Key Developments in Institutional Crypto Adoption

On December 4th, Brian Armstrong, CEO of Coinbase Global Inc., announced at the DealBook Summit that major U.S. banks are conducting pilot projects with Coinbase. These initiatives are focused on stablecoins, custody, and trading.

This collaboration highlights growing institutional interest in crypto assets. It has the potential to boost stablecoin utilization and positively impact market sentiment for cryptocurrencies like Bitcoin and Ethereum.

Coinbase Partners with U.S. Banks to Drive Crypto Adoption

Coinbase Global Inc. announced partnerships with major U.S. banks for pilot projects on stablecoins, custody, and trading at the DealBook Summit on December 4th. The partnerships signify a potential shift toward greater institutional adoption of cryptocurrencies, as indicated by Brian Armstrong, CEO of Coinbase, who emphasized opportunities for banks.

The broader crypto market reacted positively, with Bitcoin and Ethereum showing gains. No direct commentary has been made by significant figures such as Vitalik Buterin or mainstream regulatory bodies, though the SEC’s regulatory stance remains a backdrop to these developments.

"The best banks are seeing this as an opportunity. Banks that resist this trend will be left behind by the times."

Market Data and Insights

Did you know? Previous institutional forays into crypto, such as Paxos and JPMorgan’s collaborations, set the stage for mainstream adoption seen today. These efforts often precede greater acceptance and legitimization of stablecoins and Layer 1 tokens.

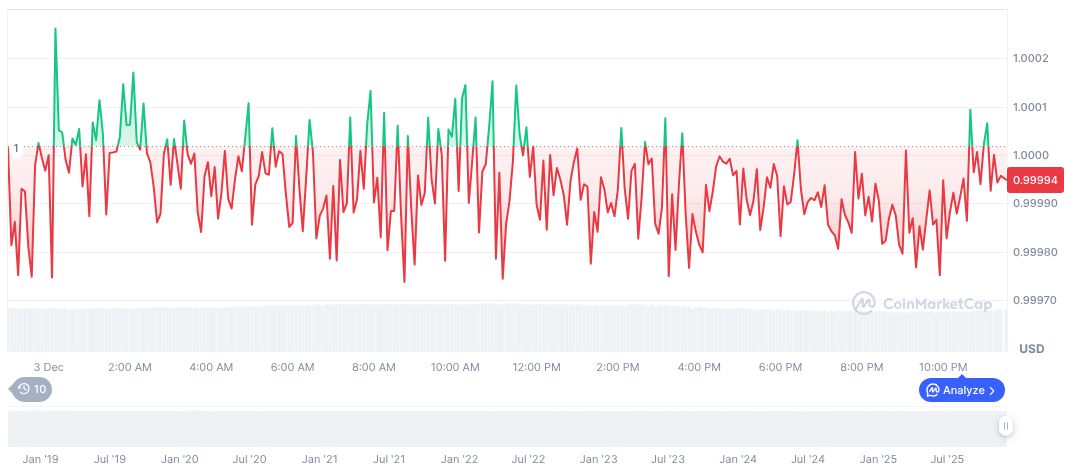

USDC maintains a $77.97 billion market cap, reflecting its stability as a key stablecoin. Trading volume was recorded at $13.43 billion, showcasing reduced activity with a 12.38% decrease, yet its circulating supply remains robust.

From Coincu's perspective, these pilot projects indicate potential shifts in regulatory discussions, especially regarding stablecoin integration within financial systems. Historical trends suggest enhanced technological infrastructure could lead to broader acceptance and trust in crypto assets.