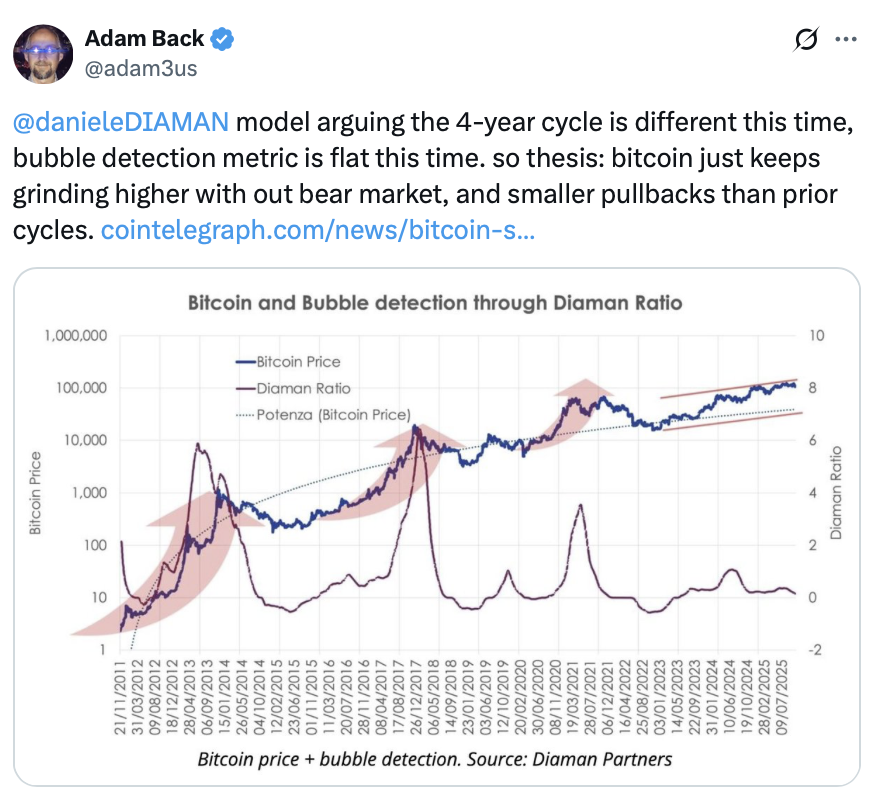

The question on many investors' minds is whether the current crypto market cycle has concluded after four years, or if the very theory of a four-year crypto market cycle should be retired. Swan Bitcoin CEO and prominent Bitcoin advocate Cory Klippsten suggests the latter, stating that there is a significant possibility Bitcoin's well-known four-year price cycles are no longer in play, largely due to institutional adoption.

This debate has divided Bitcoin analysts globally. While some maintain that the four-year cycle remains active, others argue it has ended and that Bitcoin is now following an entirely different trajectory.

As of the time of writing, Bitcoin was trading at $92,170, marking a nearly 13% decrease over the past seven days. This performance is notably lower than its price at the beginning of the year, a situation not ideal for those who predicted prices of $250,000 by year-end.

If the traditional four-year cycle were still applicable, Bitcoin's October all-time high of $125,100 would technically signify the cycle's peak. This timing aligns with the typical pattern of an 18-month post-halving bull run, followed by a substantial correction and a prolonged downturn until the next halving event.

Klippsten posits that if Bitcoin reaches a new all-time high in 2026 or avoids a drawdown exceeding 70%, it would indicate the termination of the four-year cycle. He believes this is likely, especially following the introduction of Bitcoin ETFs in January 2024, which he views as a game-changer.

Spot Bitcoin ETFs Alter Supply-Demand Dynamics

Echoing Klippsten's sentiment, Michal van de Poppe, founder of MN Trading Capital, asserts that the inflows into spot Bitcoin ETFs are fundamentally reshaping Bitcoin's supply and demand dynamics.

Van de Poppe noted that approximately 60,000 Bitcoin has been acquired through ETFs over the past 18 months, representing significant and consistent institutional demand. However, he cautions against prematurely declaring the cycle dead, suggesting such a conclusion might be short-sighted.

While acknowledging that the current cycle has exhibited different behavior, van de Poppe believes October's all-time high still has the potential to be the cycle's peak. He explained that the market is at a crossroads, experiencing the maturation of an asset like Bitcoin, which naturally leads to evolving market dynamics.

Matt Hougan, chief investment officer at Bitwise, expressed greater confidence that Bitcoin is moving beyond the traditional four-year cycle, particularly after the recent market downturn. He stated that a significant risk would have been a sharp rally towards the end of 2025 followed by a pullback, which would have aligned with the four-year thesis.

BitMEX co-founder Arthur Hayes has dismissed the notion that Bitcoin is adhering to its traditional cycle. In a recent Substack post, he moved away from his year-end price predictions and argued that Bitcoin would only surge to new highs once market conditions force central banks into aggressive monetary expansion.

Pav Hundal, lead analyst at Swyftx, is closely monitoring macroeconomic data and believes it is too early to definitively call the end of the current cycle. Hundal stated that any indication of falling inflation or concerns about labor figures would likely steer the market back towards expectations of interest rate cuts.

He further elaborated that whenever the market anticipates a reduction in U.S. rates, a rally occurs, only to be followed by a significant unwinding of risk when those rate cut hopes are dashed.

Is Bitcoin Shifting to a Five-Year Cycle?

Following recent uncertainty stirred by Federal Reserve Chair Jerome Powell, the probability of a December interest rate cut has fallen to just 40.9%, according to CME's FedWatch Tool.

Hundal suggests that the market is currently navigating uncertain territory, awaiting clearer economic data. He added that this situation is not exclusive to Bitcoin but serves as a warning signal for all risk assets.

Typically, a reduction in interest rates by the Federal Reserve is considered bullish for Bitcoin and other cryptocurrencies, as it makes traditional assets like bonds and term deposits less attractive to investors.

An alternative perspective from a segment of Bitcoin enthusiasts suggests that the four-year cycle may never have truly existed. The Bitcoin Therapist argues that Bitcoin's price movements were merely synchronized with the broader business cycle.

Similarly, Real Vision founder Raoul Pal posited that the global business cycle now operates on a five-year period, which could place Bitcoin's cycle high around 2026.

Crypto analyst Jesse Eckel commented that in retrospect, it will likely be evident that a bull market was forming in 2026 and that simply counting to four was not a viable investment strategy. He emphasized the potential for a "Five Year Cycle."

The Four-Year Cycle Persists, or Has Just Ended

Conversely, several analysts and executives have maintained for months that the four-year cycle was likely to remain relevant, and the current market conditions appear to support this view, at least for the time being.

In July, prominent crypto analyst Rekt Capital indicated that only a small window of time and price expansion remained in the current bull run. More recently, Rekt cautioned that determining whether Bitcoin is in a lengthened cycle or if the cycle has concluded will require more time.

Saad Ahmed, head of APAC at crypto exchange Gemini, also believes that some form of repeating cycle will continue. He told Cointelegraph at Token2049 that it is highly probable that the market will continue to experience cycles. Ahmed explained that these cycles stem from periods of investor excitement and overextension, followed by corrections and a return to equilibrium.

Earlier this year, before Bitcoin reached new highs in October, crypto analytics platform Glassnode noted that Bitcoin's price action still seemed to be following the historical halving pattern.

On Monday, crypto analyst Colin Talks Crypto suggested that Bitcoin's price momentum might be paused for now. He stated that without a swift recovery in the immediate days, it would indicate the onset of a bear market or a more significant corrective phase.