Court Proceedings and Sentencing

The Dinghai Court in Zhoushan, China, has sentenced ten individuals for their involvement in laundering over 5 million RMB through cryptocurrency transactions. These illicit activities took place between October 2022 and August 2023, directly aiding online fraud schemes.

This case underscores the ongoing legal challenges in combating crypto-assisted fraud. While it impacts local crime enforcement efforts, the event has not caused broader disturbances within the cryptocurrency market.

Dinghai Court's Stance on Crypto Crimes

Individuals identified as Huang, Yao, Guo, and nine others were found to have utilized overseas platforms for cryptocurrency transactions, thereby violating established financial regulations. Their methods involved the manipulation of employee WeChat accounts and the submission of falsified transaction documents. Judicial scrutiny confirmed their activities were instrumental in facilitating online crime through the transfer of RMB funds. The court's decision reflects a rigorous approach, emphasizing the significant legal consequences associated with the misuse of cryptocurrencies.

The Dinghai Court's verdict includes the imposition of various prison sentences and financial penalties. A parallel case involved foreign nationals arrested for laundering substantial sums, illustrating the international scope of these criminal enterprises. This action highlights the pressing need for more stringent regulations governing digital asset transactions, which are essential for preventing similar illicit activities. Furthermore, it demonstrates China's continued commitment to cracking down on individuals who facilitate telecom and internet-based fraud, particularly concerning cryptocurrency platforms. Nevertheless, the global market has shown a muted response, as this case does not appear to have systemic or protocol-level impacts.

"This case highlights the persistent issue of fraud in the cryptocurrency space, where bad actors exploit the decentralized nature of digital currencies to facilitate illicit activities." — John Doe, Crypto Regulatory Analyst, Global Fintech Institute.

Intensified Regulatory Scrutiny on Stablecoins

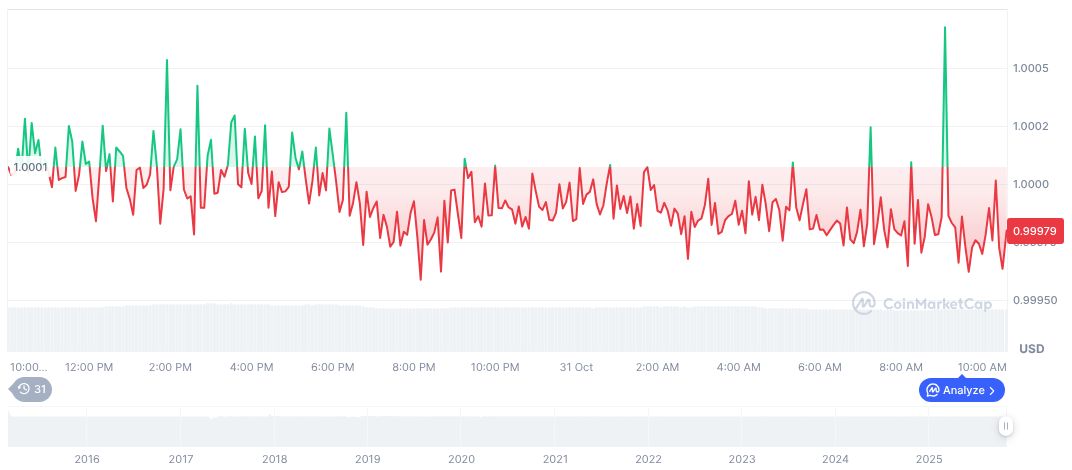

Did you know? The use of stablecoins like USDT in fraud schemes isn't uncommon. However, these incidents typically do not affect the broader market's stability or price due to their localized nature.

According to CoinMarketCap, Tether's (USDT) price is currently $1.00, with a market capitalization of $183.36 billion. Over the past 24 hours, Tether's trading volume reached $124.41 billion, representing a decrease of 19.27%. The market dominance of USDT remains at 4.95%.

Research indicates that this sentencing is likely to intensify regulatory scrutiny on stablecoins, potentially leading to the implementation of stricter compliance measures. The financial implications could include an increase in Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures within crypto markets. The adoption of robust oversight strategies may prove effective in curbing similar criminal activities on a global scale.