Bitcoin Price Decline

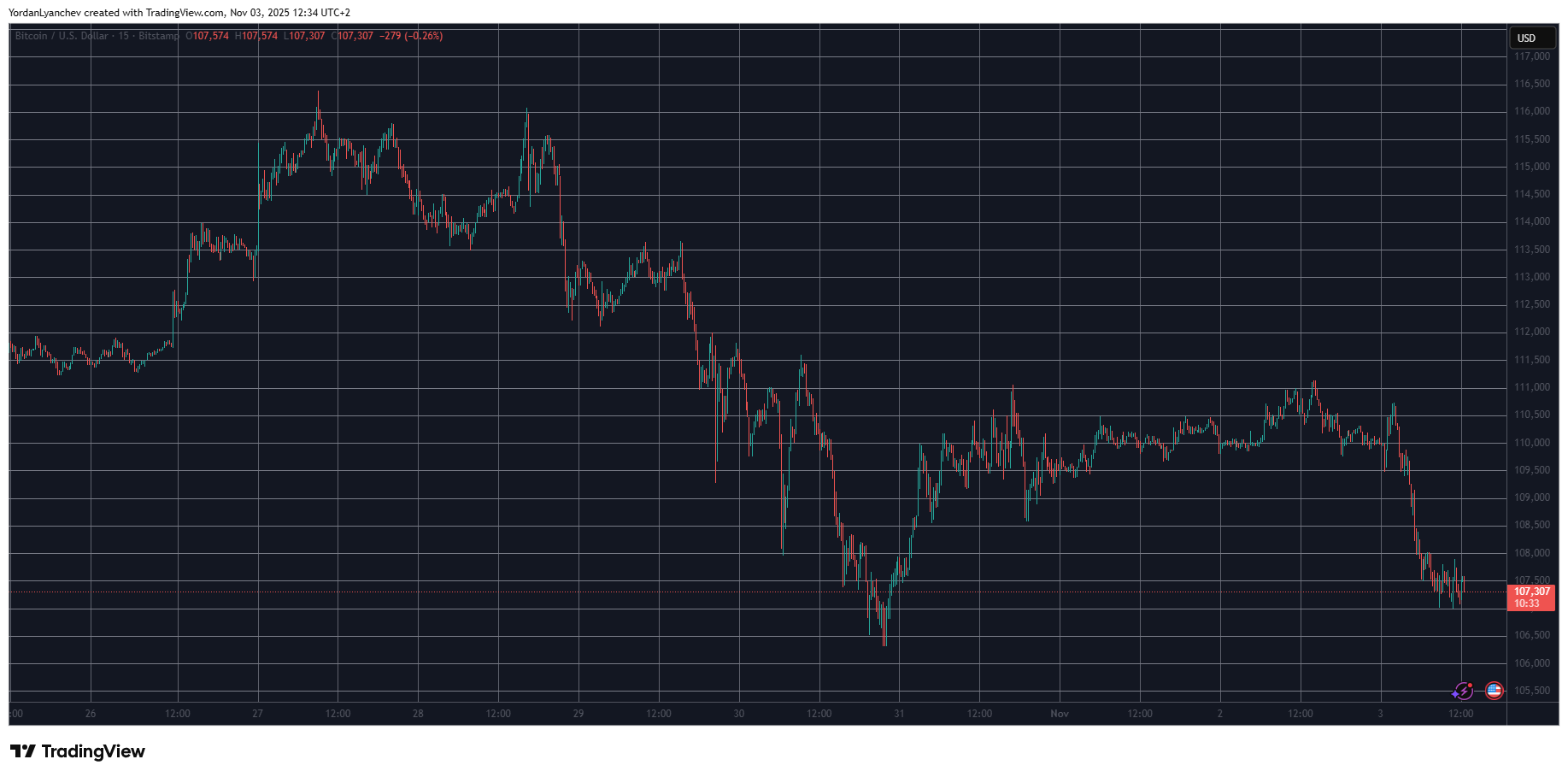

Bitcoin began November with a price slide, mirroring the end of October, and dropped to just under $107,000 earlier today. This decline has also affected altcoins, with significant price drops observed in BNB, SOL, DOGE, LINK, ADA, and many others.

The previous business week was marked by significant volatility in the cryptocurrency markets, influenced by external developments. Bitcoin reached $116,000 on Monday and Tuesday but was rejected on its second attempt.

Following this rejection, Bitcoin experienced an immediate decline to $112,000, despite positive news from the US Federal Reserve regarding a 25 basis point rate cut. Subsequently, BTC headed south again, falling below $106,000 on Thursday. A relief rally occurred when Bitcoin surpassed $111,000, spurred by news of a US-China trade war deal.

However, Bitcoin could not sustain this momentum and was again stopped at the $111,000 level over the weekend. Monday started on a negative note as the bears gained control of the market, pushing the cryptocurrency down to just under $107,000.

While this support level has so far held Bitcoin, the asset is still down nearly 3% on the day. Its market capitalization has fallen below $2.150 trillion, and its dominance over altcoins has increased to 58.3% according to CoinGecko.

Altcoin Market Performance

Altcoin charts are showing even more significant declines today. Ethereum has dropped to $3,700, representing a 3.8% decrease. XRP has fallen to $2.40 following a 4.5% daily correction. More substantial losses are visible across BNB, SOL, DOGE, ADA, LINK, SUI, HBAR, AVAX, and numerous other altcoins, with some experiencing losses of up to 7%-8%.

Most mid- and lower-cap altcoins are in a similar situation, although a few exceptions exist. ICP has seen a daily increase of over 8%, with WBT and ASTER also showing gains.

Overall, the total cryptocurrency market capitalization has decreased by over $120 billion since yesterday, now standing at $3.680 trillion according to CoinGecko.