CME Expands to 24/7 Trading Amidst Surging Crypto Demand

CME Group, the world's foremost derivatives marketplace, has announced plans to introduce 24/7 cryptocurrency futures trading, slated to commence in early 2026, subject to regulatory approval. This strategic expansion is designed to cater to the evolving needs of market participants who require continuous risk management capabilities in response to increasing institutional interest in digital assets. The move is expected to significantly enhance liquidity and better align futures trading with the persistent activity in spot markets.

The initiative is being led by Tim McCourt and aims to meet the growing demands for round-the-clock trading. This development promises to offer greater flexibility for managing cryptocurrency-related risks on a daily basis.

Record Volumes and Strategic Adjustments in Crypto Derivatives

In 2025, cryptocurrency futures and options trading volumes have reached unprecedented highs, with Bitcoin and Ethereum seeing particularly significant activity. This surge has been marked by a record volume of 795,000 contracts amidst considerable market volatility. However, CME has also made strategic adjustments, including the suspension of upcoming regulated options products for assets such as Solana and XRP. Despite these suspensions, the group plans to launch new futures products as part of its broader expansion strategy.

"Client demand for around-the-clock cryptocurrency trading has grown as market participants need to manage their risk every day of the week," stated Tim McCourt, Global Head of Equities, FX, and Alternative Products at CME Group.

The announcement of CME's proposal for continuous trading has been met with positive reception from market participants on platforms like Twitter. Many view this as a crucial step in aligning regulated financial products with the inherent 24/7 nature of cryptocurrency markets. Institutional investors, including substantial funds, have expressed optimism regarding the availability of continuous risk management solutions.

Bitcoin Price Dynamics and Institutional Interest

CME Group first ventured into the realm of regulated crypto derivatives by launching Bitcoin futures in December 2017. This pioneering move is seen as a precursor to the proposed 24/7 trading, which has the potential to once again transform market access and participation in the cryptocurrency space.

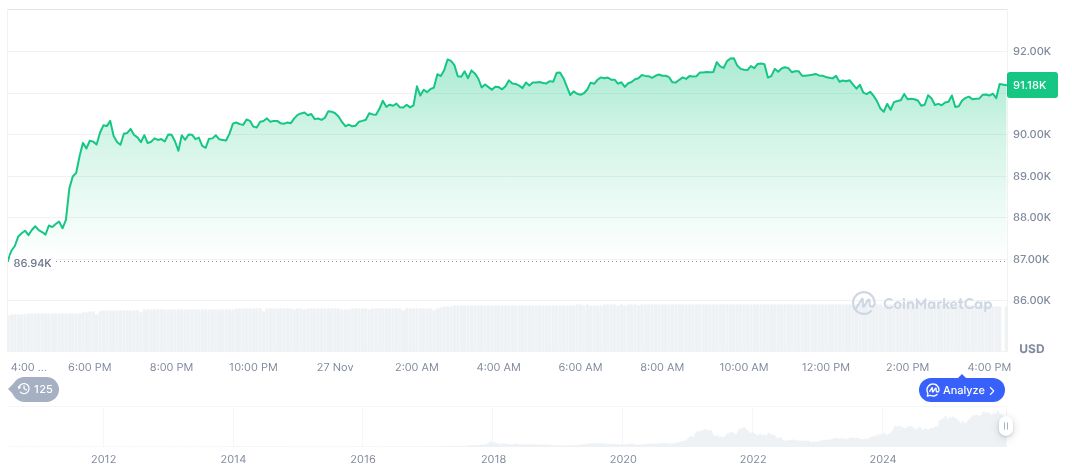

Currently, Bitcoin (BTC) is trading at $91,146.42, with a market capitalization of $1.82 trillion. It holds a dominant market share of 58.66%. Recent price performance indicates a 4.44% increase over the past 24 hours and a 6.11% rise over the last week, although there has been a decline over the past 30 days.

Research from the Coincu team suggests that the implementation of continuous trading could fundamentally alter the landscape of institutional involvement in cryptocurrencies. Historical data indicates that enhanced regulatory clarity often correlates with increased trading volumes, and new trading structures are likely to bolster on-chain stability. Regulatory transparency is identified as a critical factor in sustaining this growing momentum.