According to trader and analyst DaanCrypto, the total crypto market capitalization is hovering near a key support zone, one that could determine whether the current cycle sustains its momentum or slips into deeper correction territory.

“The total market cap is still holding where it should,” Daan wrote, cautioning that bulls don’t want to see this level lost. The chart he shared highlights the market’s consolidation around the daily 200-day moving average, suggesting that a decisive move below could invite further downside pressure.

Daan attributes the current weakness in both Bitcoin and altcoins to selling from four-year cycle participants, long-term holders who typically take profits following major peaks. “It will take a lot of capital to absorb all that selling,” he explained, noting that this type of supply pressure is a recurring feature in Bitcoin’s historical cycles.

The analyst added that, while this phase could be “theoretically good” if buying demand is strong enough to absorb the sell pressure, the absence of sufficient liquidity could create a self-fulfilling downward spiral. His advice: “Stick to the charts and be ready for either scenario.”

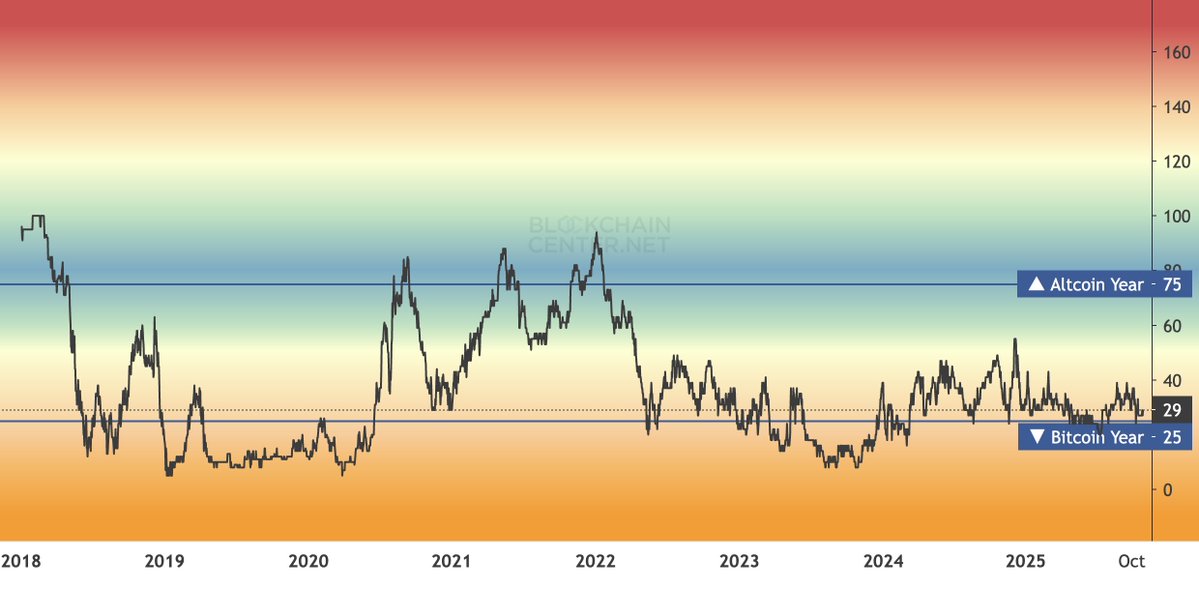

Only 29% of Altcoins Outperform Bitcoin in 2025

In a separate post, Daan highlighted that just 29% of the top 50 altcoins have outperformed Bitcoin so far in 2025, underscoring BTC’s continued dominance in the market. This ratio has remained below 39% for over six months, signaling persistent capital concentration in Bitcoin over riskier assets.

Daan’s chart shows that the last sustained altcoin outperformance occurred during the 2020–2021 bull cycle, which was driven by the DeFi boom and pandemic-era liquidity. Since then, altcoin rallies have been short-lived, typically lasting only 2–3 months, or more recently, just a few weeks.

“Anything after that point has been short periods of outperformance but never lasting more than 2–3 weeks at best,” he noted, suggesting that traders may need to temper expectations for a classic “altseason” until broader market liquidity improves.

Market Outlook: Holding Steady Amid Selling Pressure

Despite near-term caution, Daan maintains that the broader market structure remains intact. As long as total market capitalization continues to hold its key support and Bitcoin stabilizes above major cycle levels, the path to new highs by early 2026 remains possible.

The key, he emphasized, lies in absorbing the ongoing sell pressure from long-term holders while maintaining healthy spot demand. Should that happen, the correction could serve as a base for the next expansion phase across both Bitcoin and altcoins.

Until then, Daan advises traders to stay technical, patient, and objective: “Watch the key levels, they’ll tell you everything you need to know.”