Introduction to the Staking Proposal

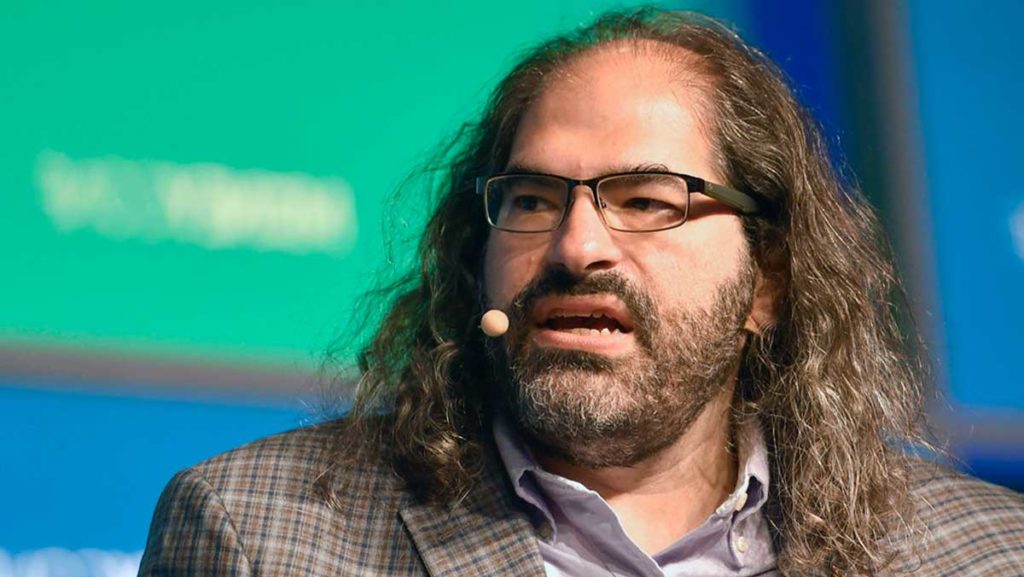

David Schwartz, Chief Technology Officer at Ripple, presented a two-tier staking model for the XRP Ledger on November 19. The proposal introduces staking rewards and aims to prevent the centralization of power across the network.

Addressing Concerns of Centralization

The discussion began after an XRP commentator raised concerns that staking could increase Ripple’s influence, given that Ripple holds the largest supply of XRP. Schwartz responded with a preliminary design where individual validators would police staked funds, describing the penalizing of misbehaving validators as a last resort.

The Two-Tier Model and Governance Token

Schwartz noted a potential weakness: validators might accept stakes only from trusted partners, creating new centralization risks. His proposed two-layer model adds a governance token designed to be worthless. Strict rules would limit its circulation and prevent it from acquiring economic value.

Holders of this governance token would collectively manage the validator list, replacing the current Unique Node List. If the governance mechanism turns malicious, participants could trigger a “fork by governance,” creating a new token and redirecting servers. Schwartz compared this mechanism to nuclear deterrence, where the threat itself provides security.

Current XRP Market Data and Technical Analysis

The current price of XRP (Ripple) is $2.13 USD, with a 24-hour trading volume of approximately $4.65 billion and a market capitalization of $128.44 billion, according to CoinMarketCap. This reflects a 1.99% increase in the past 24 hours, keeping XRP ranked #4 in the global cryptocurrency market.

From a technical perspective, XRP has shown sustained strength after consolidating above the key $2.00 level, which has now turned into a strong support zone. The bullish momentum is supported by growing trading volume and a market structure characterized by higher highs and higher lows. If the price holds above $2.05, the next short-term target lies around $2.25–$2.30, where some profit-taking resistance may emerge.

In the event of a technical correction, the support zone remains between $1.95 and $2.00, a range that has served as a solid base in recent sessions. Meanwhile, trend indicators such as the RSI and MACD remain in positive territory, although slightly overbought, suggesting a possible brief pause before another bullish leg.

Disclaimer

The information presented in this article is for informational purposes only and should not be interpreted as investment advice. The cryptocurrency market is highly volatile and may involve significant risks. We recommend conducting your own analysis.