The Federal Reserve’s widely anticipated 25-basis-point rate cut triggered an unexpected “sell the news” reaction across cryptocurrency markets, wiping out more than $815 million in leveraged futures positions within 24 hours.

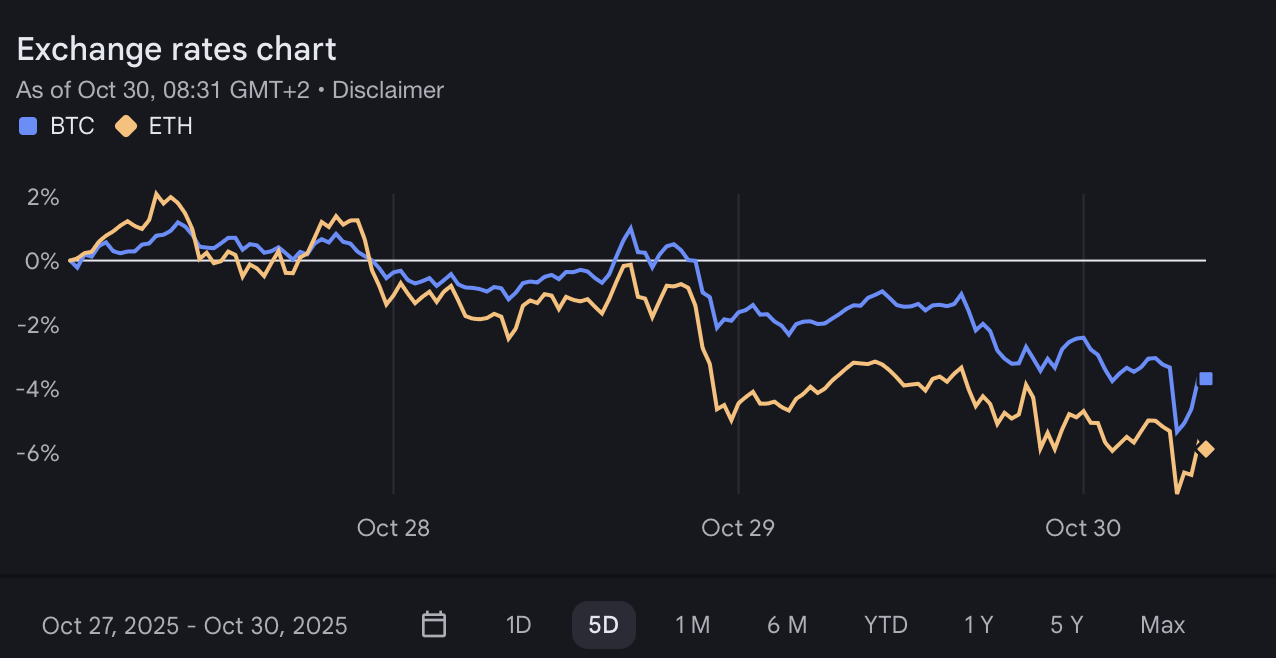

Bitcoin and Ethereum Hit by Sharp Volatility

Following the Fed’s move to lower its benchmark rate to a 3.75%–4% range, crypto traders initially welcomed the decision, but optimism quickly faded after Fed Chair Jerome Powell delivered cautious remarks that rattled risk sentiment.

Bitcoin (BTC) swung violently, plunging to around $108,000 before recovering slightly above $110,000 by Thursday morning. It closed Wednesday down nearly 3%, marking one of the steepest intraday reversals since early September.

Ethereum (ETH) also faced selling pressure, slipping 2% to hover just above $3,900 as market volatility surged across major altcoins.

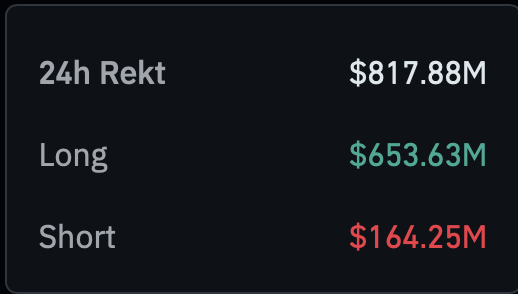

$817 Million in Leveraged Trades Wiped Out

Data from Coinglass shows that over $817.88 million worth of leveraged crypto futures were liquidated in the 24-hour period, with $653.63 million from long positions and $164.25 million from shorts.

The majority of liquidations came from overleveraged long traders betting on a post-rate-cut rally that never materialized.

This sharp liquidation cascade mirrors previous “sell the news” patterns observed after major macro events, where traders front-run positive expectations, only to unwind positions once the event unfolds.

Powell’s Hawkish Tone Cools Market Optimism

While the rate cut was fully priced in, Powell’s post-meeting statement disrupted market confidence. He emphasized that another rate cut in December is “not a foregone conclusion”, citing elevated inflation risks and uneven economic data.

His tone contrasted with broader investor expectations for a continued easing cycle, prompting a swift recalibration in both equities and crypto. U.S. Treasury yields edged higher, while risk assets, including Bitcoin, lost momentum.

“Sell the News” Dynamics Take Hold

The episode underscores how crypto remains tightly linked to macroeconomic sentiment, particularly Federal Reserve policy signals. Analysts described the market’s behavior as a textbook “sell the news” reversal, where prices decline following a seemingly bullish event already priced into valuations.

With Bitcoin still above $110,000 and Ethereum stabilizing near $3,900, traders now await fresh macro cues and clarity on whether Powell’s comments mark a pause or a pivot in the Fed’s easing trajectory.