Summary of Recent ETF Flows

Ethereum-based exchange-traded funds (ETFs) are experiencing a decline in investor demand, with outflows reported for the second consecutive week. This trend contrasts sharply with Bitcoin ETFs, which are seeing a strong resurgence and attracting significant new capital. Institutional investors appear to be rotating back into Bitcoin, favoring its perceived stability over Ethereum's recent performance.

In brief

- •Ether ETFs have posted $243.9 million in outflows for the week, marking the second consecutive week of investor redemptions.

- •Bitcoin ETFs have seen a surge with $446 million in new inflows, driven by robust institutional demand and renewed confidence.

- •BlackRock’s IBIT and Fidelity’s FBTC are leading Bitcoin ETF inflows, collectively managing over $110 billion in assets.

- •Analysts suggest that investors are favoring Bitcoin's stability amid market uncertainty, while Ethereum is experiencing fading institutional interest.

Ether ETF Outflows Continue, Signaling Shift in Investor Sentiment

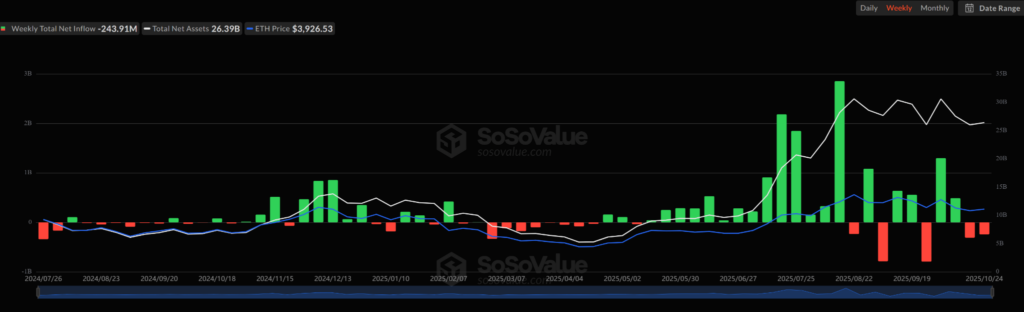

According to data from SoSoValue, Ether ETFs recorded net redemptions totaling $243.9 million for the week ending Friday. This follows a significant outflow of $311 million in the previous week. These consecutive withdrawals signify a clear reversal after a period of consistent inflows earlier in the year. On Friday alone, Ether ETFs experienced $93.6 million in redemptions.

Key performance data for Ether ETFs during the week included:

- •BlackRock’s ETHA ETF led the withdrawals, with $100.99 million in outflows during the latest trading session.

- •Grayscale’s ETHE fund showed a slight divergence, recording a modest $7.40 million in inflows amidst broader sector redemptions.

- •The weekly outflows collectively indicate a waning investor appetite for Ethereum-based products following a period of strong inflows earlier this year.

- •Despite recent outflows, cumulative inflows across all Ether spot ETFs remain substantial at $14.35 billion, reflecting sustained long-term investor interest.

- •The total net assets for Ethereum ETFs currently stand at $26.39 billion, representing approximately 5.55% of Ethereum’s overall market capitalization.

The total trading volume across Ether ETFs reached $1.41 billion for the week, suggesting a decrease in activity compared to prior periods of heightened demand.

Institutional Demand Drives $446 Million Inflows Into Bitcoin ETFs

In contrast to the performance of Ethereum-focused products, spot Bitcoin ETFs have demonstrated a strong rebound. These funds attracted $446 million in net inflows for the week, signaling a renewed enthusiasm from institutional investors.

Data from Friday indicates the following:

- •Bitcoin ETFs added $90.6 million in new inflows, underscoring continued institutional participation.

- •Cumulative inflows across all spot Bitcoin ETFs have now reached $61.98 billion.

- •BlackRock’s iShares Bitcoin Trust (IBIT) was the leader in daily activity, with $32.68 million in inflows, maintaining its prominent position among Bitcoin funds.

- •Fidelity’s Wise Origin Bitcoin Fund (FBTC) closely followed, attracting $57.92 million in inflows.

- •IBIT remains the largest Bitcoin ETF by assets, holding $89.17 billion, while FBTC manages $22.84 billion.

Following this robust performance, the total net assets of Bitcoin investment vehicles amount to $149.96 billion, which represents approximately 6.78% of Bitcoin’s market capitalization. The total trading volume among Bitcoin ETFs for the week reached $3.34 billion.

Analyst Commentary on Shifting Investor Preferences

Vincent Liu, Chief Investment Officer at Kronos Research, observed that the recent trends clearly indicate a shift favoring Bitcoin. He noted that investors are prioritizing Bitcoin's "digital gold" appeal during a period of global market uncertainty. Liu added that Bitcoin's inherent resilience, coupled with expectations of potential monetary easing, has bolstered its attractiveness as a store of value.

Conversely, the ongoing outflows from Ethereum ETFs highlight a softening in demand and a decline in on-chain activity. Liu suggested that institutional investors might be awaiting clearer market catalysts before increasing their exposure to the Ether market.

As of the time of writing, Bitcoin was trading at $111,383, and Ethereum was priced at $3,948. Both assets showed limited price movements, with markets anticipating upcoming macroeconomic developments.