Key Developments in CME Globex Trading

CME Group's Globex market, a significant platform for futures and options trading, is set to implement extended trading hours. Starting November 28, 2025, the pre-opening session will commence at 7:00 AM Central Time, with the official market opening at 7:30 AM Central Time. This adjustment aims to enhance trading flexibility and increase market liquidity.

This strategic move is expected to impact major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) by potentially drawing more institutional participation into related derivative markets. The platform continues to serve a diverse range of participants across multiple industries with its extensive offerings in metals, energy, and crypto derivatives.

Impact of Extended Trading Hours

The extension of CME Globex's trading hours represents a significant evolution in market accessibility. This change, driven by CME Group's leadership, provides traders with earlier electronic access to a wide array of contracts. The platform's ongoing appeal stems from its comprehensive selection of derivatives covering various asset classes.

By modifying its trading schedule, CME Group is enhancing market fluidity and expanding its global reach. This update is also concurrent with the upcoming launch of 24/7 trading for swap-based event contracts, underscoring the company's commitment to adapting to market dynamics and fostering volume growth.

CME Group's Globex futures and options market will begin a pre-opening session at 7:00 AM Central Time and officially open at 7:30 AM Central Time. - CME Group, Official Update

Although notable figures have not made public statements, analysts suggest that this change could attract new institutional investment. The extended trading hours set a precedent for further broadening market access and could lead to improved liquidity for BTC and ETH futures, alongside other derivatives.

Anticipation of Institutional Inflows

CME's initiative to introduce 24/7 trading for swap-based event contracts is scheduled to begin on December 5, 2025. This development further emphasizes the platform's dedication to market evolution and its responsiveness to dynamic global trading demands.

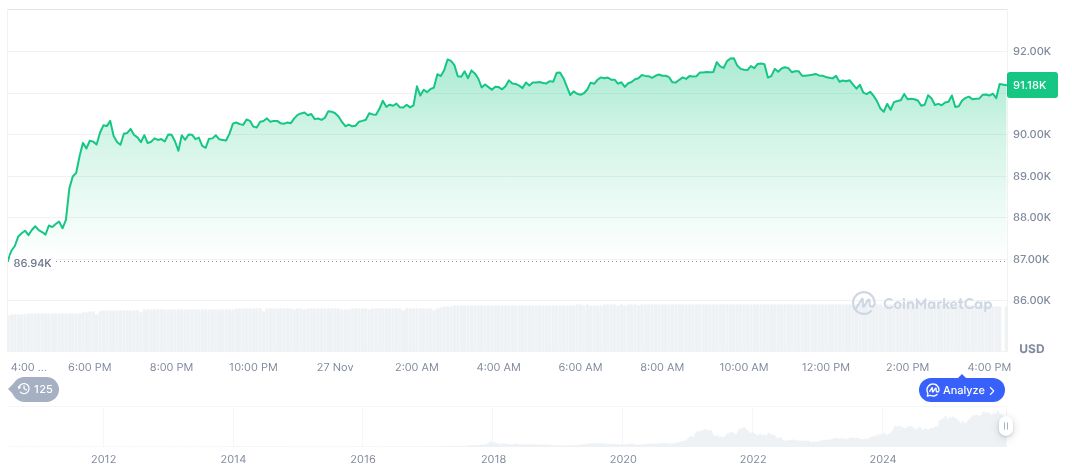

As of November 28, 2025, Bitcoin (BTC) is trading at $91,522.46, with a market capitalization of $1.83 trillion and a 24-hour trading volume of $49.41 billion. The cryptocurrency has shown modest gains of 1.14% in the last 24 hours and 8.98% over the past week. The circulating supply of BTC is approaching its maximum limit of 21 million units.

Industry experts anticipate that this strategic move by CME could stimulate greater institutional involvement in the market. The enhanced accessibility aligns with historical patterns where extended market hours typically correlate with increased liquidity and greater price stability, potentially reducing long-term volatility in the crypto derivatives market.