Coinbase Global Inc. experienced a significant boost on Wednesday afternoon as Bitcoin surged back above the $93,000 mark, underscoring the symbiotic relationship between Coinbase and the world's largest cryptocurrency.

The stock closed the day at $276.92 per share, marking an increase of over 5%. This rally highlights a fundamental dynamic: when Bitcoin experiences an upswing, trading volume increases. Higher trading volumes directly translate to increased revenue for Coinbase. Consequently, when Coinbase performs well financially, investor concerns about price targets and valuation multiples tend to diminish, creating a favorable cycle, particularly on days when Bitcoin's price is rising.

Wednesday's upward movement in Coinbase shares occurred despite a recent downgrade by Argus Research. The firm had advised caution, citing the stock's 39x 2026 earnings multiple as potentially too high.

Coinbase investors appeared unfazed by the downgrade. This resilience can be attributed to the company's strong performance in the third quarter, where it surpassed expectations with an Earnings Per Share (EPS) of $1.50, exceeding the consensus estimate of $1.10. Furthermore, Cathie Wood's Ark Invest demonstrated continued confidence by investing over $7 million in fresh COIN shares for its exchange-traded funds (ETFs) following a recent dip in the stock price.

Future Outlook and Market Trends

Looking ahead, investors are anticipating December 17th, a date when Coinbase is expected to introduce new products. These potential additions could include a prediction market and even stock trading functionalities, further expanding the platform's offerings to its user base.

From a technical perspective, Coinbase shares still have some recovery to achieve. The stock remains approximately 13.9% below its 50-day moving average and 2.7% below its 200-day moving average, reflecting a broader downturn experienced by crypto-linked equities. However, Ark Invest has shown a sustained commitment, actively acquiring shares not only in Coinbase but also in other related companies such as Block, Circle Internet Group, Bullish, and Robinhood, alongside its own Bitcoin ETF, during this market pullback.

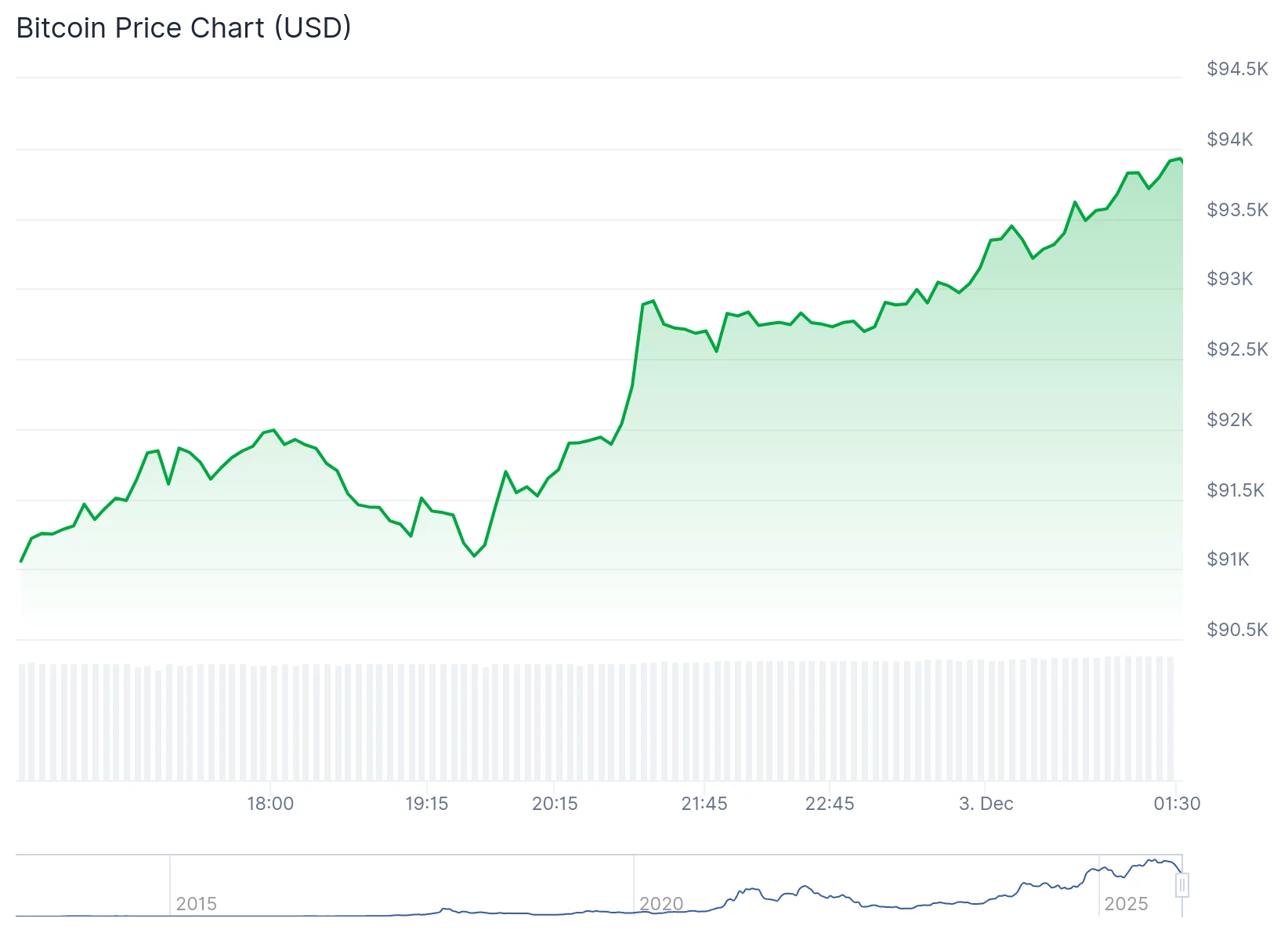

Bitcoin itself has not yet reached its record high from six weeks prior, with trading volumes being constrained by thin liquidity and ongoing macroeconomic uncertainties. The following chart illustrates this trend:

Nevertheless, the current resurgence in Bitcoin's price, with Coinbase closely following, serves as a mid-week reminder to investors of the rapid shifts in sentiment and stock performance that are characteristic of the cryptocurrency market.