Binance co-founder Changpeng Zhao, also known as CZ, has engaged in a public disagreement with Bitcoin critic Peter Schiff regarding Schiff's pronouncements on tokenized gold.

The dispute was sparked by comments Schiff made during a live stream with Threadguy, where he outlined his intention to launch a blockchain-based platform for a tokenized gold product, asserting it would possess advantages over Bitcoin.

Schiff stated, "Because gold will maintain its purchasing power so ideally the one thing that makes sense to put on a blockchain is gold."

He further elaborated that his tokenized gold product would "do all the things that Bitcoin promises but can never do," and that traders would be able to acquire it through a platform named SchiffGold.

"And then you can transfer the quantity of gold, instantly at very low cost," Schiff explained. "Much cheaper and much quicker than you can transfer Bitcoin. You can pay or be paid in gold. And you can redeem it in physical gold or eventually you can redeem it in a token."

CZ Argues Tokenized Gold Tokens Are a "Trust Me Bro" Product

CZ voiced his objections to Schiff's statements on the social media platform X.

"Most people ‘in crypto’ know this, most people ‘not in crypto’ may not understand yet," CZ commented. "Tokenizing gold is NOT ‘on chain’ gold."

He clarified that tokenizing gold necessitates trust in a third party to provide gold at a future date, "even after their management changes, maybe decades later, during a war, etc."

"It’s a ‘trust me bro’ token," CZ stated, contending that the significant level of trust required for tokenized gold is the reason why no "gold coins" have achieved widespread adoption.

Saying the obvious. Most people “in crypto” know this, most people “not in crypto” may not understand yet.

Tokenizing gold is NOT “on chain” gold.

It’s tokenizing that you trust some third party will give you gold at some later date, even after their management changes, maybe… https://t.co/KMYfz2dG04

— CZ 🔶 BNB (@cz_binance) October 23, 2025

Gold Experiences Its Worst Correction in Years

Following multiple record highs this year, gold has undergone its most significant correction in years this week.

This pullback saw the price of gold fall from a high of $4,381 to a weekly low of $4,1115, resulting in a loss of $2 trillion in market capitalization.

Despite this, Schiff maintains his position that gold is a superior investment compared to Bitcoin.

"If gold can drop by 6.5% in one day on panic selling, imagine what can happen to Bitcoin," Schiff posted on X. "Such a crash may not be imaginary for long."

Schiff dismissed the notion that the decline in gold prices would lead to capital rotation into Bitcoin, as predicted by many analysts. Instead, he forecast that the drop "may set off a mass exodus out of Bitcoin."

Instead of gold's sharp correction setting off a widely hyped rotation into Bitcoin, it may set off a mass exodus out of Bitcoin. Look out below!

— Peter Schiff (@PeterSchiff) October 22, 2025

Meanwhile, Bitcoin has seen an increase of over 1% in the past 24 hours, trading at $109,563.88 as of 6:03 a.m. EST.

CZ Predicts Bitcoin Will Surpass Gold in Market Capitalization

Earlier this week, the Binance founder predicted that Bitcoin could eventually surpass gold's market capitalization.

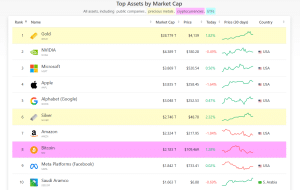

According to CompaniesMarketCap data, gold's market capitalization exceeds $28.77 trillion, positioning it as the world's most valuable asset. Bitcoin's market capitalization is approximately $2.18 trillion, ranking it as the eighth-largest asset globally and larger than Meta Platforms and Saudi Aramco.