Key Takeaways

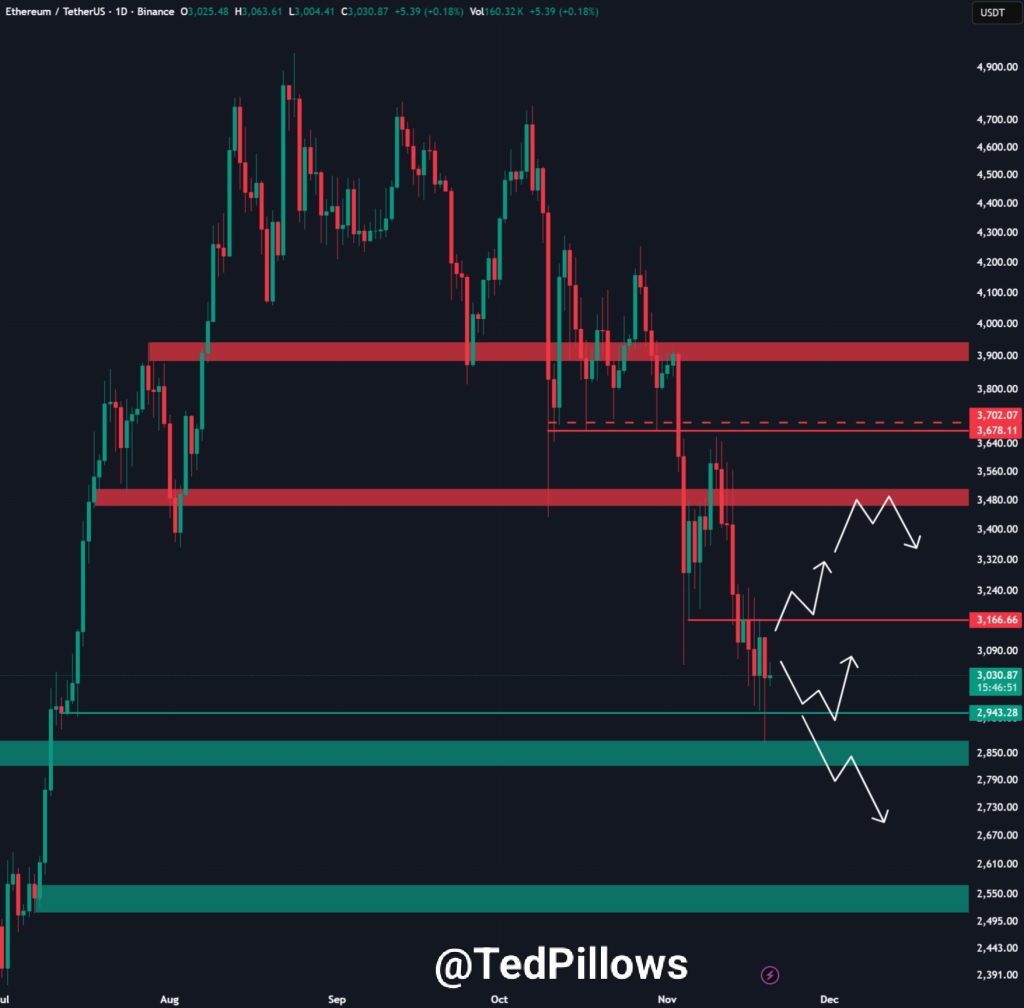

- •Ethereum has fallen below $2.9K, with $2.8K identified as a potential support level for a short-term rebound.

- •Whales are accumulating ETH, while retail investors are selling, indicating a divergence in market sentiment.

- •A sustained recovery above $3,200 is necessary to confirm a local bottom for ETH.

Ethereum's Price Action and Market Indicators

Ethereum's price recently dropped below the $2.9K mark, leading to concerns about its immediate future. However, analysts are closely watching the $2.8K level, which is identified as a significant on-chain support zone that could trigger a short-term rebound.

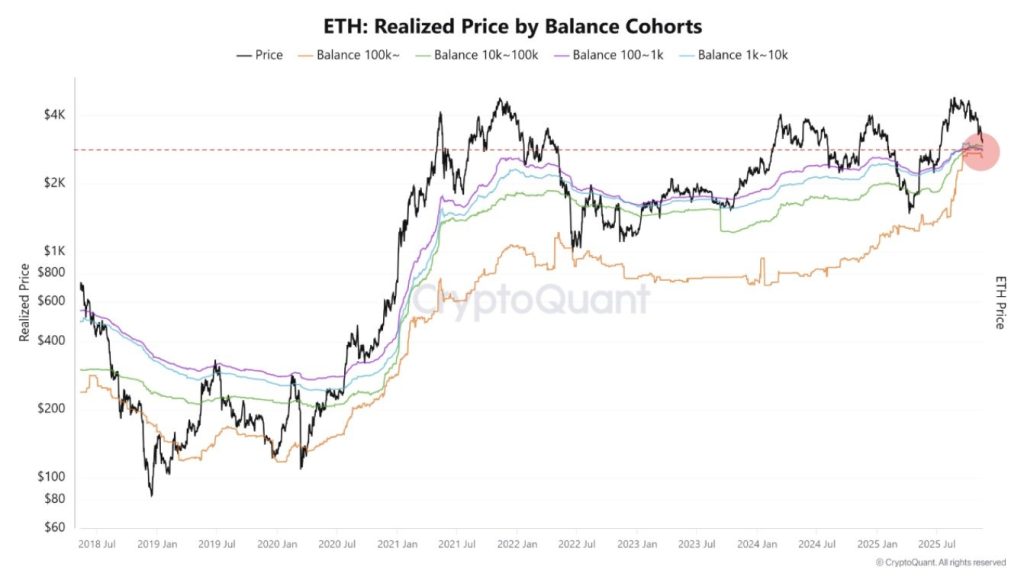

Historically, this $2.8K price range has played a crucial role in marking cycle bottoms, potentially providing a stable foundation for price recovery. The current market sentiment is divided, with some investors viewing this dip as a potential opportunity for a short-term rally.

Key Support Level and Market Dynamics

While Ethereum's decline below $2.9K has caused apprehension among traders, the $2.8K area presents a potential zone for stabilization. This price point is aligned with historical realized price levels, which have often served as key indicators for price reversals in previous market cycles.

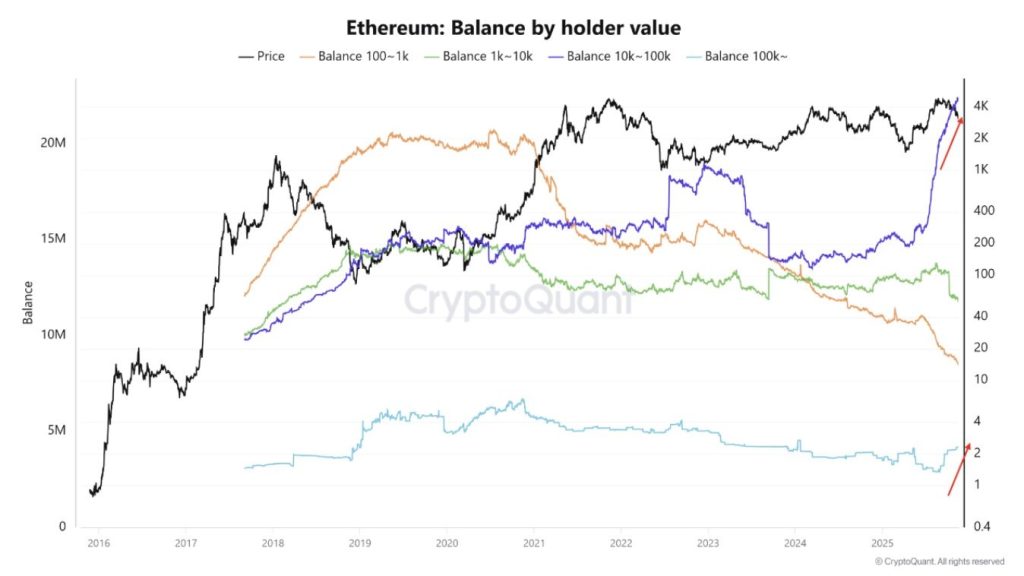

Analysis of the balance by holder value metric reveals a distinct shift in market dynamics. While retail investors have been actively selling their holdings, large whales, those possessing over 10,000 ETH, have continued to accumulate. This trend suggests that larger, long-term investors maintain confidence in Ethereum's future prospects, even as short-term traders exit the market.

Furthermore, a decrease in forced liquidations at new lows indicates that the selling pressure in the market is diminishing. Concurrently, short positions have been expanding, which could potentially set the stage for a short squeeze. This scenario is more likely to occur if the price begins to ascend, particularly within a low-liquidity environment.

Potential for a Price Reversal

Ethereum's current price performance suggests that a recovery above the $3,200 level is essential to confirm a local bottom. This level acts as a critical psychological and technical barrier.

However, if Ethereum is unable to reclaim this $3,200 threshold, the cryptocurrency could face further downside risks. Recent ETF outflows, notably from major institutional players like BlackRock, suggest a potential waning of institutional confidence. This sentiment could exert downward pressure on Ethereum's price.

Conversely, if the $2.8K support level holds firm, Ethereum might experience a short-term rally. The ongoing market rotation, characterized by whales buying and retail investors selling, reflects a sentiment shift that has historically preceded price reversals in the cryptocurrency market.

The behavior of Ethereum's price at these key support and resistance levels will be pivotal in determining its next significant price movement.