Chainlink Price Momentum Shifts

Chainlink price action is exhibiting patterns reminiscent of earlier market cycles, suggesting a potential shift from a period of consolidation to more directional movement. LINK price has spent months trading sideways, absorbing selling pressure and filtering out less committed investors. Recent structural changes on the chart indicate that this quiet phase may be transitioning into a more dynamic period, with underlying strength growing beneath the surface.

The current analysis of LINK price focuses on its stability rather than its velocity, a crucial distinction during periods of market transition from recovery to growth.

Key Support Zones and Bullish Structure

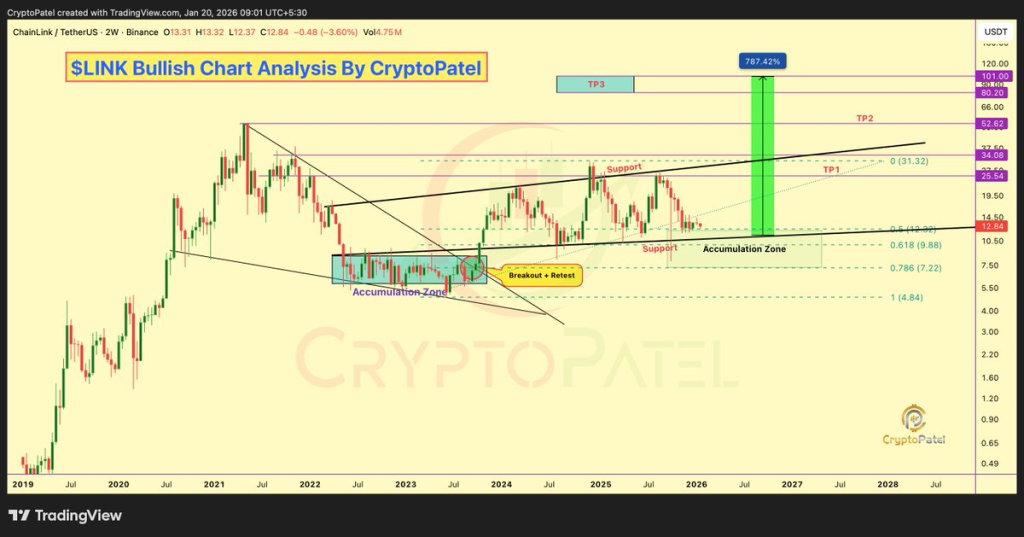

Crypto analyst Crypto Patel highlights that LINK price is currently positioned within a significant support zone that has historically played a vital role since the previous cycle's peak. The two-week chart reveals Chainlink price holding above a critical Fibonacci retracement level near $9.88, specifically the 0.618 mark. The ongoing formation of higher lows in price action is a structural indicator often preceding significant trend reversals.

Crypto Patel points out the similarity between this current structure and the early recovery phase observed after the 2021 peak. His analysis suggests that the price range between $10 and $7 is acting as a long-term accumulation area rather than a zone of distribution, which helps maintain the broader bullish structure for LINK price.

Breakout, Retest, and Accumulation Phase

Further analysis of LINK price involves observing the breakout and retest pattern that has already occurred. The price successfully moved above long-standing resistance, subsequently pulled back to test former supply levels, and has since stabilized. This behavior is often interpreted as a sign of acceptance by the market rather than rejection.

According to Crypto Patel, this phase is indicative of accumulation rather than distribution. The gradual compression of price beneath resistance has allowed LINK to reset its momentum indicators while preserving its macro structural integrity. The absence of sharp downside movements, which typically precede deeper corrections, strengthens the bullish outlook for Chainlink price, provided the current structure holds.

On-Chain Data Supports Chainlink Price Prediction

On-chain data provides additional context to the Chainlink price prediction. Information from Santiment indicates that wallets holding significant amounts of LINK have been increasing their positions below the $13 mark. This trend suggests a focus on long-term investment rather than short-term speculative trading.

Crypto Patel often emphasizes that accumulation phases can appear uneventful during their occurrence. The current LINK price action aligns with this observation, characterized by slow movements that may mask a broader shift in ownership. The strength of Chainlink price is more significant when supported by stable on-chain trends, as opposed to isolated price surges.

Potential Expansion Triggers and Risk Levels for LINK Price

LINK price is currently trading below a resistance band situated between $25 and $31. Reclaiming this zone could serve as a significant expansion trigger for further price increases. Crypto Patel has outlined potential higher cycle targets at $31, $52, and $100, contingent on continued momentum building. These projections are conditional on LINK price maintaining its position above the broader Fibonacci support zone.

The defined risk level for LINK price is also clear. A weekly close below $7 would indicate a weakening of the macro structure, necessitating a reassessment of the Chainlink price prediction narrative.

Chainlink price continues to trade at a juncture where patience is more critical than rapid price movements. The current structure of LINK price suggests that a significant development is underway, even if it has not yet fully manifested on the charts. Observing how the price interacts with resistance levels in the coming weeks may provide clearer indications of future direction.