Key Points

- •Mike Selig leads CFTC to formalize crypto regulation for future stability.

- •New rules aim for stable, adaptable crypto framework.

- •Innovation Advisory Committee will guide financial tech policies.

Mike Selig, Chair of the U.S. CFTC, plans to establish enduring crypto regulations, moving to prevent easy reversals, announced January 21st on social platforms and major publications.

Analysts believe Selig's approach signals a favorable stance towards U.S. crypto innovation, potentially elevating the CFTC's status as a key regulatory body.

CFTC Strategies for Stabilizing Digital Assets Market

On January 21, 2026, Mike Selig, Chairman of the CFTC, outlined a plan to formalize crypto regulations. The announcement focused on moving away from an "enforcement-first" approach to create a future-proof regulatory framework.

The CFTC’s new regulatory framework aims to stabilize digital assets and financial innovations, significantly impacting U.S. financial markets. The establishment of an Innovation Advisory Committee will guide policy adjustments.

The community and analysts observe that the CFTC's proactive stance reinforces the United States’ aim to maintain a competitive market. Selig's strategy is seen as supporting crypto's evolution, with further details anticipated. According to Mike Selig, "A wide range of novel technologies are enabling the creation of entirely new products, platforms, and businesses and transforming the financial markets landscape. Innovators are harnessing technologies such as artificial intelligence, blockchain, and cloud computing to modernize legacy financial systems and build entirely new ones. Under my leadership, the Commission will develop fit-for-purpose market structure regulations for this new frontier of finance."

Crypto Market Volatility and Institutional Investment Prospects

The CFTC's regulatory framework shift from "enforcement-first" model aims to give the U.S. a competitive edge in global financial markets compared to past volatility in policy direction.

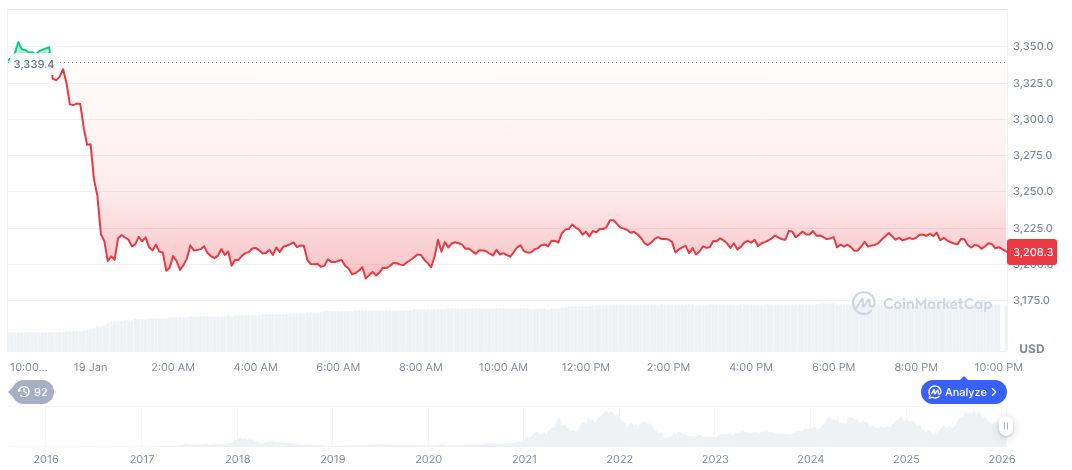

As of January 20, 2026, Ethereum (ETH) is priced at $3,018.12, with a market cap of $364.27 billion. ETH's 24-hour trading volume reached $28.14 billion, although the price fell by 6.27% over the same period.

The Coincu research team suggests that this formal regulatory approach could reduce crypto market volatility and foster technological growth. Stable policy frameworks are likely to attract more institutional investments, enhancing overall market resilience, as described in the Senate testimonies.