Crypto.com has submitted an application for a U.S. National Trust Bank Charter to the Office of the Comptroller of the Currency (OCC). This strategic move aims to broaden the company's federally regulated digital asset services.

If approved, this charter could significantly enhance institutional access to custody and staking services. Such developments have the potential to influence major cryptocurrencies like Bitcoin and Ethereum by facilitating more regulated inflows into the market.

Crypto.com Pursues Federal Charter to Enhance Digital Offerings

Crypto.com has taken a substantial step in its strategic plan by applying for a National Trust Bank Charter. This application places the company alongside other major players like Coinbase and Ripple in seeking federal regulatory approval. CEO Kris Marszalek has consistently highlighted regulated and secure offerings as a core focus since the company's inception, underscoring a commitment to providing trusted services.

This filing, if it receives approval, could enable Crypto.com to offer federally regulated digital asset solutions across various blockchains and protocols. Such an expansion is anticipated to attract institutional clients looking for deeper partnerships, including those interested in Exchange Traded Funds (ETFs) and Digital Asset Treasuries (DAT).

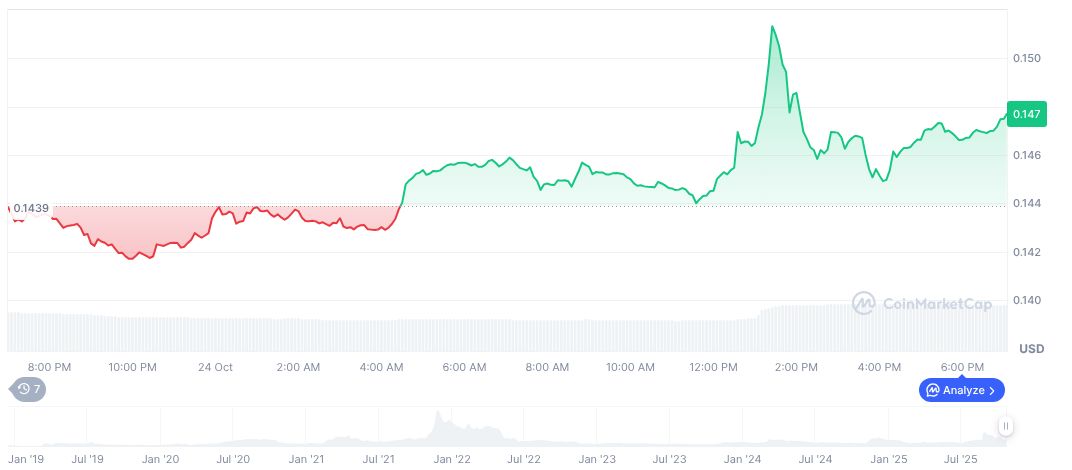

Following the announcement, Cronos (CRO), Crypto.com's native token, experienced a short-term price increase. However, no significant on-chain data or liquidity shifts directly attributable to this development were immediately apparent. The company's official statements indicated a focus on growth rather than direct competition within the banking sector, with no other executives offering public comments during the reporting period.

Cronos Token Experiences Uptick Amid Trust Bank Charter Application

Historically, similar filings for National Trust Bank Charters by entities like Coinbase and Ripple have been linked to increased institutional adoption of cryptocurrencies. While these trends suggest potential positive outcomes, the timelines for approval and the actual impact on market inflows can vary.

According to CoinMarketCap data, as of October 24, 2025, Cronos (CRO) was trading at $0.15. Its market capitalization stood at $5,320,363,680, representing 0.14% of the total market dominance. The token showed a 2.54% price increase over the preceding 24 hours, with a corresponding 17.69% rise in 24-hour trading volume, amounting to $31,383,668. Notably, CRO's performance over the last three months indicated a 5.17% gain, despite a 26.79% decrease over the past 30 days.

Research from the Coincu team indicates that strong indicators suggest positive financial outcomes for institutional asset inflows into Crypto.com, contingent upon regulatory approval. Past trends demonstrate that the establishment of federally regulated services tends to bolster market confidence, although significant inflows typically require time to materialize.