Market Overview

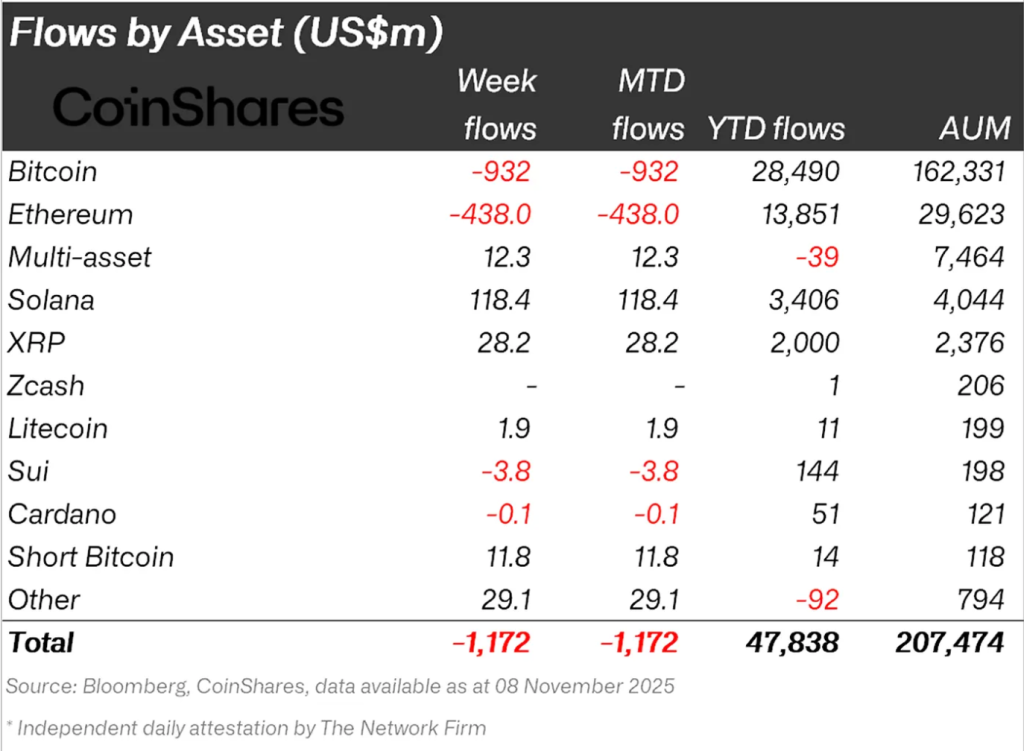

Digital asset funds experienced substantial outflows totaling $1.17 billion last week, largely driven by selling activity in the US market. This cautious investor behavior is attributed to heightened market volatility and concerns regarding potential delays in interest rate cuts.

Bitcoin investment products saw redemptions amounting to $932 million, while Ethereum followed with $438 million in outflows. Conversely, short Bitcoin ETPs attracted $11.8 million, marking their strongest inflow since May 2025.

US spot Bitcoin ETFs recorded their third-largest weekly outflow on record, with $1.22 billion exiting the market. Friday alone accounted for $558.4 million in redemptions, underscoring a growing investor caution leading into the weekend.

Despite the overall outflow trend, ETP trading volumes remained elevated at $43 billion. This was partly supported by mid-week optimism surrounding the US government shutdown, although renewed outflows resumed by Friday as this optimism faded.

Altcoins Show Resilience Amidst Mixed Market Signals

While major cryptocurrencies faced selling pressure, certain altcoins demonstrated resilience and continued to attract investor interest. Solana led altcoin inflows last week, securing $118 million. Over the past nine weeks, Solana has amassed $2.1 billion in inflows, indicating sustained investor confidence.

Other altcoins also saw positive momentum, with HBAR attracting $26.8 million and Hyperliquid receiving $4.2 million in inflows. This suggests a growing confidence in the potential of emerging blockchain platforms.

On a geographical note, Germany and Switzerland recorded significant inflows, with $41.3 million and $49.7 million, respectively, indicating positive sentiment in these markets.

Bitcoin is currently trading at $106,308.22, showing a 4.70% increase in the last 24 hours and a 0.31% gain over the past hour. The weekly trend remains slightly negative with a 1.10% decline, suggesting that recent gains have followed earlier pullbacks.

The short-term momentum for Bitcoin appears bullish; however, longer-term sentiment remains mixed due to ongoing macroeconomic pressures. The observed capital rotation into altcoins highlights selective confidence amidst the broader market uncertainty.