Key Takeaways

- •USDC Treasury destroyed 135.6 million USDC as part of regular operations.

- •This routine burn reduces USDC supply and aligns with standard market practices.

- •The transaction is attributed to institutional redemption and has not shown immediate adverse market effects.

Routine USDC Burn on Ethereum

Circle's USDC Treasury executed a burn of approximately $135.6 million USDC on the Ethereum blockchain. This transaction was detected by Whale Alert and is considered a routine supply adjustment.

The burn aligns with institutional redemption flows, reflecting standard operational procedures rather than market distress. This event impacts the USDC supply on Ethereum without indicating any liquidity issues.

Circle's $135.6M USDC Burn and Its Implications

Circle conducted a sizable USDC burn as part of its routine treasury operations, involving the destruction of approximately 135.6 million USDC on the Ethereum network. The transaction involved Circle Internet Financial, the entity responsible for minting and burning USDC through its treasury wallets, and was detected by Whale Alert.

The primary outcome of this operation is a reduction in the circulating supply of USDC on Ethereum. This action is consistent with Circle's operational model, where redemptions result in a one-to-one payout of USDC for USD. Such burns are a typical component of Circle's redemption cycle, and this particular event signifies the flow of USDC back into fiat currency.

Jeremy Allaire, Co-founder & CEO of Circle, stated, "USDC is a fully backed stablecoin, redeemable one-to-one with USD. As part of normal operations, large burns like the recent ~$135.6M occur when institutions redeem USDC for fiat."

The market reaction to this burn was neutral, with stakeholders recognizing it as a routine event associated with institutional activity. No significant official commentary on this specific burn was released by Circle executives, and the action is consistent with the established USDC mint-burn mechanics.

Analyzing USDC Market Dynamics and Historical Trends

Historically, USDC releases and burns have often served as indicators of market sentiment shifts. Generally, stablecoin burns suggest that investors are withdrawing capital from the cryptocurrency market, while an increase in minting is correlated with bull market phases.

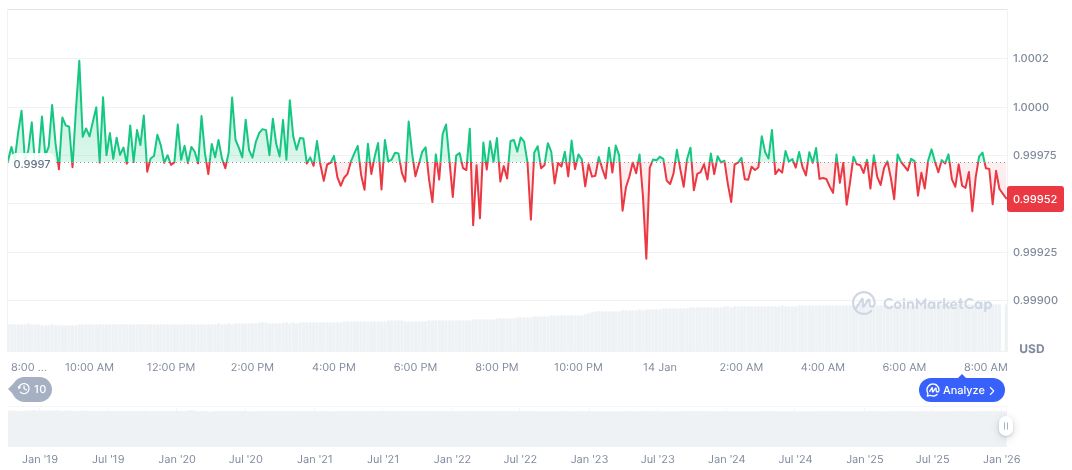

USDC currently maintains a price of $1.00 and a market capitalization of $75.22 billion, representing a 2.3% market dominance. Its total market supply remains unrestricted, with recent fluctuations showing minimal change. CoinMarketCap data indicates a 24-hour trading volume of $22.75 billion, reflecting stability within the stablecoin market.

Consistent USDC burns are in alignment with fiat movement trends and broader economic cycles. Regulatory developments concerning stablecoin reserves are expected to continue influencing issuance and redemption dynamics, as well as Circle's treasury operations.