Supported by record inflows into spot ETFs and a favorable technical configuration, Ethereum is quietly outperforming Bitcoin. As capital flows shift and retail interest rises again, a turning point is occurring. The question remains whether this trend change is permanent.

In Brief

- •Ether has outperformed Bitcoin in recent weeks, both technically and fundamentally.

- •Spot ETH ETFs recorded $360 million in net inflows, significantly higher than the $120 million for BTC ETFs.

- •This dynamic suggests a capital rotation favoring Ethereum, which has regained the short-term upper hand.

- •If current conditions persist, a target of $3,900 for Ether is being considered.

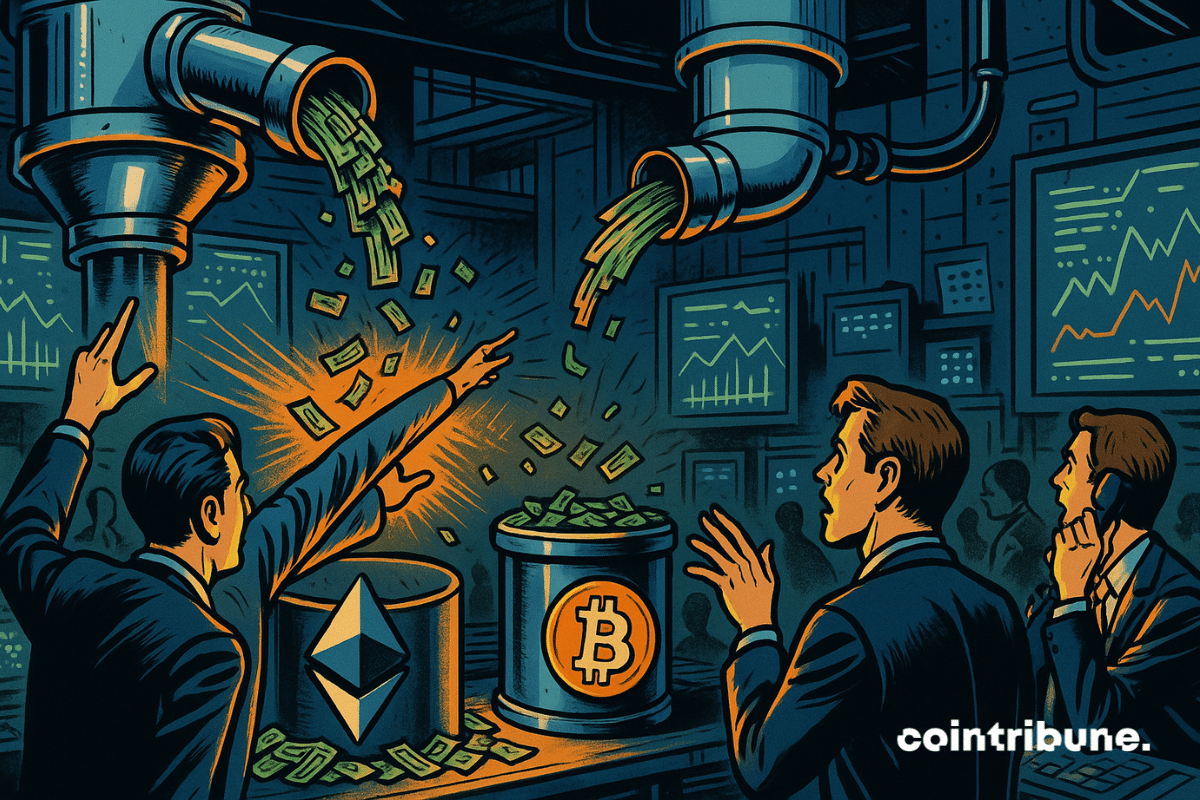

Flows Reverse: ETH Attracts Capital at BTC's Expense

Over the past two weeks, financial products backed by Ether have experienced significant net capital inflows, a stark contrast to those of Bitcoin.

Specifically, spot ETH ETFs attracted $360 million in net inflows, compared to only $120 million for BTC ETFs – three times more. This sudden imbalance reflects a temporary but significant shift in investor preferences and validates the thesis of a capital rotation in favor of Ether.

This favorable dynamic for ETH is also evident in its structural outperformance against Bitcoin. The key elements supporting this trend include:

- •Massive inflows to ETH spot ETFs: +$360 million in two weeks, versus +$120 million for BTC.

- •Technical momentum favoring ETH: The asset has surpassed a 20-day high above $3,200, indicating a bullish breakout.

- •BTC lagging behind: Bitcoin awaits a strong signal, with a decisive technical close above $96,000 still absent.

- •The ETH/BTC comparison: The gap is widening in favor of Ether, which has technically regained the short-term upper hand.

In summary, ETH is benefiting from a context where capital is redeploying in its favor, reinforced by technical signals indicating a clear trend change. Conversely, Bitcoin remains under pressure and has not yet validated a comparable bullish setup.

Technical Signals Supporting the Trend

Beyond institutional movements, Ether's positive dynamic is also supported by renewed interest from retail investors.

A notable turning point occurred on November 21, when the price of ETH fell below $2,700, triggering a wave of purchases by retail investors. This behavior is reminiscent of previous episodes, particularly in spring 2023, where an initial accumulation phase by retail investors preceded a more pronounced correction, followed by a prolonged rebound.

Technical indicators also lend support to the thesis of a moderate bullish continuation. Ether's Net Unrealized Profit/Loss (NUPL) currently stands around 0.22, which signifies a zone of balance, neither euphoric nor bearish.

Furthermore, as long as this indicator remains above 0.20, market sentiment stays favorable for a rebound whenever catalysts emerge. Graphically, ETH/BTC has broken upwards out of a 30-day consolidation zone and has reclaimed its 200-day moving average, a zone that historically coincides with prolonged periods of ETH outperforming BTC.

The hypothesis of Ethereum reaching $10,000 is resurfacing. The current momentum is present, but nothing is guaranteed. The trajectory remains dependent on upcoming signals, balancing speculative appetite with investor caution.