Chainlink (LINK) is trading near $15 at press time, showing a slight decrease over the last day but maintaining a weekly gain of over 9%. The price remains within a defined range that analysts suggest could dictate its next significant movement.

Price Structure Tightens Ahead of Key Break

A long-term symmetrical triangle has formed on the weekly LINK/USDT chart. This pattern, characterized by lower highs and higher lows, has developed over several years. Analyst Ali Martinez highlighted that the $13–$26 range has become a “no-trade” zone, indicating that a major price shift is likely to occur once LINK breaks out of this established boundary.

The range between $13 and $26 is a no-trade zone for Chainlink $LINK. The next major move will come once price breaks out of this range. pic.twitter.com/y69Adpc5un

— Ali (@ali_charts) November 12, 2025

The asset has tested both the upper and lower boundaries of the triangle without a decisive breakout. The current structure is nearing its final stages, suggesting that a clear break above $26 or below $13 could establish the next significant trend. Until such a breakout occurs, the token is expected to remain within this consolidating range.

Near-Term Trend Holds Above Support

On the daily chart, LINK is currently trading between its 9-day and 21-day moving averages, which are situated at $15 and $17, respectively. A sustained close above $17 could signal a move towards higher price levels, while a drop below $15 would indicate a weakening of the current setup.

The MACD data shows the indicator line has crossed above the signal line, although both remain in negative territory. This early upward movement may suggest a potential shift in momentum, but further confirmation is still required. CRYPTOWZRD noted that the price needs to remain above $16 to open targets towards $20. They also stated, "Below $15.40 is a bearish zone that will expose the $13.50 support." The broader outlook for LINK currently remains closely tied to the overall direction of Bitcoin.

On-Chain Data and Developments

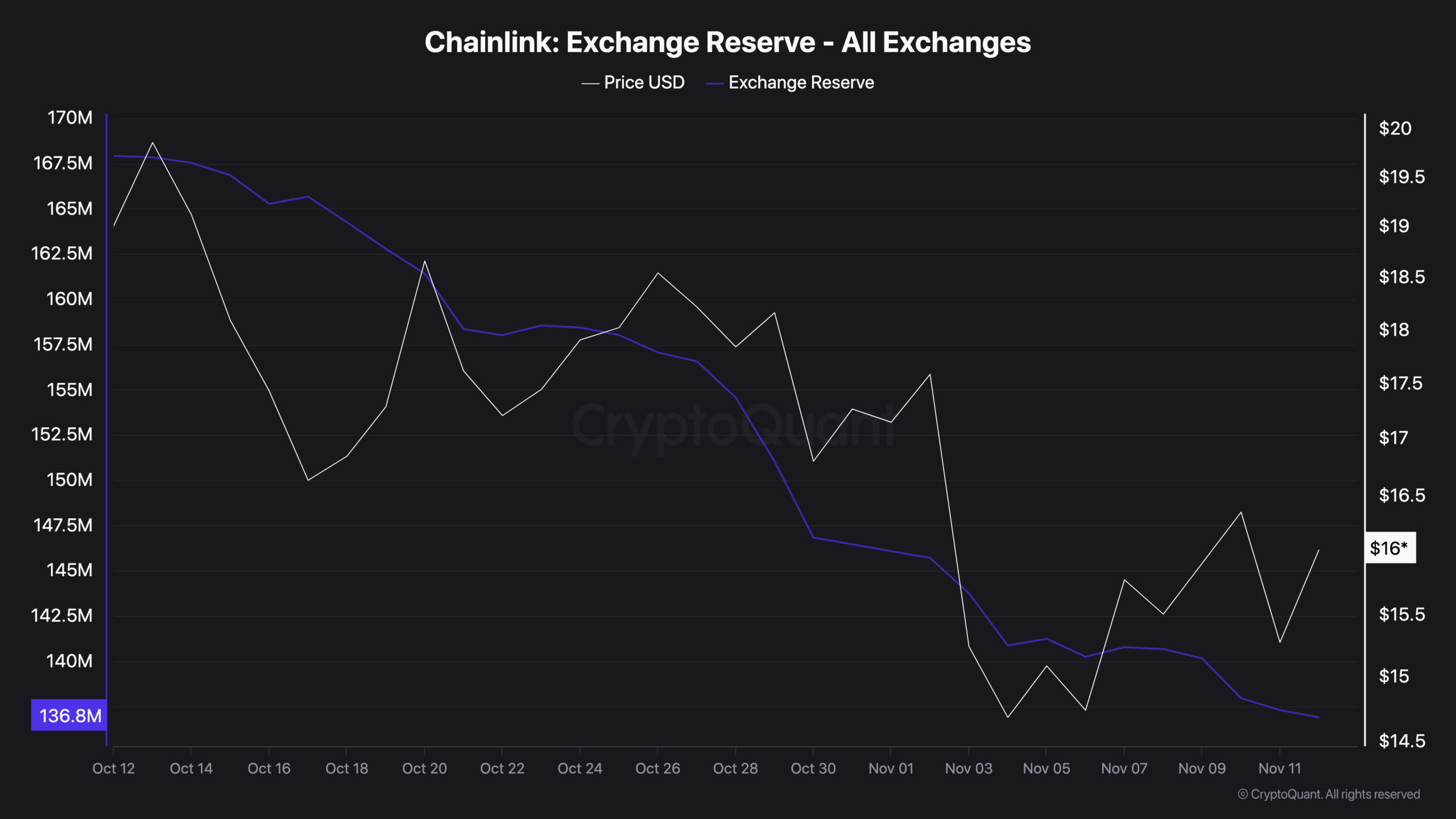

Data from CryptoQuant indicates that LINK's exchange reserves decreased from approximately 167 million to 136.8 million tokens between October 12 and November 12. This reduction suggests that a significant number of holders are moving their tokens off exchanges, likely for long-term storage or investment.

This trend typically points to reduced selling pressure in the market. However, LINK's price has not yet experienced a substantial uptrend, suggesting that the market is awaiting further confirmation before a significant reaction.

In related news, Bitwise's proposed spot Chainlink ETF (CLNK) has been listed on the DTCC's pre-launch list. This development follows its registration with the SEC in August. The listing suggests that the fund may be approaching its launch.

Separately, Chainlink has initiated its Rewards Season 1 campaign. Eligible stakers can earn points from nine different projects by allocating "Cubes" between November 11 and December 9. Token rewards are scheduled to unlock from December 16 and will be distributed over a 90-day period.