4/ 📉 Bitcoin has tested $107k support 4 times already.

— Maartunn (@JA_Maartun) November 3, 2025

Each test weakens buyer conviction at that level. If this continues, a breakdown becomes more likely. pic.twitter.com/vUakghIuJL

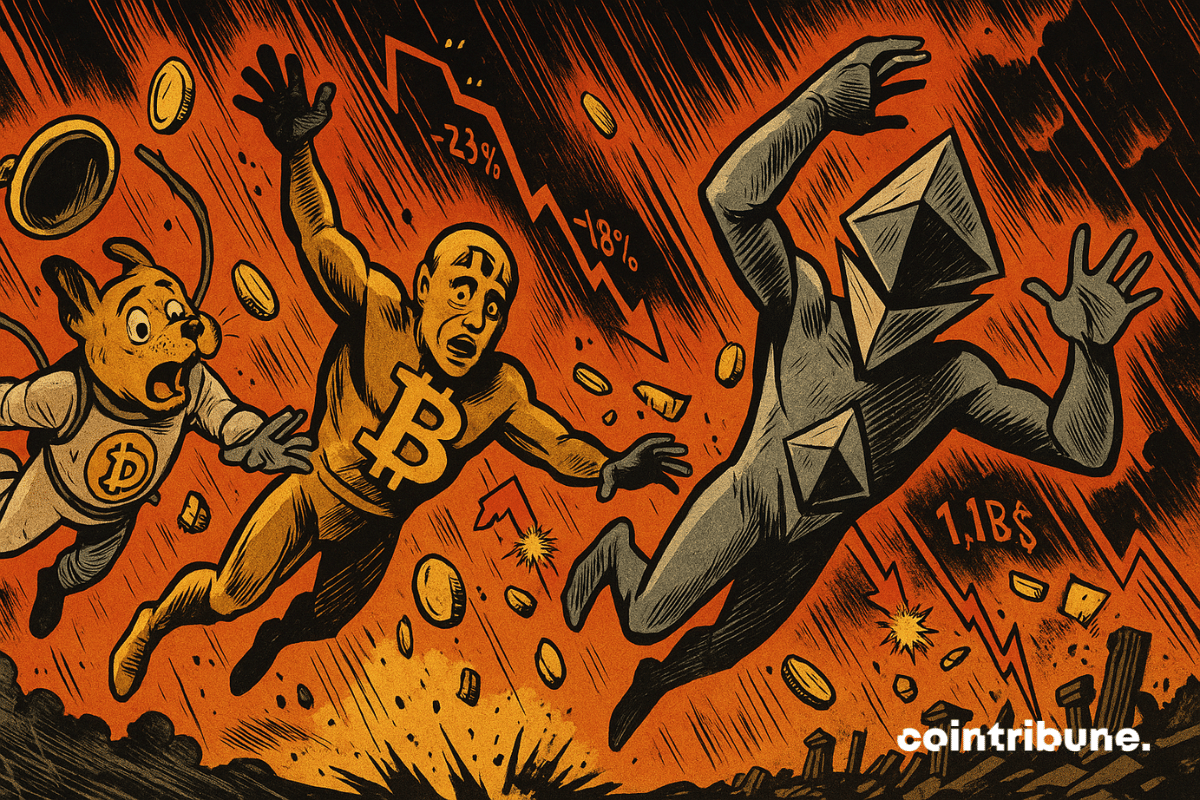

The crypto market experienced a sharp pullback at the start of the week. While US stocks remained in the green, Bitcoin, Ethereum, and Dogecoin saw significant declines, triggering over $1.1 billion in liquidations within a 24-hour period. This sudden drop, occurring without a clear catalyst, highlights the ongoing instability and vulnerability of the crypto ecosystem to panic-driven movements. The substantial setback has reignited concerns about the market's resilience and investor confidence in the face of persistent volatility.

In brief

- •The crypto market experienced a sharp correction at the start of the week, with over $1.1 billion of positions liquidated in 24 hours.

- •Bitcoin, Ethereum, and Dogecoin were among the hardest hit, recording losses ranging from 4% to 9%.

- •This drop occurred without an obvious catalyst, even as equity markets remained oriented upward.

- •Outflows from Bitcoin ETFs confirm a short-term waning institutional interest.

Over One Billion Dollars Liquidated in 24 Hours

On Monday, the crypto market was significantly impacted by a wave of massive liquidations that occurred within a matter of hours. According to data from CoinGlass, over $1.1 billion in positions were liquidated within a 24-hour timeframe, with $1.08 billion specifically from long positions, which represent bets on price increases.

This market movement caught many traders and investors by surprise, as the decline lacked an apparent trigger. Maartunn, an analyst at CryptoQuant, commented that "Repeated tests of the same support levels are not a bullish signal," suggesting that buyers "simply end up exhausting themselves" during periods of market weakness.

The most significant losses were observed in the primary cryptocurrencies, with a notable impact across major altcoins. The key figures from this period of sharp decline include:

- •Total liquidations: $1.1 billion

- •Liquidations from long positions: $1.08 billion

- •Bitcoin (BTC): A 4% drop, with $298 million in positions liquidated. The price reached $105,699, its lowest point since October 17.

- •Ethereum (ETH): A 7% drop, with $273 million liquidated. The price fell to $3,583, its lowest in nearly three months.

- •XRP: A 7% decrease, trading at $2.33.

- •BNB, Solana, Dogecoin: Each experienced daily drops close to 9%.

- •Total market capitalization: A 3% decrease over 24 hours, settling at $3.68 trillion.

This sudden correction occurred even as US stock markets registered modest gains, reinforcing the notion of a temporary decoupling between cryptocurrencies and traditional financial indexes. The absence of an immediate, identifiable catalyst amplified market tension, leading observers to scrutinize the underlying reasons for this downturn.

Weak Technical Signals and Persistent Macroeconomic Pressures

Beyond the immediate figures and liquidation dynamics, several leading indicators suggest that the market is under considerable pressure.

According to Maartunn, the Coinbase premium – the difference between Bitcoin's spot price on Coinbase and its average price on other platforms – reversed and turned negative at the market's opening on Monday morning.

"The Coinbase premium turned negative again and continued to deepen at the market opening. This shows that American investors exert strong influence on the price, as last month," he explained. This indicator, which is often correlated with selling pressure from US institutional desks, supports the idea that the current market movement is driven by arbitrage activities from large players rather than widespread panic among retail investors.

The broader economic context also plays a crucial role. Recent statements from US Treasury Secretary Scott Bessent have tempered market sentiment. He acknowledged that "certain parts of the economy" might have been "pushed into recession" due to high interest rates.

This statement contributed to tighter growth expectations ahead of a highly anticipated employment report. In this climate of uncertainty, the flow data for Bitcoin ETFs is particularly revealing: $798.95 million in net outflows were recorded last week, contrasting with only $15.97 million in net inflows into Ethereum ETFs.

Data from Glassnode further indicates a noticeable slowdown in institutional demand. Weekly net inflows into BlackRock's ETF have been less than 0.6k BTC, a significant decrease compared to over 10k BTC weekly before previous rallies.

Facing this dual slowdown, both technically and fundamentally, the short-term outlook remains uncertain. While some analysts, such as Shawn Young of MEXC Research, still anticipate a potential recovery for Bitcoin towards $125,000 – $130,000 by the end of the year, contingent on crossing specific resistance levels, the declining institutional flows, the current consolidation of BTC between $108,000 and $110,000, and ongoing macroeconomic uncertainties suggest that a cautious approach remains advisable.