The crypto market experienced a downturn on Thursday, even as the Dow Jones Industrial Average achieved a fresh record high. This movement underscores a significant investor rotation away from technology stocks and into economically sensitive sectors, following the Federal Reserve's most recent interest-rate cut.

Market Snapshot

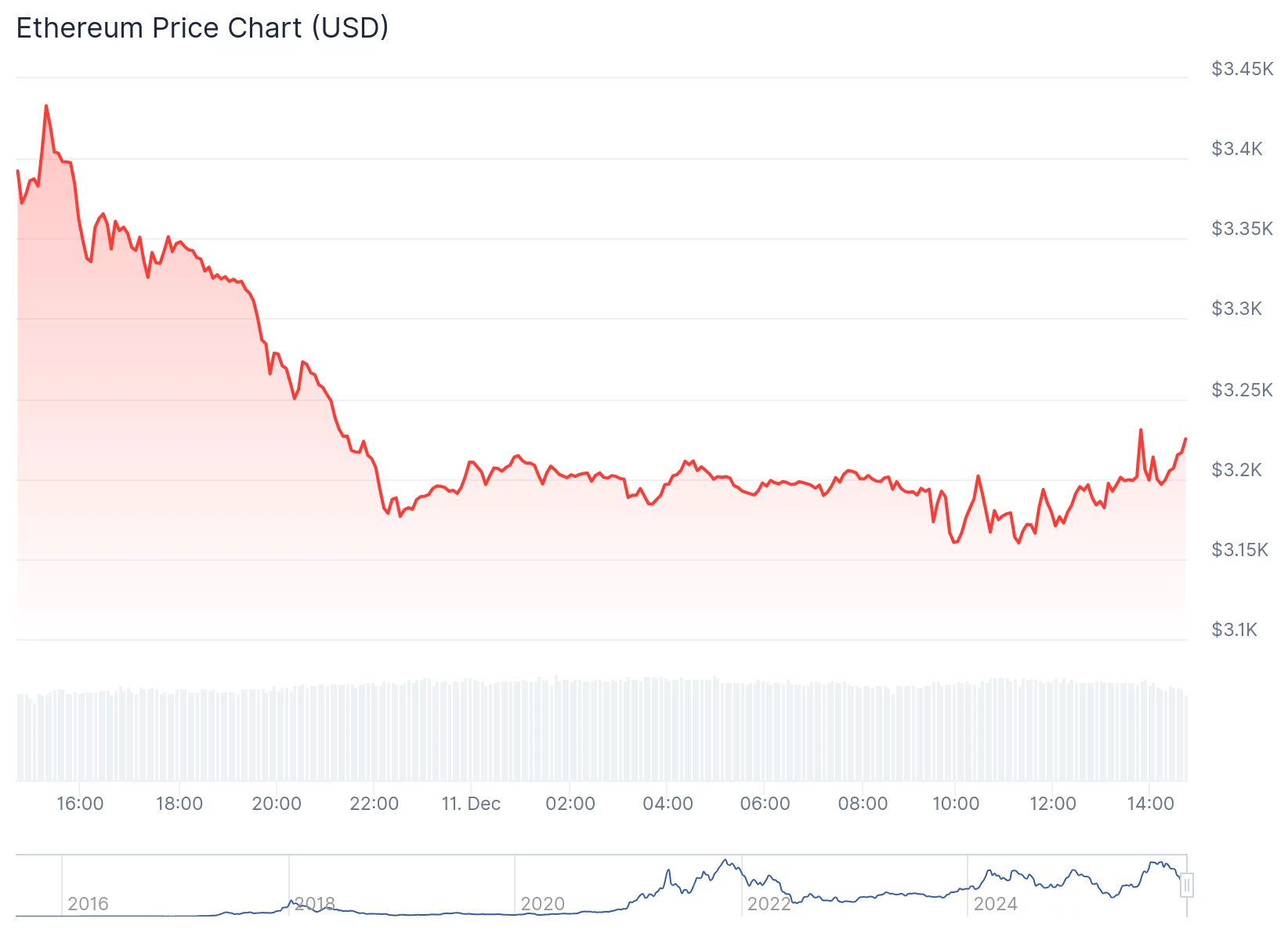

Bitcoin was trading just above $91,000, marking a decline of approximately 1.5%. Ethereum also saw a decrease, slipping around 5% to trade near $3,200.

These declines were reflective of a broader selloff across the digital asset space. The total crypto market capitalization fell by 2.3%, settling at approximately $3.2 trillion. Reports indicated that 97 out of the top 100 tokens were trading lower.

Sustained Institutional Interest Despite Price Declines

Despite the market slump, Bitcoin and Ethereum Exchange-Traded Funds (ETFs) continued to attract significant inflows, suggesting sustained institutional interest. Data compiled on Thursday, December 10, revealed the following:

- •Spot Bitcoin ETFs garnered net inflows totaling $224 million.

- •Ethereum ETFs experienced a net inflow of $57.6 million.

- •Spot XRP ETFs have attracted $954 million in investment since Canary Capital's launch in November.

Traditional Markets Show Divergent Trends

In contrast to the crypto market, traditional financial markets presented a different picture. The 30-stock Dow Jones Industrial Average surged by 600 points, or 1.3%, reaching a record high, according to CNBC.

Investors shifted away from high-growth technology stocks following disappointing earnings from Oracle. This move raised concerns about the ability of companies to quickly monetize their substantial investments in artificial intelligence (AI).

Oracle's significant debt associated with data-center expansion negatively impacted market sentiment, affecting other AI-linked stocks such as Nvidia, Broadcom, AMD, and CoreWeave.

This rotation tempered the momentum from the previous trading session, where the S&P 500 closed just shy of its own record. This occurred after the Federal Reserve cut interest rates for the third time this year, establishing a benchmark range of 3.5%–3.75% and indicating no further rate hikes were anticipated.

The reduction in borrowing costs provided a boost to small-cap stocks. The Russell 2000 index, up 1.3% at the time of reporting, reached a new intraday high on Thursday, following a record close the preceding day.

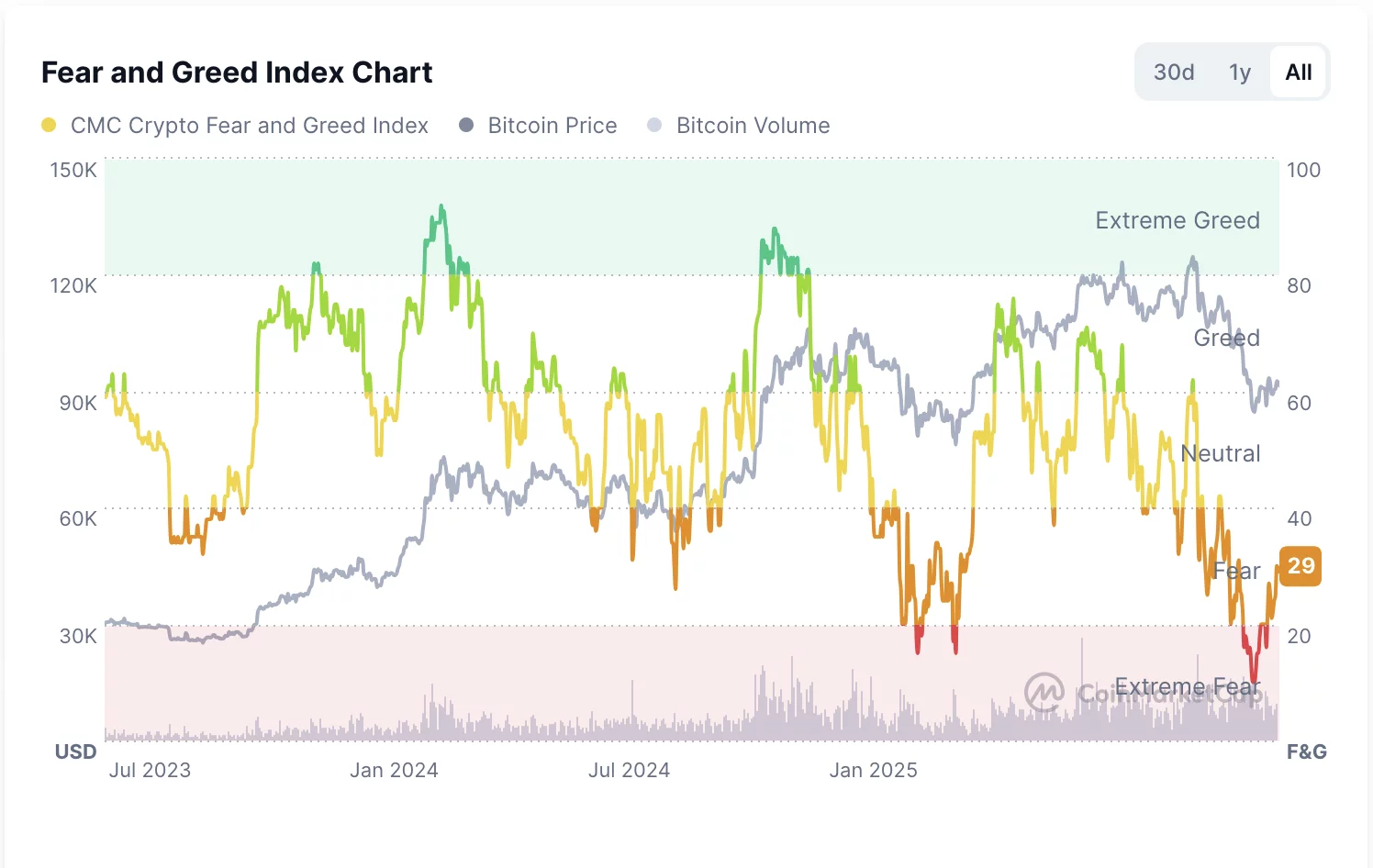

Within the crypto sphere, market sentiment remains delicate. The crypto fear and greed index declined from 30 to 29, staying firmly within the "fear" territory. This indicates caution ahead of further macroeconomic signals and potential government actions following recent administrative disruptions.

Future Outlook

Despite rising uncertainty, the consistent ETF inflows suggest that major investors are not exiting the crypto market but are rather preparing for a more volatile period.

The possibility of a "Santa Claus rally" pushing the S&P 500 above 7,000 by the end of the year remains uncertain. Looking ahead to 2026, analysts anticipate various challenges, including potential changes in Federal Reserve leadership and the impact of midterm elections.