Market Overview

The price of Dogecoin experienced an 8% decline on Monday, contributing to a broader downtrend in the cryptocurrency market that began late last week. This downturn occurred as renewed trade tensions between the U.S. and the EU negatively impacted investor appetite for riskier assets.

Specifically, Dogecoin fell to a multi-week low of $0.126 on Tuesday. This price movement was influenced by a fading risk sentiment, which intensified after U.S. President Donald Trump threatened fresh tariffs against European allies concerning the Greenland acquisition dispute. This development triggered a wave of profit-taking across the cryptocurrency sector, with investors shifting towards perceived safe-haven assets.

Despite initial support from dip buyers earlier in the week, their efforts were ultimately overcome by bearish pressure, pushing the token back towards the $0.127 level observed at the time of reporting.

Futures Market and Investor Sentiment

Demand for Dogecoin within the futures market has seen a significant drop this week. Data from CoinGlass indicates that Dogecoin futures open interest has declined by approximately 19%, decreasing from $1.78 billion recorded on Sunday to $1.44 billion on Monday.

Open interest represents the total number of outstanding derivative contracts that have not yet been settled. A reduction in open interest signifies less capital entering the market and a decrease in speculative interest. This trend typically leads to lower price volatility and a weakening of existing upward momentum.

On-Exchange Holdings and Potential Selling Pressure

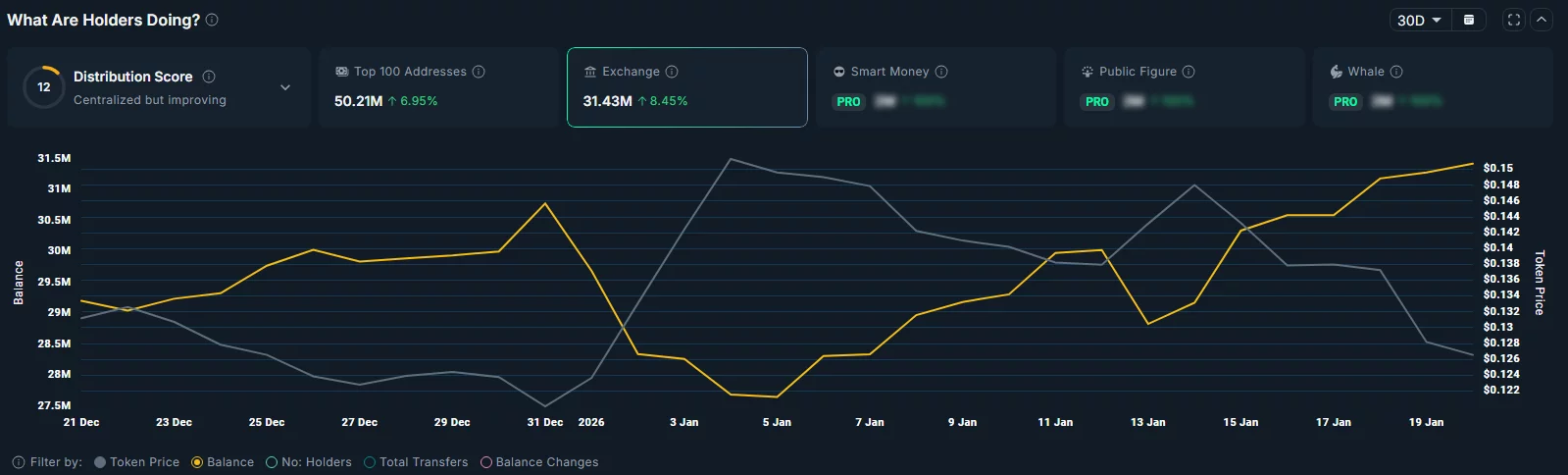

Another factor potentially contributing to the bearish outlook for the meme token is the increasing volume of DOGE tokens being moved to exchanges. Data from Nansen reveals that the total number of DOGE tokens held on exchanges has risen by nearly 8.4% over the past 30 days, reaching 31.4 million.

Investors typically transfer their holdings to exchanges when they are preparing to sell, either to secure profits or to mitigate potential losses.

Dogecoin Price Technical Analysis

On the daily chart, Dogecoin's price has formed a classic double top pattern. This pattern emerges after two unsuccessful attempts by bulls to breach a key resistance level, failing to establish a higher high. This technical formation is a strong indicator that buying pressure is diminishing and could potentially signal a trend reversal.

Further supporting this bearish outlook, the MACD lines are trending downwards. Concurrently, the Aroon indicators show the Aroon Down at 92.86% and the Aroon Up at 0%, indicating that bears are currently dominating the market.

Traders are closely monitoring the $0.10 psychological support level. A breakdown below this level could result in a loss of a resistance-turned-support flip, potentially leading to further price declines. Conversely, a rebound above $0.154 would invalidate this bearish setup.

At the time of writing, Dogecoin's price was trading slightly above $0.127.