USDC's Market Leadership: Compliance and Institutional Trust

Analysts from JPMorgan have noted a significant milestone as Circle’s USDC overtakes Tether’s USDT in both market capitalization growth and on-chain activity. Key factors include USDC’s regulatory compliance and increased institutional adoption, highlighting changes within the stablecoin landscape.

USDC's growth traces back to adherence to the Crypto Asset Markets Regulation (MiCA) and the U.S. Genius Act, enhancing user trust and adoption. Its success has been attributed to increased integration with payment networks and cross-chain transfer protocols.

Market reactions suggest a preference for USDC based on transparency and compliance. Circle's CEO Jeremy Allaire stated that the company remains committed to full regulatory transparency, reinforcing their stablecoin’s institutional appeal. In contrast, USDT faces challenges due to reduced market presence and regulatory scrutiny.

“Circle’s adherence to MiCA and regular audits have unlocked incredible institutional trust in USDC. Transparency is now the market expectation.” — Jeremy Allaire, Founder & CEO, Circle Internet Financial

Stability and Growth Benchmarked by Market Data

A significant regulatory shift like MiCA influencing stablecoin velocity has parallels to past regulatory adjustments that redirected the flow of institutional trust from offshore issuers to compliant platforms.

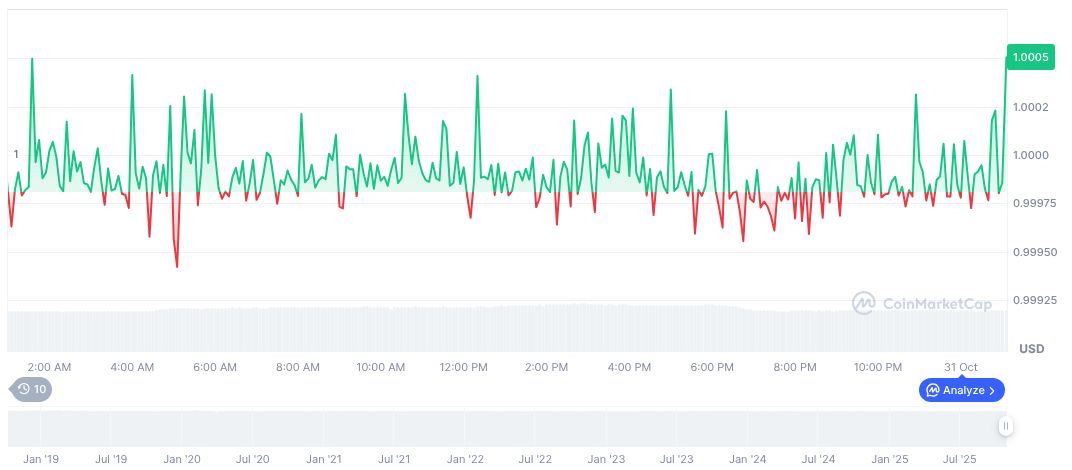

CoinMarketCap data indicates USDC has a current market capitalization of $75.95 billion and a 24-hour trading volume of $18.96 billion, showcasing a relatively stable price around $1.00. Despite a short-term decrease of 1.29% over the past seven days, USDC continues to maintain its value as a key stablecoin competitor.

Coincu's research suggests that USDC might continue expanding its market share due to its compliance-first approach and robustness in reserve management. The research also highlighted ongoing technological advancements in cross-chain interoperability as potential catalysts for future growth.