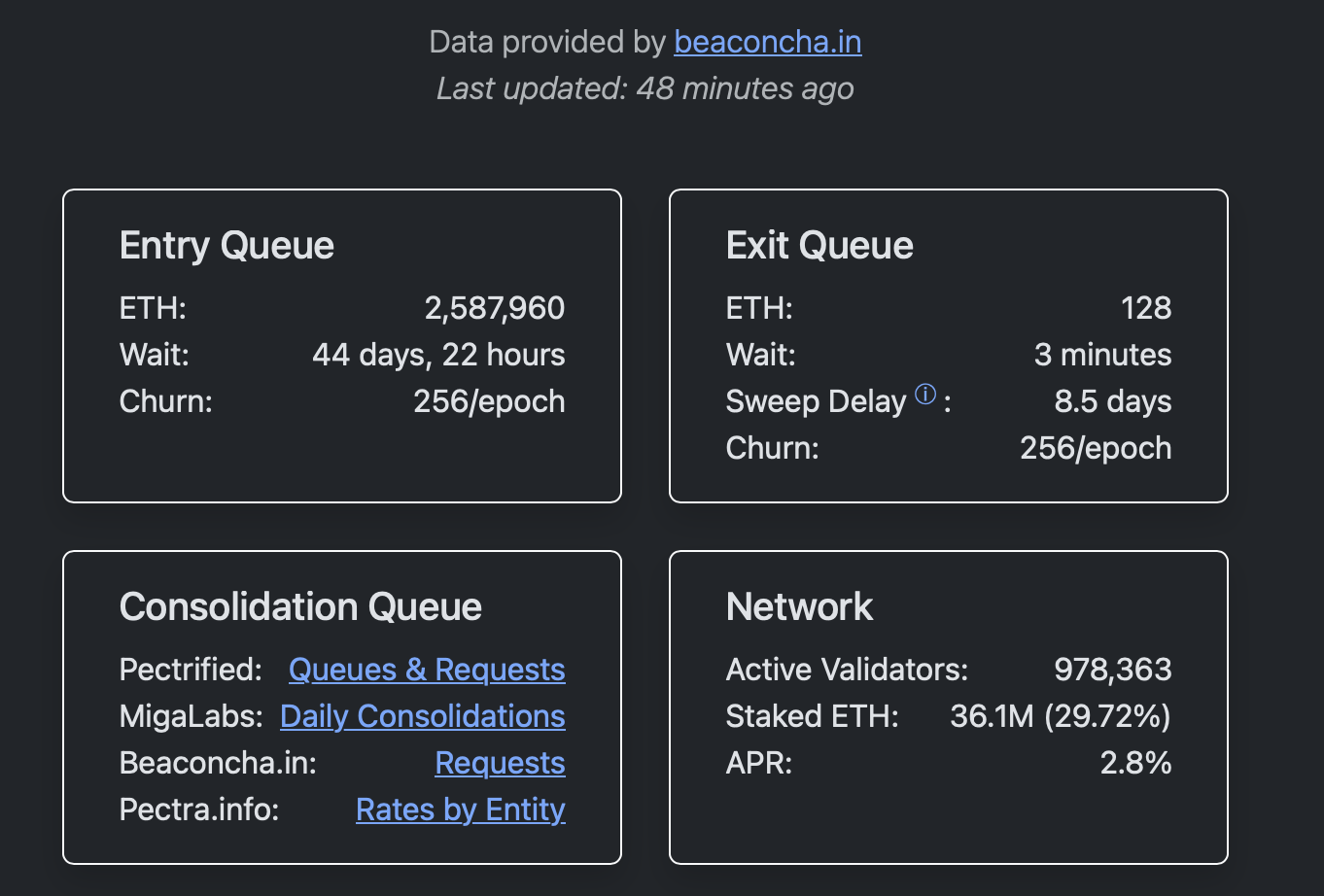

As of January 2026, exit requests that once stretched into weeks are now being processed within minutes, reflecting the absence of validators seeking to leave the network. Just four months ago, the exit queue peaked at 2.67 million ETH in September 2025, a level that had raised concerns about potential supply returning to the market.

Entry Demand Swells as Exits Vanish

While exits have dried up, the opposite is happening on the entry side. The staking entry queue has expanded fivefold over the past month, reaching approximately 2.6 million ETH, its highest level since July 2023. Due to this surge, new validators are now facing an activation wait time of roughly 45 days before they can begin earning rewards.

In total, around 36.1 million ETH, about 29–30% of Ethereum’s total supply, is currently locked in staking. At current valuations, that represents more than $118 billion committed to securing the network.

Institutional Capital Drives the Shift

A significant share of the recent inflows is tied to institutional participation. BitMine has staked more than 1.25 million ETH, accounting for over a third of its total holdings, according to the data provided. The move reflects a preference for long-duration yield exposure rather than liquidity.

Another milestone arrived with Grayscale, which recently issued the first staking rewards payout for a U.S.-listed spot Ethereum ETF. The event marked a step forward in making Ethereum staking yields accessible to institutional investors through familiar market vehicles.

Supply Tightens as Confidence Builds

The combination of a cleared exit queue and a swelling entry queue is reshaping Ethereum’s supply dynamics. With fewer validators leaving and more ETH waiting to be locked, circulating supply is tightening rather than expanding. This structure contrasts sharply with periods where exit queues dominated the narrative and raised fears of sustained sell-side pressure.

While price implications depend on broader market conditions, the current staking data points to a network where participants are increasingly willing to commit capital for the long term. For Ethereum, January’s zero exit queue is less about a single metric, and more about what it reveals: a market choosing yield and conviction over liquidity.