Suspected of emptying the coffers of Pump.fun, the co-founder of the Sapijiju project denies all accusations. In full turmoil, the crypto platform specialized in memecoins must face the anger of a divided community. Analysis of a transfer that sows doubt!

In Brief

- •Pump.fun denies cash-out accusations and speaks of simple internal fund management.

- •The crypto community remains divided, between suspicions of manipulation and defense of the project.

Suspicions of Massive Cash-Out on Kraken: The Crypto Case Shaking Pump.fun

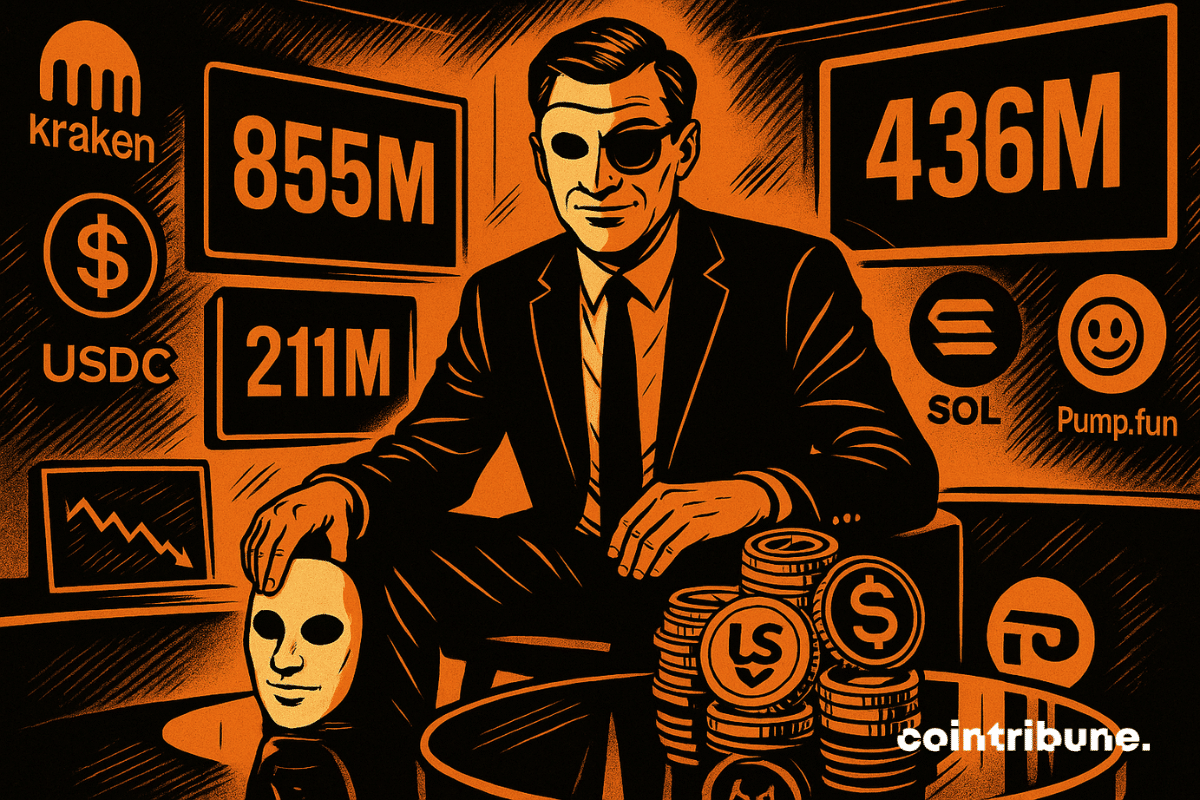

It all started with an alert issued by Lookonchain. According to the onchain analysis company, crypto wallets linked to Pump.fun allegedly transferred $436 million in USDC to Kraken since October. An operation interpreted as a massive cash-out!

This comes at a time when the crypto platform’s revenues plunging to $27.3 million in November, down from $40 million in previous months.

Another worrying sign: the fall of the PUMP token. It is currently trading around $0.0027.

Specifically, this crypto asset has declined:

- •by 32% compared to its introduction price;

- •by nearly 70% since its September peak.

The Co-founder Strikes Back and Mentions Treasury Management

In response to the suspicions, Sapijiju reacted publicly via a post on X. He explains that these crypto fund movements are simply part of a treasury management strategy. More specifically, the goal is to redistribute assets from the ICO into different wallets to extend the life of the crypto project.

He even specifies that Pump.fun has never collaborated with Circle, the issuer of USDC.

According to the latest data, wallets associated with the crypto project still hold over 855 million stablecoins and 211 million in SOL. This suggests that no full withdrawal has been made.

Of course, the co-founder’s response divides opinion. Some netizens highlight contradictions in his statements. Others denounce opaque management, particularly regarding allegedly arbitrary airdrops. Conversely, more moderate voices remind that Pump.fun retains control of its revenues and freedom over its financial choices.

In any case, this case highlights a central issue in the crypto world: transparency of projects, especially when they handle hundreds of millions. In an ecosystem where trust relies on algorithmic promises, words must reassure as much as numbers.