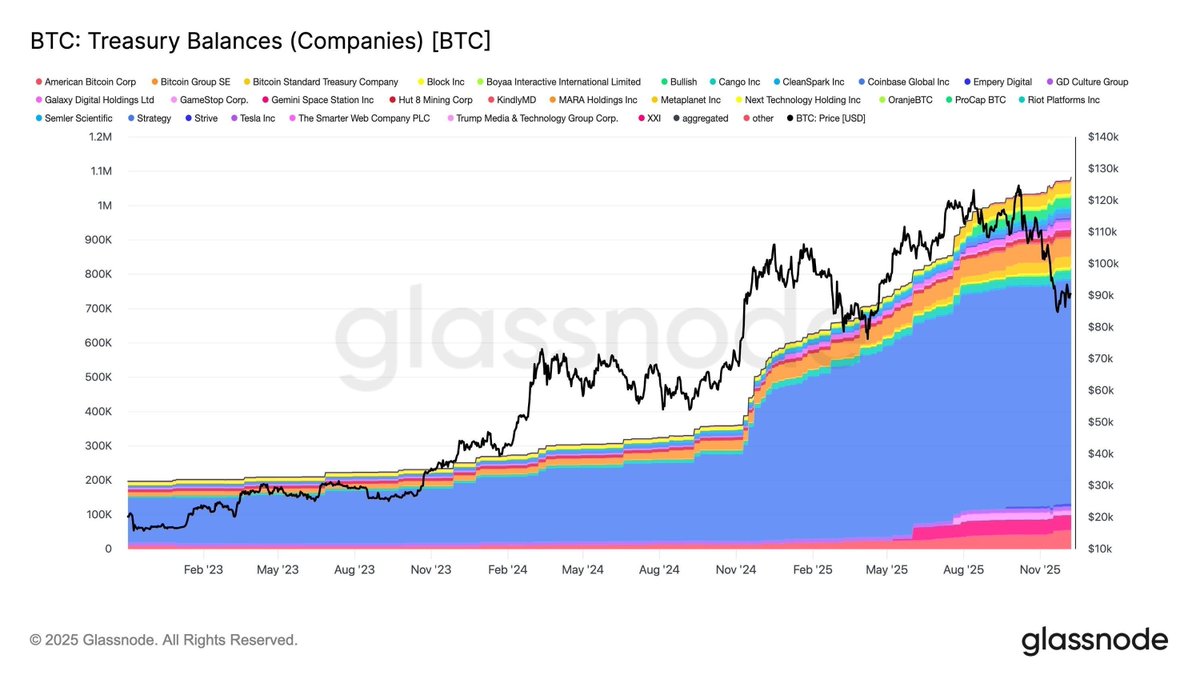

Corporate demand for Bitcoin is strengthening again, with new data from Glassnode showing a dramatic expansion in company-held BTC.

Total corporate reserves jumped from 197,000 BTC in early 2023 to more than 1.08 million BTC, marking a ~448% increase over less than three years. This surge underscores how aggressively institutions have moved into accumulation mode, even during periods of market volatility.

With major regulatory efforts such as the Clarity Act and the upcoming crypto market structure bill, analysts expect corporate adoption to intensify. These frameworks are designed to provide clearer rules for custody, reporting, and asset classification, key factors institutions require before increasing exposure. As confidence grows, any pullback in price is quickly turning into a fresh entry point for companies expanding their treasuries.

Why Companies Are Buying the Dips

The tone across institutional desks has shifted. Instead of waiting for ideal market conditions, corporations appear increasingly comfortable scaling into weakness. The message is straightforward: dips are opportunities, not threats.

Corporate treasuries now view Bitcoin less as a speculative instrument and more as a long-term strategic reserve asset. This mindset, buy consistently, accumulate during market fear, and expand reserves over time, is becoming more common as traditional financial and technology firms embrace BTC in parallel with companies like MicroStrategy and Tesla.

What the Chart Shows

The Glassnode chart illustrates the steady and accelerating rise of corporate BTC balances from early 2023 through late 2025.

- •The stacked colored bands represent holdings across dozens of companies, from public miners to tech firms and financial entities.

- •Total reserves remained modest until mid-2023, then began climbing aggressively through 2024 and into 2025.

- •Even during major market corrections, the chart shows no significant reduction in holdings; instead, companies consistently added to their positions.

- •The BTC price line (in black) highlights how accumulation accelerated during dips, especially after sharp pullbacks in early and mid-2025.

This upward trend supports the broader narrative: corporate buyers are not only holding but continuing to scale in, treating volatility as a strategic advantage.

Trend Outlook

If regulatory clarity progresses as expected, the next wave of adoption could bring even larger players into the market, such as insurance firms, asset managers, and multinational corporations with global cash reserves. Such entities often deploy capital in multi-year cycles, creating sustained demand rather than short bursts of interest.

Corporate Bitcoin ownership has already reached historic levels. Yet, based on recent behavior, the accumulation phase still appears to be in its early innings.