USDC Supply Growth and Market Position

Circle has issued 8.2 billion USDC and redeemed 6.2 billion USDC, resulting in a net increase of 2 billion in its circulating supply. This brings the total circulating supply of USDC to 78 billion, as of December 4, 2025. This expansion reflects a growing demand for stablecoins, particularly USDC, which is recognized as the world's largest regulated stablecoin. Its influence is significant in enhancing liquidity across various blockchain networks.

Under the leadership of CEO Jeremy Allaire, USDC continues to solidify its position as a regulated stablecoin. It is fully backed by 78.1 billion in liquid assets. This includes approximately 46 billion in overnight repo and 21.6 billion in short-term Treasuries, underscoring its stability. The net increase in USDC circulation signifies a notable shift in stablecoin demand, supporting its broader adoption across different digital asset ecosystems.

Market participants have taken notice of this upward trend, acknowledging USDC's crucial role in providing stablecoin-backed liquidity across multiple platforms. Institutional research further corroborates USDC's strategic importance in financial technology applications.

Stablecoin Liquidity and USDC's Strategic Importance

The recent increase in USDC's supply aligns with a broader pattern of stablecoin growth, driven by the demand for liquid and fully backed digital currencies. Historically, USDC's circulation has seen spikes during periods of heightened interest in reliable stablecoin investments.

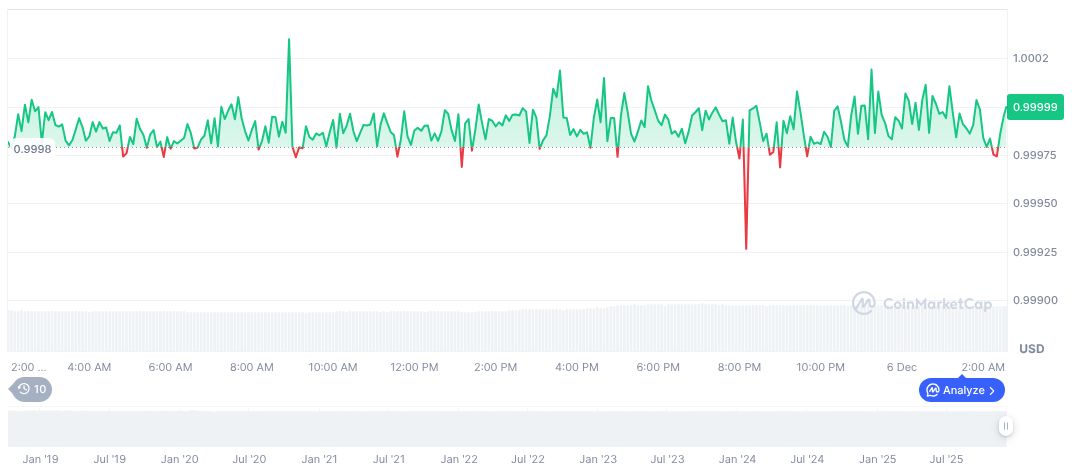

As of December 6, 2025, USDC is trading at $1.00. Its market capitalization stands at 78.14 billion, with a dominance of 2.56% according to CoinMarketCap. The 24-hour trading volume is 12.29 billion, indicating a 10.14% change. The circulating supply of USDC is 78.16 billion.

Insights from Coincu's research team highlight USDC's potential to reshape cross-border finance due to its stability and robust security measures. Andrew W. Jeffrey, Analyst at William Blair, commented, "We expect USDC to catalyze a seismic shift in cross-border B2B finance… As the issuer of USDC, Circle will be the primary beneficiary of stablecoin commercialization outside the crypto ecosystem, in our opinion." USDC's consistent backing in U.S. government obligations provides a stable platform amidst fluctuating crypto markets.