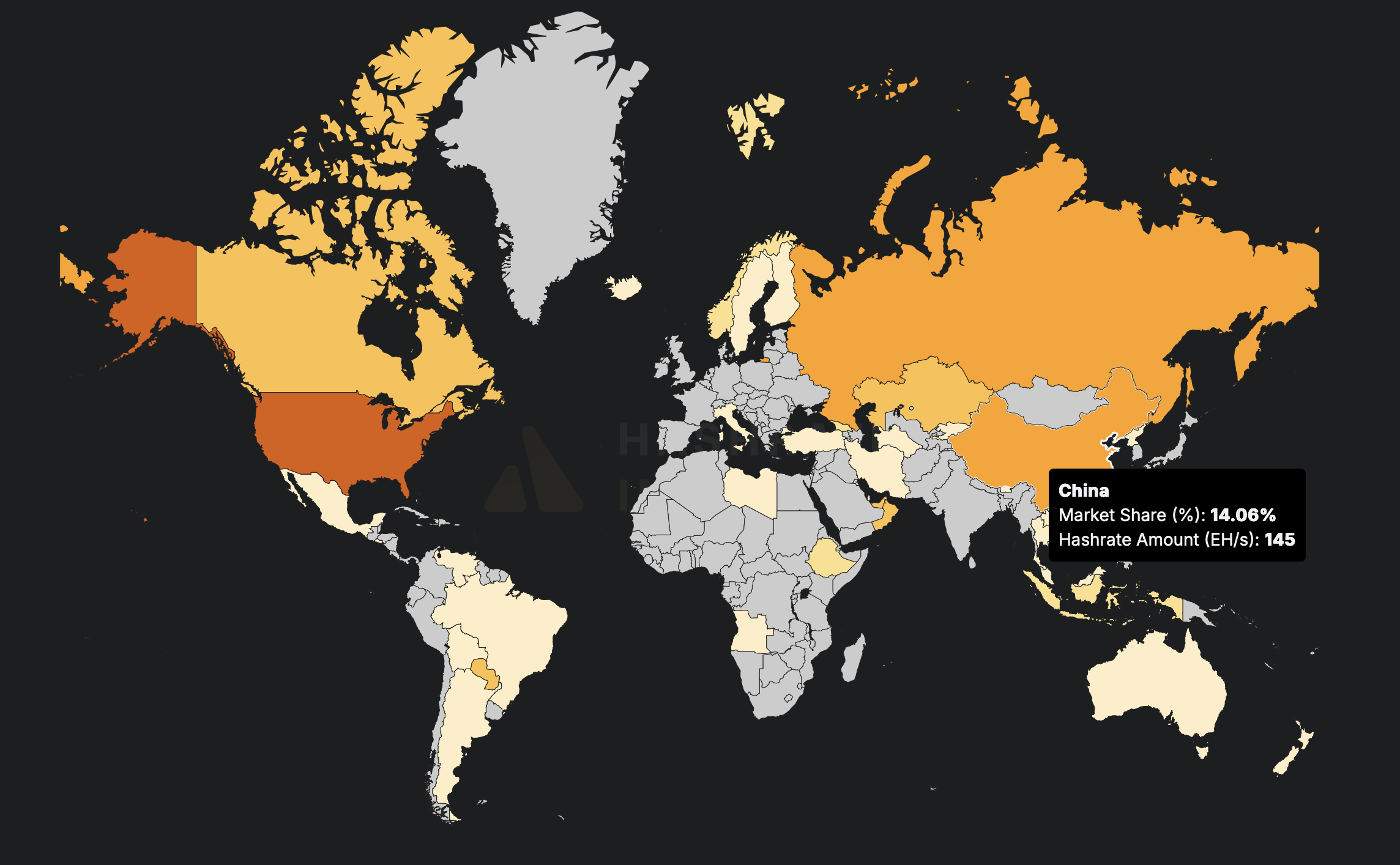

Despite China’s sweeping 2021 crackdown that forced miners offline and reshaped the global Bitcoin landscape, underground mining activity is rapidly resurging. New estimates show that by the end of October 2025, China had quietly climbed back to 14% of global hashrate, making it the third-largest Bitcoin mining hub in the world once again.

The rebound highlights a simple reality: China’s vast energy infrastructure, surplus computing power, and informal networks of miners never fully disappeared; they adapted, reorganized, and waited for market conditions to turn favorable.

Cheap Power and Data Center Surpluses Fuel the Rebound

One of the biggest contributors to the renewed activity is ultra-low-cost electricity. Provinces such as Xinjiang continue to produce power far exceeding local demand, and transmission limitations make it difficult to export the excess. That surplus is increasingly being absorbed by miners who can operate discreetly or through semi-formal arrangements with local partners.

China’s data center boom has also played an unexpected role. Years of over-investment by local governments resulted in empty, underutilized server farms. These facilities, flush with power and cooling capacity, have become fertile ground for miners seeking low-visibility operations.

Add to this the sharp rise in Bitcoin’s price over the last year, and mining profitability has surged high enough to draw both individual miners and corporate groups back into the business.

Policy Shifts Suggest a Softer Regulatory Climate

Although the 2021 ban remains officially intact, analysts say recent developments hint at a more flexible attitude in Beijing. Hong Kong’s push to become a regional crypto hub, including spot ETF approvals and new stablecoin frameworks, reflects a broader, more pragmatic stance within the Chinese policy ecosystem. That shift, combined with limited enforcement resources, has allowed a resilient underground mining sector to re-expand rather than vanish.

Data Confirms China’s Mining Revival

Fresh numbers support the resurgence. Hashrate Index data shows China’s global share has climbed back to 14%, a remarkable recovery from near-zero levels after the ban.

Meanwhile, mining rig maker Canaan Inc. has reported that sales inside China have rebounded sharply, with the domestic market accounting for over half of its global revenue in Q2.

Together, these trends point to a clear conclusion: even with strict regulations on paper, Bitcoin mining never truly left China; it simply went underground, and now it’s rising again.