Crypto investment funds have experienced a significant resurgence, attracting $921 million in net inflows. This surge is attributed to cooling U.S. inflation data and growing expectations of interest rate cuts. Consequently, the total assets under management for crypto have climbed to $229 billion, indicating a strong return of institutional capital to the market.

Bitcoin ETPs Show Bullish Momentum with $931M Inflows as US Inflation Eases

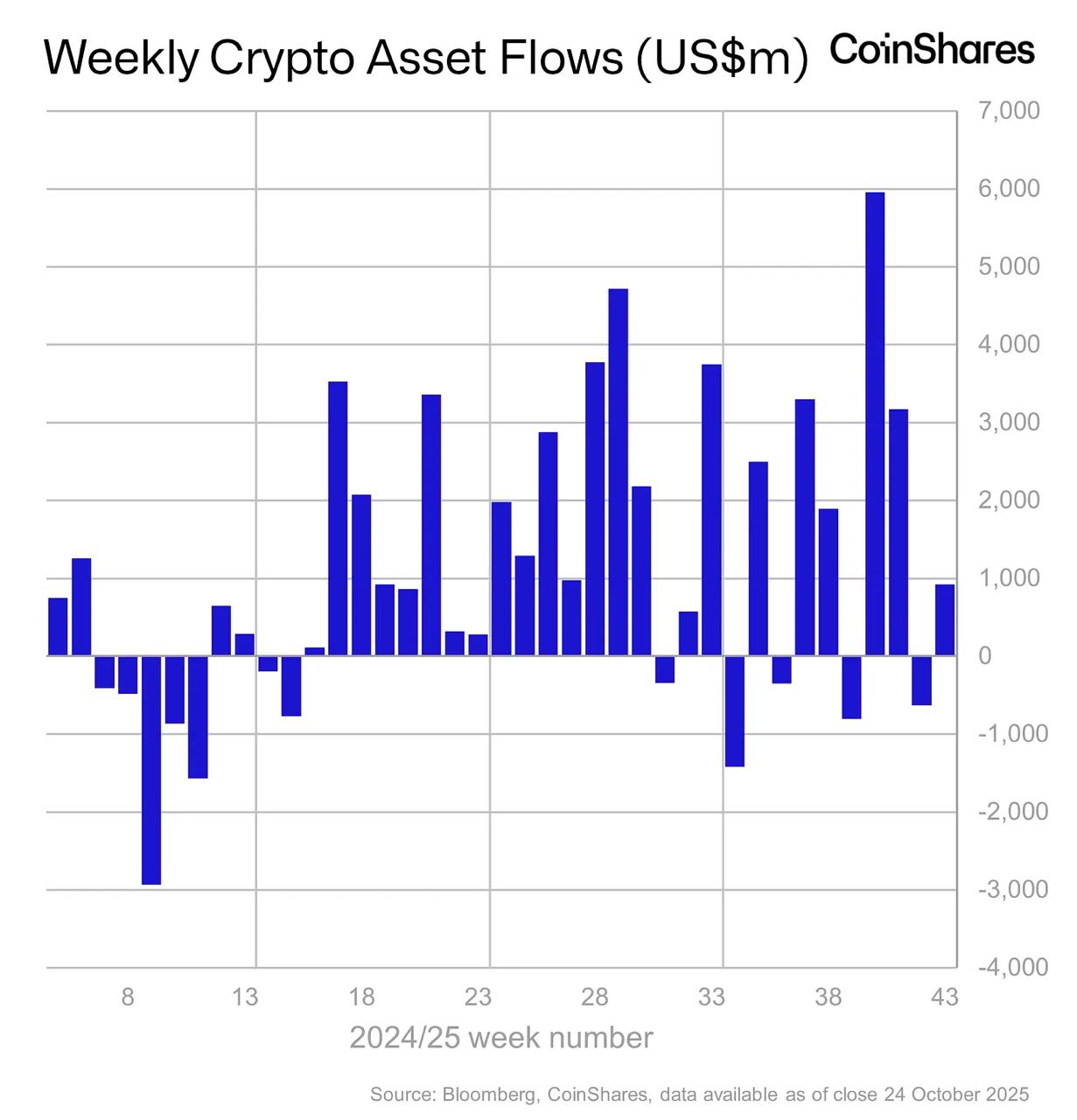

Crypto investment products demonstrated a robust comeback last week, driven by renewed optimism surrounding U.S. monetary policy. According to CoinShares, digital asset ETPs recorded net inflows totaling $921 million, effectively reversing the $513 million in outflows experienced the previous week.

This substantial inflow followed the release of lower-than-expected U.S. inflation data. The Consumer Price Index for September rose by only 0.3%, bringing the annual inflation rate down to 3%. This development has significantly bolstered investor confidence in the likelihood of upcoming Federal Reserve rate cuts.

Bitcoin was the primary driver of this rebound, securing $931 million in inflows, which almost completely offset the losses from the prior week. This brings the total inflows for Bitcoin ETPs since the Fed's policy shift in September to $9.4 billion. In contrast, Ether experienced outflows amounting to $169 million, although demand for leveraged ETH products remained stable.

Solana and XRP ETPs also saw a slowdown in their inflows, attracting $29.4 million and $84.3 million, respectively. Solana's inflows specifically dropped by over 80% compared to the previous week.

Despite the gains recorded last week, Bitcoin fund flows are still down 38% year-to-date when compared to 2024. Nevertheless, the total assets under management for crypto funds have risen to $229 billion, with $48.9 billion in inflows recorded so far this year, signaling that institutional interest in the crypto market remains strong.

Meme Coins See Momentum Shift: DeepSnitch AI Emerges as a Profitable Alternative

While the broader crypto market experiences a surge in institutional investment, meme coins are also riding the momentum. However, the current trend sees traders favoring DeepSnitch AI over established names like Dogecoin and Shiba Inu due to its perceived profitability.

DeepSnitch AI Positioned as a Leading Meme Coin for 2026

Dogecoin and Shiba Inu have previously delivered substantial returns during past bull markets. However, the landscape in 2025 is evolving, with a noticeable shift away from hype-driven meme coins towards projects that integrate virality with tangible utility. DeepSnitch AI is presented as a project that meets these new investor demands.

The protocol is designed for viral growth, with a significant portion of its presale funds allocated to marketing and exposure to reach a wide audience of traders. Beyond the hype, DeepSnitch AI is developing an AI-powered infrastructure aimed at assisting traders in making more informed decisions by replacing emotional trading with real-time, actionable insights.

This focus on providing an emotional edge is highlighted as a key differentiator for traders seeking to move beyond speculative pumps and dumps. Consequently, many investors anticipate the possibility of a 100x return on investment. Projections suggest that if the DSNT token reaches $2.34, an initial investment of $500 could potentially grow to $50,000.

Momentum for DeepSnitch AI is reportedly building, with its presale having already raised over $473,000. The token price has risen to $0.02032, representing a 33% gain for early investors. With rapid accumulation observed, DeepSnitch AI is being positioned as a potential breakout token for the current cycle.

Dogecoin Price Prediction: Potential for $0.25 Breakout

As of October 27, Dogecoin was trading near the $0.208 mark, with bulls attempting to establish a new support base. While a breakout has not yet occurred, the current technical setup appears promising. If trading volume increases and the support level holds, DOGE could potentially move towards $0.26.

A significant technical signal comes from its anchored Volume Weighted Average Price (VWAP), measured from its 2021 peak. Dogecoin briefly dipped below this level on October 22 but quickly recovered to near $0.21. This rejection of the lower price point suggests that selling pressure may be diminishing, and early buyers could see a more bullish Dogecoin price prediction.

DOGE is also maintaining its position just above the 0.5 Fibonacci retracement level at $0.1907. This level is often considered a pivot point for long-term trends. Sustained trading above this level could bring targets such as $0.41 back into view. Conversely, according to most Dogecoin price predictions, a drop below $0.1907 could shift the narrative and potentially lead to a decline towards $0.138.

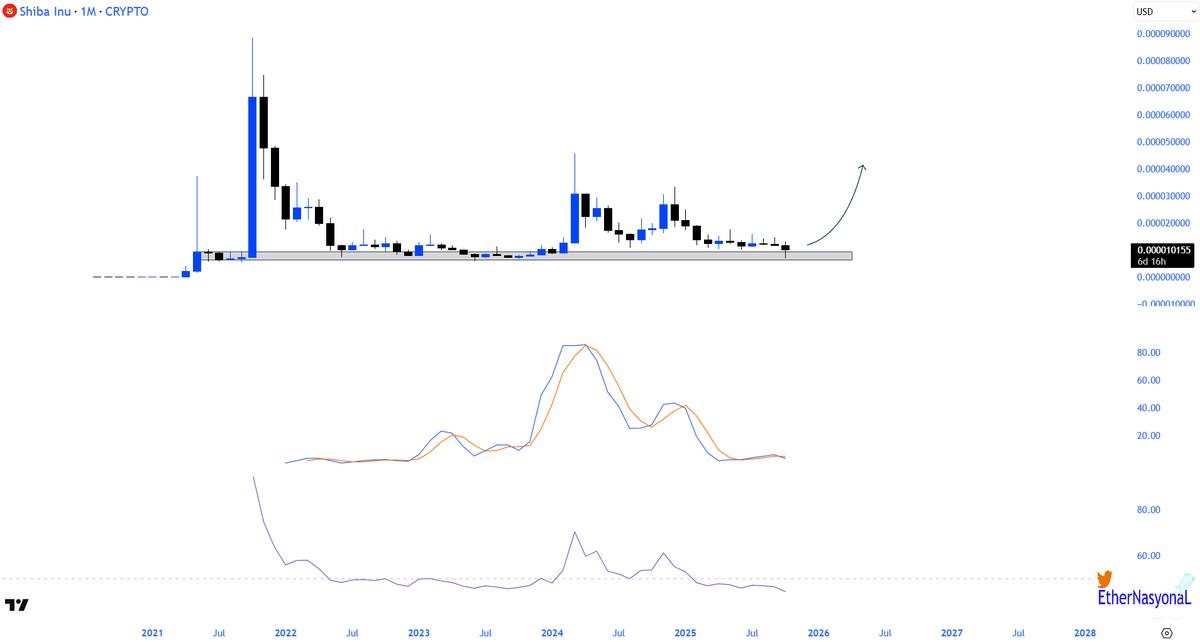

Shiba Inu Poised for a Breakout After Consolidation

Shiba Inu has been trading within a prolonged consolidation phase, with its price near $0.0000147 on October 27, while holding above strong support levels. Although it has not led the market in 2025, both its chart patterns and underlying fundamentals suggest a period of quiet accumulation is underway.

Analysts are observing a familiar pattern that has preceded sharp rallies in both 2021 and 2023. If current support levels hold, the next target zone for Shiba Inu could be between $0.000020 and $0.000030.

On the fundamental side, Shibarium is reportedly operating more smoothly following its launch, and ongoing token burns are contributing to a reduction in supply. These factors collectively indicate steady progress, setting the stage for a potential breakout when market conditions are favorable.

Closing Thoughts on Market Trends and Emerging Opportunities

The meme coin market has historically generated significant wealth for early investors, with projects like Shiba Inu and Dogecoin serving as prime examples. However, the era of achieving 100x returns from these established meme coins may be in the past, given their substantial market capitalizations.

This shift is leading traders to explore emerging opportunities, such as DeepSnitch AI, a presale project currently priced at $0.02032. If the project continues its current growth trajectory, an investment of $1,000 today could potentially yield $100,000 in the coming months.

Further information about DeepSnitch AI can be found on its official website.

FAQs

What is the Dogecoin forecast for 2025?

Analysts generally anticipate continued volatility for Dogecoin in 2025. Key support is expected near $0.19, with potential upside targets ranging from $0.26 to $0.41 if trading volume increases. However, its large market cap suggests that another 100x return is unlikely.

What is the future outlook for DOGE compared to DeepSnitch AI?

Dogecoin's future outlook appears stable but constrained by its current market position. In contrast, DeepSnitch AI, being an early-stage presale project with a focus on utility and viral potential, is seen by many investors as offering the 100x growth potential that Dogecoin may no longer be able to achieve.

Are there any recent Elon Musk Dogecoin updates?

As of October 2025, Elon Musk has not issued any significant new statements regarding Dogecoin. While his past social media activity has influenced DOGE's price, the token's current market movements are more closely tied to macroeconomic trends and technical trading levels rather than Musk's direct commentary.

Could DeepSnitch AI replace Dogecoin as the top meme token?

It is possible. DeepSnitch AI is already demonstrating strong performance in its presale phase and has a clear product vision, positioning it as a significant contender in the meme token space.