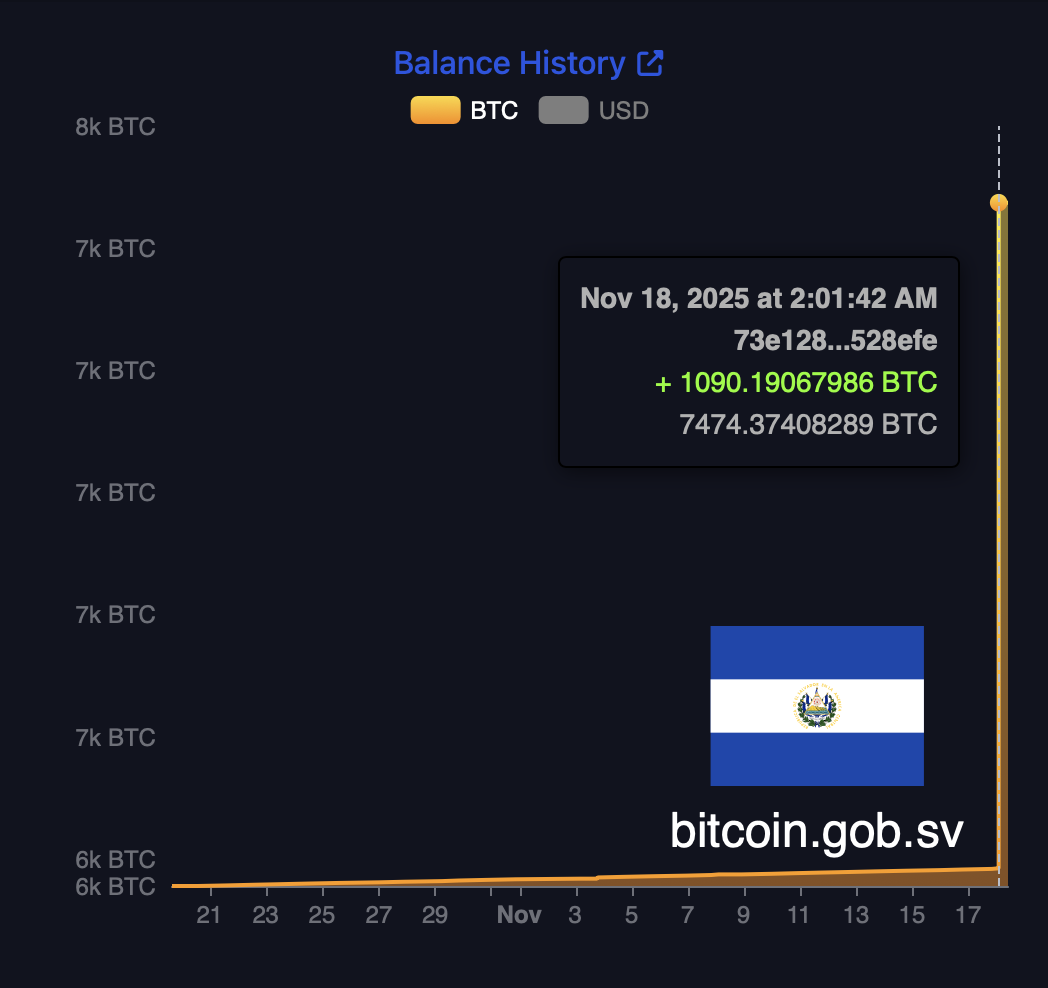

El Salvador has made one of its largest Bitcoin purchases to date, adding nearly 1,100 BTC, worth $100 million, to its national reserves as crypto markets continue to face intense sell-offs. According to on-chain data published through bitcoin.gob.sv, the country’s holdings spiked sharply on November 17, marking the biggest single-day accumulation since the nation adopted Bitcoin as legal tender in 2021.

The timing is impossible to ignore: Bitcoin has just fallen below $90,000 for the first time since late April, triggering widespread panic among retail traders. While sentiment across global markets remains fragile, President Nayib Bukele’s administration doubled down, treating the drawdown as a strategic buying opportunity.

A Nine-Figure Bet Against Fear

As traders liquidate positions and ETFs see multi-day outflows, El Salvador is sending the opposite message, confidence, not capitulation. The latest $100 million purchase pushes the country’s total holdings toward the 8,000 BTC range, based on balance history charts shared publicly.

The government’s willingness to accumulate during deep red days stands in sharp contrast to current market sentiment. Retail investors remain nervous, spurred by macro uncertainty, ETF-driven selling pressure, and a rapid decline from Bitcoin’s recent highs. Yet the Salvadoran state appears to view the pullback as cyclical rather than structural.

What This Signals for the Broader Market

Government-level accumulation during a downturn carries weight. It reinforces the long-term thesis that nation-states may increasingly treat Bitcoin as a strategic asset, especially at discounted prices.

While ETFs, hedge funds, and institutional players reassess risk amid volatility, El Salvador’s move signals conviction in the asset’s long-term trajectory. It also comes ahead of upcoming Bitcoin supply dynamics and continued global discussions around digital asset regulation.

As one analyst put it, “When governments are stacking BTC on red days, it tells you exactly where this is heading.”

El Salvador, once mocked for its Bitcoin strategy, is again making headlines, not for hesitation, but for doubling down when others are fearful.