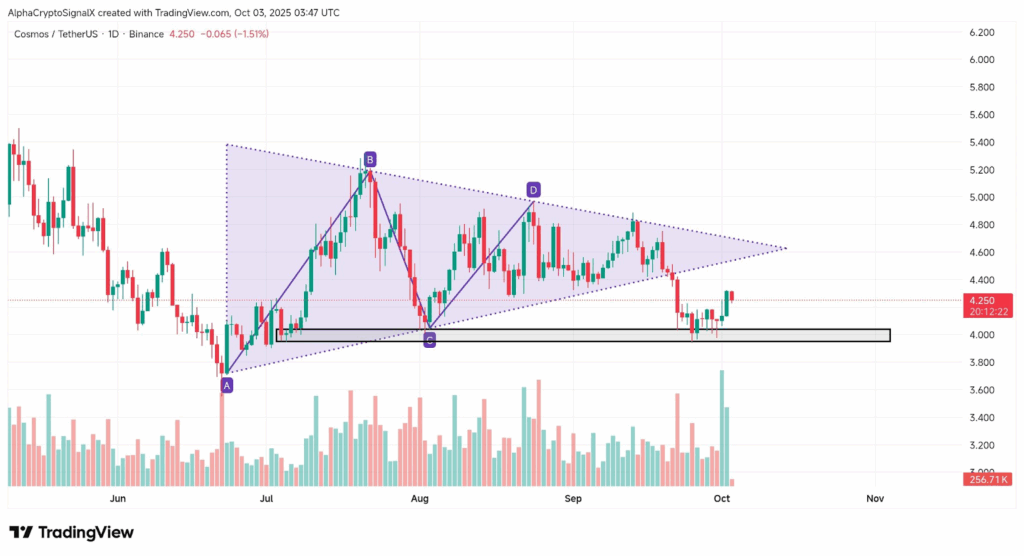

- •Cosmos Hub broke down from a symmetrical triangle, confirming bearish control and weakening its technical setup.

- •The $4.0 horizontal support level remains critical for buyers, offering a temporary lifeline and bounce opportunity.

- •Resistance at $4.5–$4.6 is the key test for bulls to reclaim lost ground and shift market sentiment.

Cosmos Hub faces a pivotal moment after breaking down from a triangle formation, leaving traders watching the $4.0 horizontal level. The price has managed a bounce, but the broader structure remains under pressure with resistance still ahead.

Breakdown From Symmetrical Triangle

Analyst Alpha Crypto Signal (@alphacryptosign) noted that Cosmos Hub ($ATOM) recently broke below its symmetrical triangle structure. Such a pattern often signals the end of price compression, leading to a stronger directional move. The exit to the downside confirmed that sellers had taken control of the market.

The inability to sustain strength above the triangle during September weakened momentum and created conditions for a bearish shift. The consistent lower highs within the formation showed fading buyer strength as the apex narrowed. The eventual failure confirmed growing selling pressure.

Following the breakdown, the price did not collapse immediately. Instead, ATOM moved toward a horizontal demand area near $4.0, where buyers reappeared. This reaction has created a relief bounce, but the overall setup remains cautious until stronger confirmation emerges.

Horizontal Support at $4.0

The $4.0 level has now become the main defense line for buyers. This horizontal area has acted as both support and resistance in past cycles, giving it technical importance. Holding this level is essential to prevent a deeper slide.

Alpha Crypto Signal emphasized that losing the $4.0 base would open the way to $3.6–$3.7, the next demand region. This area has not been tested since July and could mark a sharper correction if retested. This would also add more bearish dominance in the short term.

As of this writing, ATOM is up 0.2% over the past 24 hours at a price of $4.24. The 24‑hour trading range between $4.18 and $4.32 indicates low volatility, while buyers are attempting to stabilize the token. Trade volume remains stable, with a recent volume of $144.7 million.

Resistance Test Ahead

While support has held so far, the next challenge lies in overcoming resistance at $4.5–$4.6. This range previously acted as the breakdown area and now serves as a cap on recovery attempts. Bulls must reclaim this level to neutralize bearish momentum.

Any upward move over $4.5‑$4.6 might permit ATOM to re‑test higher levels at $4.8 or $5.0. Such a development would indicate renewed accumulation and a stronger position for buyers. Until then, the current rally is best described as a tradable bounce within a weak structure.

Volume activity reinforces this battleground scenario. The initial breakdown was accompanied by heavier selling participation, validating the bearish shift. However, the bounce from $4.0 also drew notable buying volume, showing that demand remains active. The duel between buyers and sellers makes the coming sessions critical.