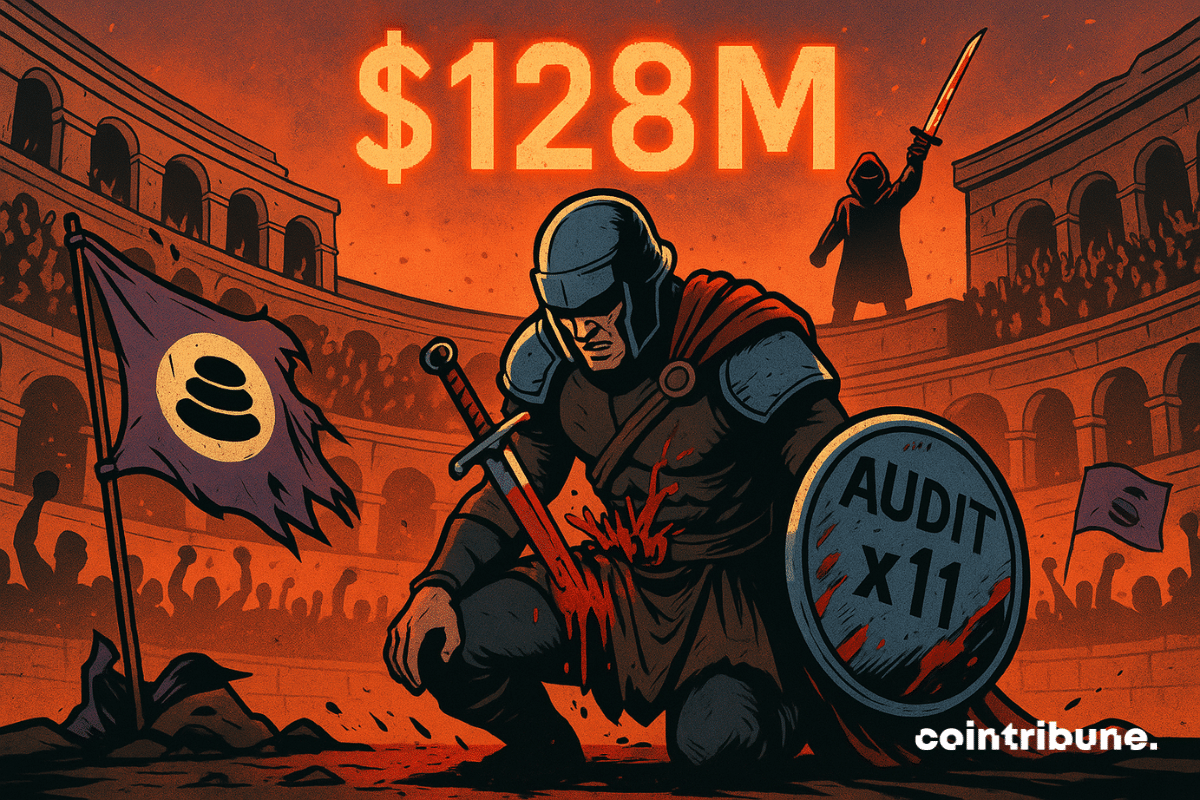

The crypto industry’s nightmare is back: the hack. We had almost forgotten it. Like that old demon pretending to sleep to strike better. The year 2025 offered us a lull until November 3. Balancer, this DeFi protocol said to be shielded by a dozen audits, got stripped. And not halfway. Behind the well-crafted contracts, reality hits hard: in the crypto jungle, nothing is ever really under control. When the vulnerability appears, it hits hard.

In brief

- •Balancer was hacked despite eleven audits, with over 128 million dollars stolen.

- •The attack spread through interconnected pools, affecting several chains like Ethereum and Base.

- •Projects like Berachain suspended their networks to contain the impact of the Balancer hack.

- •This hack questions the effectiveness of audits in the decentralized and interconnected crypto world.

Audited Security Shattered Trust: Balancer Loses $128 Million

When PeckShield raised the alert, it was already too late. Within hours, Balancer saw 128 million dollars evaporate. Just on Ethereum, nearly 70 million were siphoned off. Base, Arbitrum, Polygon, even forks like Sonic and Beethoven were not spared. What hurts? This protocol had done everything by the book. Eleven audits, including three on the vaults. Yet, the hack passed through.

The modus operandi involved a surgical manipulation of Balancer Pool Tokens (BPT) during batch swaps. By playing with the internal price calculation logic, the hacker created an artificial imbalance, withdrawing funds before the system corrected itself. All orchestrated via Tornado Cash, a classic method to blur the tracks.

Conor Grogan, an analyst at Coinbase, summarizes the situation:

The hacker appears experienced: (1) He funded his account with 100 ETH and 0.1 ETH via Tornado Cash, without operational leakage. (2) Given the absence of recent 100 ETH deposits on Tornado, it is likely the hacker already had funds from previous exploits.

Trust, however, flew away. Balancer lost 46% of its Total Value Locked (TVL) in one day. The shock was immediate.

Balancer and Composability: Genius or Ticking Time Bomb?

In the crypto universe, composability reigns. It is what allows several protocols to interlock like Lego bricks. Balancer was built on that principle. Its architecture allowed pools to reference each other in real time. It was ingenious until the day this interconnection triggered a chain reaction.

The attacker did not just empty one pool; they took advantage of the domino effect. Each impacted pool unbalanced the others. On Berachain, validators had to stop block production to prevent a snowball effect. Other projects, like Sonic, disabled bridges and suspended lending.

Robdog, a developer at Cork Protocol, reacted to the event:

Although DeFi foundations are becoming increasingly secure, the sad reality is that risks related to smart contracts surround us everywhere.

Balancer, by pushing the “all connected” logic, also revealed the model’s limits.

Crypto Under Tension: After Balancer, Signals Turn Red

This drama goes beyond just Balancer. In the crypto ecosystem, a question rises: have audits become useless totems? Suhail Kakar asks the uncomfortable question: over ten audits, yet a $110 million hack. Should crypto developers rethink their approach? Or accept that risk is part of the game?

While developers look for band-aids, investors run for the hills. Even the most loyal withdraw their funds. This is an understandable reaction: if even ultra-audited projects fall, who can really inspire trust?

Key Takeaways:

- •The Balancer hack exceeds $128M, affecting Ethereum, Arbitrum, Base, Polygon, and other networks.

- •Eleven audits failed to detect the vulnerability in smart contracts.

- •Balancer lost 46% of its TVL in just 24 hours, with approximately $348M vanishing.

- •The protocol’s composable architecture multiplied failure points.

- •Berachain suspended its network to limit impact and prepare a hard fork.

While DeFi heals its wounds, another piece of bad news clouds the horizon: over 1.1 billion dollars were liquidated in 24 hours on the crypto market. This resulted in Bitcoin, Ether, and Dogecoin sharply falling. These are cascading shocks in an industry that remains too unstable.