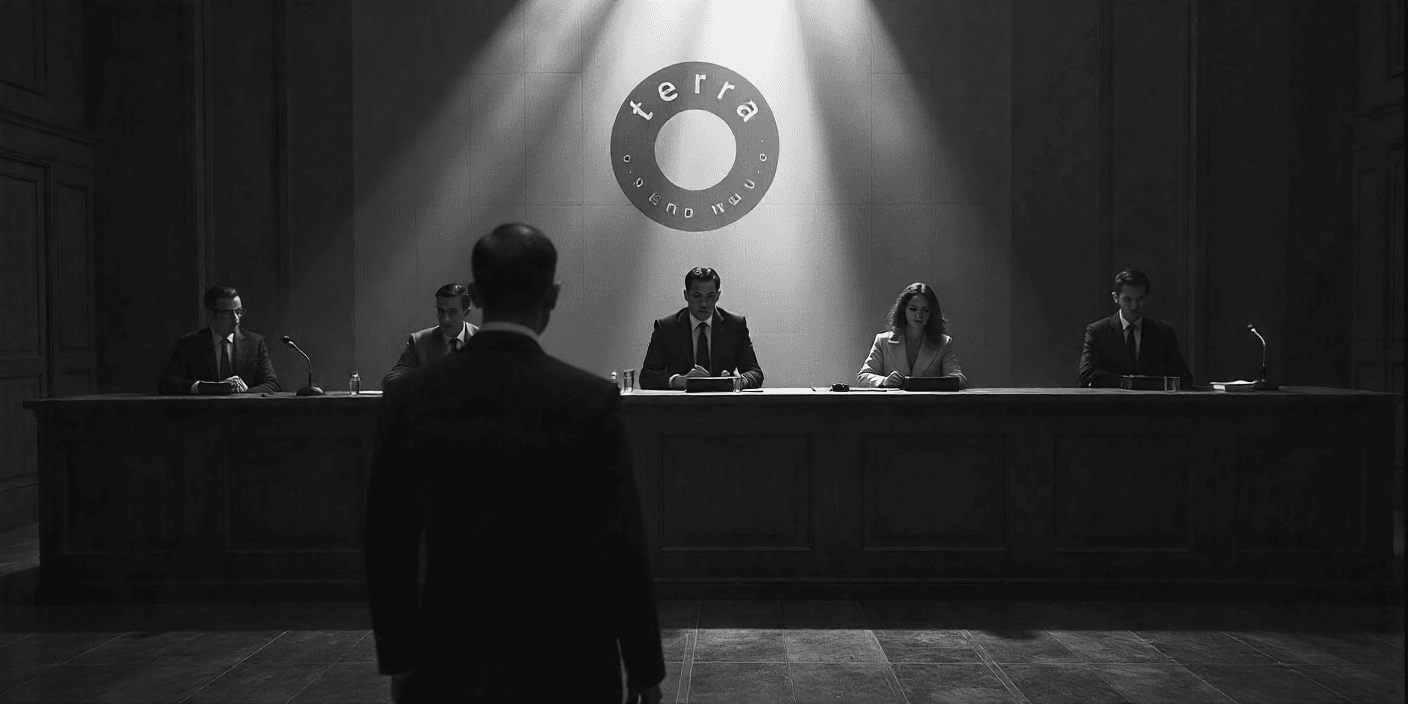

The legal saga surrounding Do Kwon, a central figure in the collapse of Terraform Labs, continues to unfold with significant personal stakes. As his sentencing approaches, Kwon is attempting to persuade a U.S. court to limit his prison term to five years, arguing for a proportional punishment for his role in one of the most substantial failures in cryptocurrency history. This chapter details his plea, the reasoning behind it, and the potential judicial considerations.

Why Is Do Kwon Requesting a Five-Year Cap?

Do Kwon and his legal team have submitted a comprehensive 23-page letter to the court, advocating for a maximum prison sentence of five years. Their primary argument centers on proportionality, asserting that the government's proposed cap of 12 years does not adequately consider the broader context of Terra's collapse or Kwon's subsequent actions. The defense portrays Kwon as a young founder who became overwhelmed by pressure, rather than an individual who deliberately orchestrated a fraudulent scheme for personal enrichment.

How Did the Terra-Luna Collapse Shape This Case?

Understanding Kwon's request requires acknowledging the immense scale of the fallout from the Terra-Luna collapse. This was not merely another cryptocurrency failure; it resulted in the erasure of over $40 billion in market value and initiated a ripple effect that significantly impacted the entire digital asset industry. Kwon pleaded guilty in August to two fraud-related charges stemming from the May 2022 crash of Terraform Labs' ecosystem, which included the algorithmic stablecoin TerraUSD (UST) and its associated token, Luna.

The defense contends that external forces played a substantial role in the collapse, citing coordinated trades that exploited system vulnerabilities. They reference academic research and Chainalysis reports suggesting that third-party firms may have contributed to accelerating the implosion. Concurrently, the defense acknowledges an undisclosed agreement Kwon had with Jump Trading to discreetly support UST's peg approximately a year prior. This deal, they argue, was a misjudgment born from overconfidence and poor decision-making, not a calculated attempt to defraud investors for personal gain.

What Factors Is the Defense Highlighting?

Kwon's lawyers are emphasizing several key points to influence the judge's decision. Firstly, they stress that Kwon did not personally profit from the collapse, stating his decisions were driven by ego and the desperation of a founder struggling with an escalating crisis. Secondly, they point to his nearly two-year detention in Montenegro, which included periods of solitary confinement, as evidence that he has already endured significant hardship.

His detention in Montenegro followed his arrest in March 2023 for attempting to travel using a forged passport. He remained in custody until his extradition to the United States in December 2024. The defense argues that this period of confinement, coupled with the intense public scrutiny he has faced, warrants a shorter sentence.

What Legal Risks Does Do Kwon Still Face?

Even if the U.S. court accepts his plea for a five-year sentencing cap, Kwon's legal challenges are not entirely resolved. He still faces a separate trial in South Korea, where prosecutors are seeking a much more severe penalty, potentially up to forty years in prison for the same allegations. His defense letter acknowledges this situation and presents it as an additional reason to avoid an excessively long sentence in the United States. The implicit message is that regardless of the American court's decision, Kwon's legal difficulties will persist.

The sentencing is scheduled for December 11, and the cryptocurrency community is expected to follow the proceedings closely. Kwon's request does not guarantee a specific outcome; it serves as a presentation of the narrative his legal team hopes the judge will adopt. The final decision will depend on how the court weighs the profound financial devastation, the admitted errors in judgment, the claims of external manipulation, and Kwon's own extensive period of detention.

This juncture signifies a critical turning point in one of the most prominent legal sagas in cryptocurrency history. The central question remains how much accountability the court deems appropriate for a collapse that fundamentally altered the landscape of an entire industry.