Key Insights

- •In the latest crypto news, digital asset funds saw $716 million in net inflows.

- •Bitcoin recorded $352 million in inflows as bearish sentiment wanes.

- •Investors purchased $245 million in XRP and $52.8 million in Chainlink amid ETF launch.

Digital Asset Funds Experience Significant Inflows

In major crypto news, crypto funds recorded $716 million in inflows amid a rebound in interest among institutional investors. Bitcoin (BTC), XRP, and Chainlink (LINK) saw the largest inflows. BTC, ETH, XRP prices have stabilized as investors brace for the upcoming FOMC Meeting.

Bitcoin Records Substantial Inflows

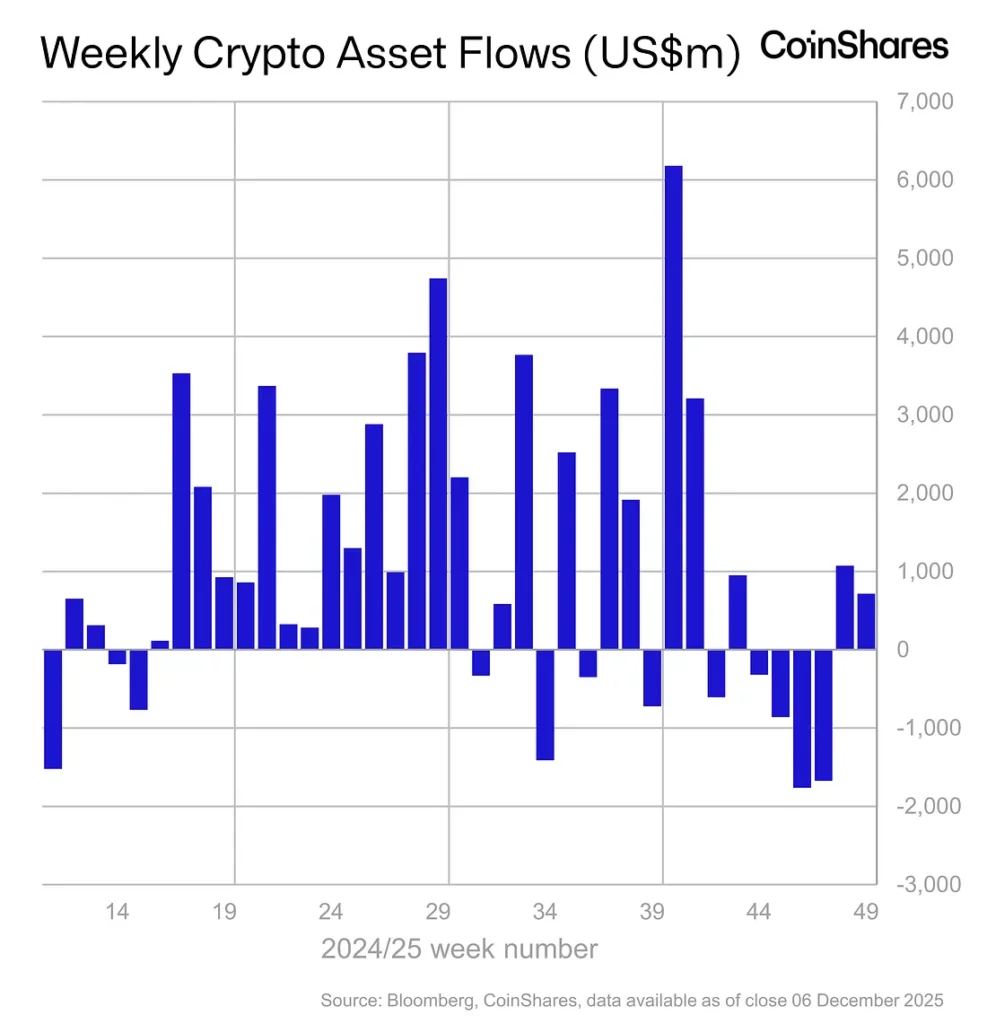

Crypto funds saw a modest $716 million in inflows, reported CoinShares on December 8. The crypto funds recorded their second consecutive week of inflows, reclaiming total assets under management (AuM) to $180 billion. Institutional interest in Bitcoin continues as it saw $352 million in inflows. This brings the year-to-date (YTD) inflows to $27.1 billion, but below the $41.6 billion recorded in 2024. Notably, Short-Bitcoin products saw outflows of $18.7 million, suggesting that negative sentiment on Bitcoin has likely reached its bottom.

Meanwhile, Ethereum (ETH) and Solana (SOL) also saw $39.1 million and $3 million in inflows. Both top crypto assets saw a decline in institutional interest compared to last week. Solana-based tokenized stocks and sentiment on spot Solana ETF have contributed to continuous buying in SOL. As per the report, minor outflows were recorded on Thursday and Friday as a result of US macroeconomic data. This could have caused a decline in inflows data.

XRP and Chainlink See Significant Investor Interest

Investors purchased $245 million in XRP and $52.8 million in Chainlink. This comes amid massive buying recorded by XPR and Chainlink ETFs. Spot XRP ETF in the United States continues to record inflows. Canary XRP ETF (XRPC) leads with $20.19 million in inflows last week. As The Coin Republic reported, Grayscale Chainlink ETF launch last week grabbed massive interest. It has recorded a total inflow of $48.25 in a week.

As per the report, institutional investors were largely bullish in all regions, with the United States seeing $483 million in inflows. Germany and Canada also saw positive massive flows of $96.9 million and $80.7 million, respectively. Switzerland, Hong Kong, Australia, and Brazil also contributed significantly to total inflows.

Price Performance of Bitcoin, XRP, and LINK

Bitcoin price rebounded more than 4% to trade near $92K level at the time of writing. The intraday low and high were $87,799.56 and $92,267.11, respectively. Trading volume in spot and derivatives markets rises despite the FOMC Meeting and other macroeconomic events this week.

XRP price jumped nearly 3% in the past 24 hours, with the price currently trading at $2.09. The 24-hour low and high were $2 and $2.12, respectively. Meanwhile, LINK price wavers near $14, up almost 1% over the past 24 hours. Trading volume has increased by 73% over the past 24 hours, indicating interest among traders.