CoinShares Withdraws Solana ETF Proposal

CoinShares, a European digital asset manager, withdrew its Solana staking exchange-traded fund (ETF) proposal from the U.S. Securities and Exchange Commission (SEC) on Friday. SEC filings indicate that no shares were ever issued or sold in connection with this proposal. The withdrawal signifies a strategic shift by CoinShares, as the company aims to redirect its efforts toward more profitable sectors within the digital asset industry. Ryan McIntyre, CEO of CoinShares, stated that the registration statement was intended to register shares proposed to be issued in connection with a transaction that ultimately did not occur, and that no shares are being sold under the registration statement.

This decision acknowledges the current competition and regulatory hurdles associated with enabling regulated Solana investments through ETFs. The absence of public statements from CoinShares officials underscores the reliance on SEC filings as the primary source of information regarding this withdrawal.

Solana Market Dynamics and Industry Context

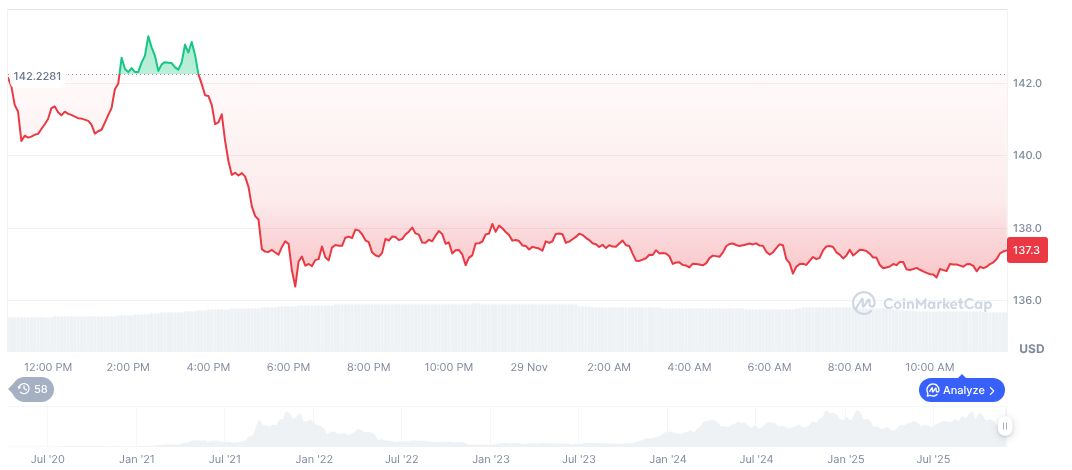

The cryptocurrency asset management sector has been navigating complex regulatory environments, particularly concerning altcoin ETFs, in contrast to the Bitcoin and Ethereum products launched in 2024. As of November 30, 2025, Solana's market capitalization stood at approximately $76.34 billion, with a circulating supply nearing 559.53 million tokens. The 24-hour trading volume for Solana experienced a decline of 46.27%, though the asset saw a 6.11% increase over the preceding week despite recent market fluctuations.

Experts suggest that this withdrawal highlights the ongoing challenges within the regulatory landscape for staking-focused ETFs. Competitive market conditions are shaping strategies that prioritize higher-margin business areas over the development of new ETF avenues.