Copper has demonstrated one of its most robust yearly performances in recent memory, and some analysts suggest this upward trend is just beginning. Chamath Palihapitiya recently highlighted copper as his primary trade recommendation for 2026, citing significantly underestimated global supply shortages and escalating demand.

Copper's Performance Over the Past Year

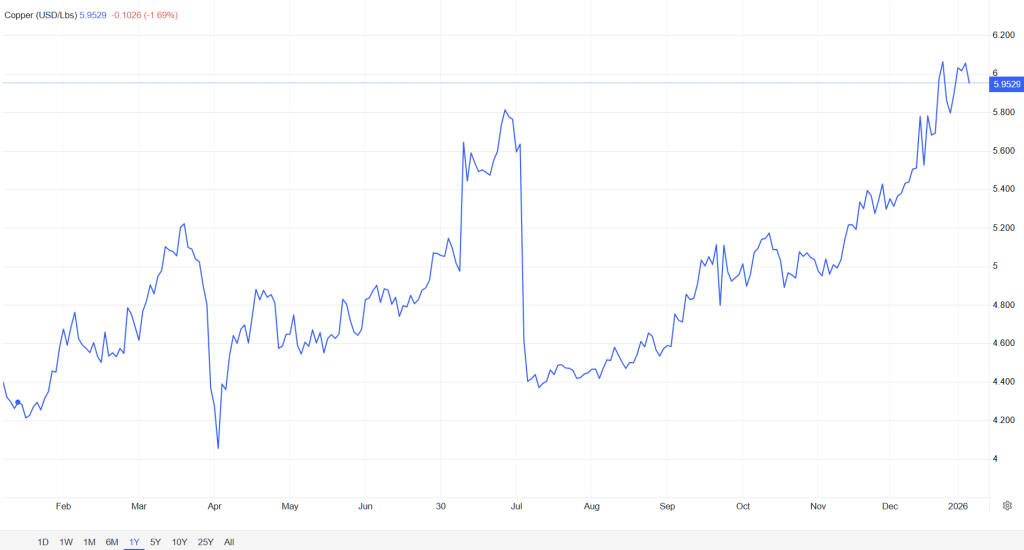

The recent focus on copper is evident in its price chart. Over the last 12 months, copper has experienced a consistent upward trajectory, interspersed with several notable pullbacks. Early in the year, prices hovered around the low $4 range with limited momentum. This changed in the spring when copper broke through resistance, surpassing $5 for the first time in months.

April saw a sharp decline, but buyers quickly intervened, leading to a strong recovery. By early summer, copper prices surged towards the $5.80 mark. This rally was followed by another significant correction in July, with prices briefly dipping back towards $4.40. However, this downturn proved to be short-lived.

From August onwards, copper entered a more controlled uptrend. Higher lows were established, volatility decreased, and prices climbed steadily through the fall. By December, copper broke above previous resistance levels, accelerating towards the $5.90 zone where it is currently trading.

Despite a minor pullback in recent sessions, the broader upward trend remains intact. Over the past year, copper has appreciated by approximately 40%, outperforming many equity sectors.

Analyst Outlook: Continued Upside Potential

Chamath Palihapitiya's analysis extends beyond short-term price movements. He posits that copper is central to several long-term demand drivers, including data centers, semiconductor manufacturing, power grid infrastructure, electric vehicles, and defense systems. Concurrently, the supply side faces challenges such as declining ore quality, lengthy permitting processes, and geopolitical complexities, hindering new production.

Chamath stated, "We are still completely underestimating how short we are," emphasizing that copper is "the most useful, cheap, and amenable conductive material we have."

Chamath's best trade idea for 2026 is not a stock. It is copper.

— Boring_Business (@BoringBiz_) January 14, 2026

"We are still completely underestimating how short we are in terms of the global demand and supply dynamics of a handful of critical elements that we need.

The asset that is set up to go absolutely parabolic is… pic.twitter.com/jXvD5GKokB

A Shift from Traditional Commodity Trading

The current dynamics of the copper market distinguish it from typical commodity trades. The price action observed over the past year, characterized by aggressive buying on dips, suggests long-term positioning rather than speculative, short-term trading.

Copper's performance is increasingly decoupled from traditional economic cycles, becoming more closely linked to infrastructure development, energy security initiatives, and technological advancements.

If demand continues its upward trajectory while supply remains constrained, the recent rally in copper prices may be viewed as modest in retrospect. For many investors, this strategic positioning explains why copper, rather than equities, is being identified as the significant trade opportunity as 2026 progresses.