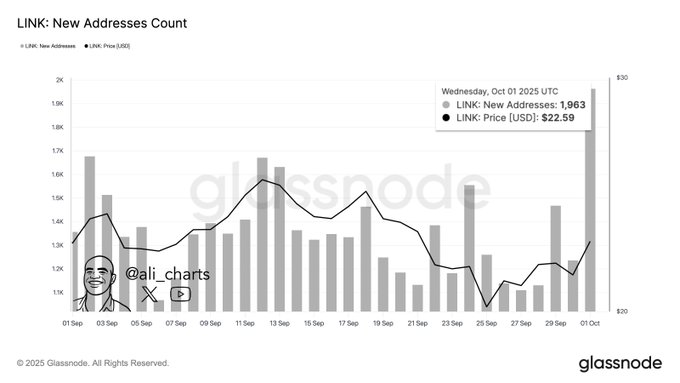

- •Chainlink added 1,963 new addresses on October 1, marking the strongest network growth in a month.

- •LINK trades around $22.50, facing resistance near $23.20 while maintaining strong long‑term performance.

- •Long/short ratios reveal a bullish skew, with top traders holding strong conviction on upward price potential.

Chainlink has shown signs of renewed network growth, with a surge in new addresses recorded on October 1. This rise in participation coincided with a modest recovery in price, suggesting new entrants are positioning during market consolidation.

Network Expansion Sparks Interest

On October 1, Glassnode data recorded 1,963 new Chainlink addresses, the largest daily inflow in a month. Market analyst Ali (@ali_charts) noted that this spike reflects renewed participation after a quieter September. The increase followed a period of steady decline in new address creation.

The histogram data shows mid‑September peaks between 1,500 and 1,700 new addresses before a decline in the third week. The October 1 spike reversed this trend, arriving as LINK recovered from late‑September lows near $20. Price climbed back to $22.59, pairing network growth with market stabilization.

Address growth remains a top‑line adoption metric. While one‑day surges may not confirm sustained demand, they often serve as early signals. Sustained growth in daily new addresses could confirm a structural shift, pointing toward a broader return of participation.

Market Performance and Price Levels

Chainlink is as of writing trading, trading near $22.50, marking a 1.26% decline over the past 24 hours. The asset has seen mixed performance in short timeframes, losing 4.19% over the last 30 days. However, over the past year, LINK remains up 111%, showing robust long‑term momentum.

The trading chart depicts volatility where it has declined sharply to $21.80 then picked up further to above 23 and then relaxed downwards. The recent support is 22.20 ‑ 22.40, and the resistance is $23.00 ‑ $23.20. Breach above resistance would leave room to gain whereas a breach below 22 would mean further corrections.

It has a market capitalization of $15.27 billion and fully diluted valuation of $22.52 billion. Circulating supply is 678 million tokens out of a 1 billion maximum, suggesting a mature supply model with reduced dilution risk.

Trader Sentiment and Market Positioning

Derivatives data shows strong bullish sentiment among traders. On Binance, the long/short ratio for accounts stands at 3.15, while top traders show an even higher 4.00. Position ratios also lean long at 3.50, reflecting strong market conviction. On OKX, the ratio is 1.46, indicating a milder but still positive skew.

This bias toward long positions suggests traders expect further upward momentum. However, heavy long exposure also brings the risk of liquidations if support levels fail. Maintaining price stability above $22 becomes essential to sustain this sentiment.

Chainlink has a favorable future outlook through high adoption and investor confidence. The number of new addresses continues to grow, as well as the liquidity and derivatives positioning, indicating that the market participants remain attentive to the token. If network growth sustains beyond one day, it could confirm a stronger foundation for further expansion.