Key Financial Performance and Market Reaction

Circle's stock experienced a decline of over 8% following its Q3 financial announcement, despite the company reporting revenue of $740 million and a profit of $214 million, both significantly exceeding analysts' expectations. This strong financial performance, representing a 66% year-on-year revenue growth and a 202% surge in profit, was notably higher than the forecasted $700 million in revenue and $31 million in profit. However, the company's market capitalization has fallen to approximately $21 billion, a nearly 70% decrease from its peak earlier in the year. This contraction in market cap has not yet led to immediate adjustments in DeFi protocols that utilize USDC as a primary collateral.

The stock's sharp decline, despite surpassing financial targets, has surprised market analysts. Circle CEO Jeremy Allaire has not issued direct comments regarding the Q3 results, prompting speculation within the industry. Arthur Hayes, Co-founder of BitMEX, commented on the situation, stating, "The reaction to Circle's Q3 results highlights the ongoing skepticism surrounding stablecoins and their market impact."

Regulatory Environment and Stablecoin Market Dynamics

Circle's recent market cap, now at $21 billion, represents a significant decrease from its earlier peak this year. While Circle's financial results demonstrate resilience, industry research suggests that ongoing regulatory scrutiny surrounding stablecoins may be contributing to investor caution. Transparency and adherence to global regulatory compliance are identified as critical factors for understanding potential future outcomes in the stablecoin sector.

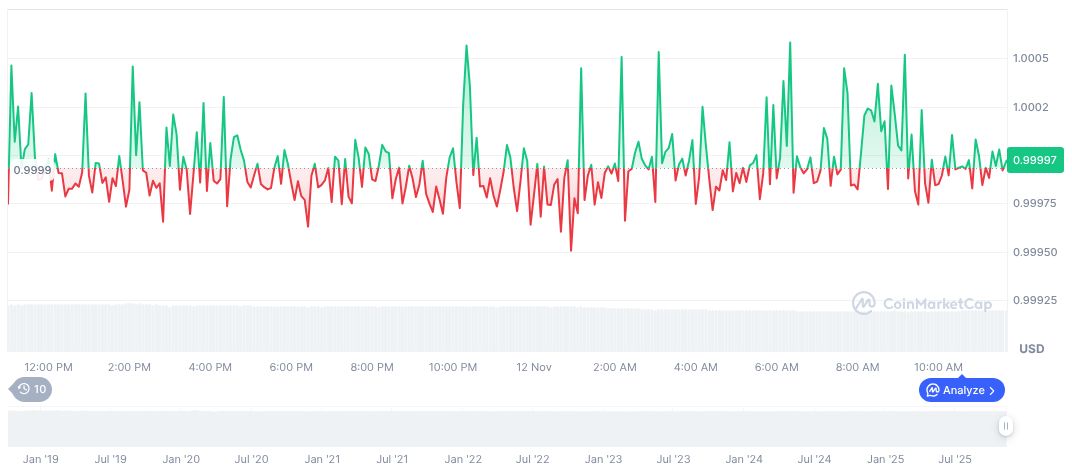

According to CoinMarketCap data, USDC is currently priced at $1.00 with a market capitalization of $75.99 billion. The 24-hour trading volume for USDC was $14.30 billion, showing a decline of 9.87%. The value of USDC has exhibited minor fluctuations across different timeframes, underscoring its role as a stable asset within cryptocurrency markets.